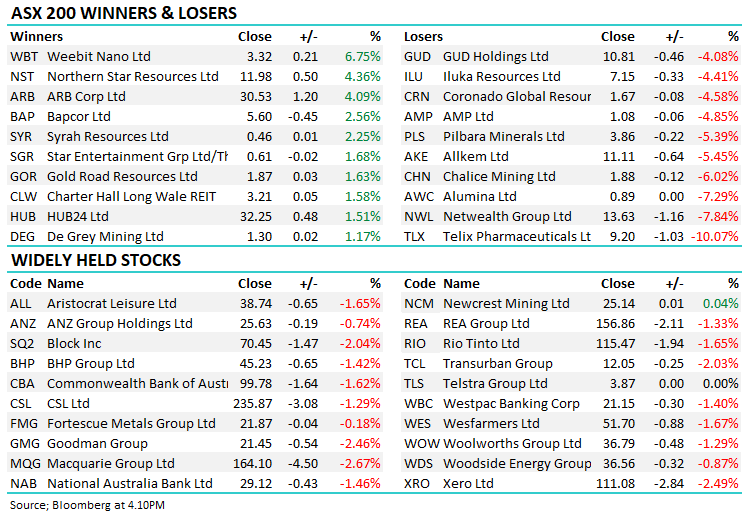

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -1.36% to 6981.60.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

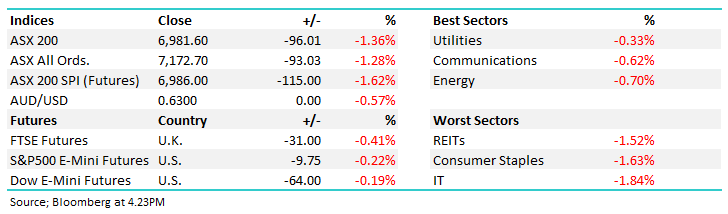

A tough day at the office for the ASX, tracking weakness in US/European markets that permeated across Asia. More tension in the Middle East is threatening higher Oil prices that would underpin persistent inflation and higher interest rates, all very logical and these concerns have pushed the ASX 200 back down to the bottom of its recent trading range.

- The ASX 200 share price finished down -96pts/ -1.36% to 6981

- All sectors closed lower, though Utilities (-0.33%) held up the best on a weak day

- Tech (-1.84%), Consumer Staples (-1.63%), Real Estate (-1.52%) and Financials (-1.50%) were the notable laggards.

- Local Employment data was a mixed bag today with a surprise drop in Unemployment share price to 3.6% offset by a fall in the Participation rate. Employment change was a measly +7k with a fall in full-time offset by a Part-time jump, likely a sign of some underlying weakness in the labour market.

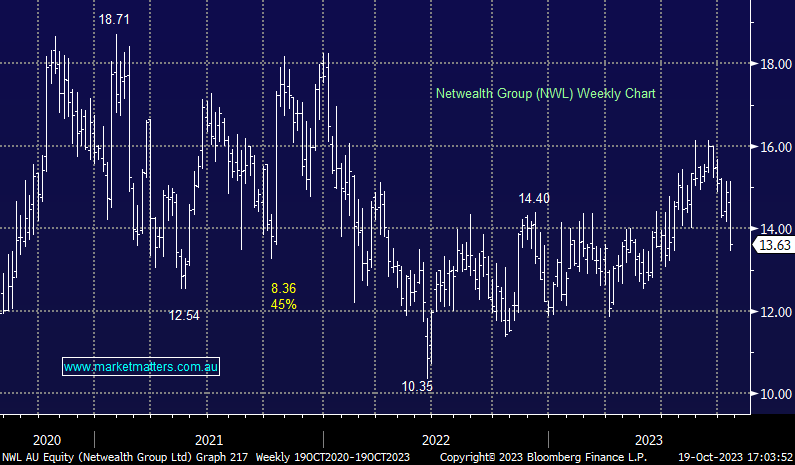

- Netwealth Group Ltd (ASX: NWL) share price -7.84% struggled with a soft Funds Under Administration (FUA) update, though their high Beta to the market also hurt today. More below

- Nick Scali Limited (ASX: NCK) share price -0.29% finished marginally lower with signs that sales had improved after a soft start to FY24 that was flagged at the FY23 result. That is despite store traffic running 10-15% lower in Q1 vs the same period last year.

- Qantas Airways Limited (ASX: QAN) share price -2.47% scrapped plans to buy charter and FIFO operator Alliance Aviation 6 months after the ACCC raised concerns. Shares struggled today, though probably more due to higher oil prices in our view.

- Northern Star Resources Ltd (ASX: NST) +4.36% 1Q production update was largely as expected with sales of 369koz, down on the prior quarter due to planned (and well-flagged maintenance). The company maintained guidance for FY24 which was the key

- Iluka Resources Limited (ASX: ILU) -4.41% 3Q update was soft with sales volumes down -37% on 3Q22, the company blaming a soft China property market.

- A suite of downgrades to US-listed Lithium companies by Bank of America Corp (NYSE: BAC) had the battery chemical stocks on the nose today. More on that below

- Iron Ore was marginally higher in Asia though miners of the bulk commodity were all lower.

- Gold was flat during our time zone at $US1,947

- Asian stocks were all weaker as well, Hong Kong down -2.15%, China -1.42% & Japan -1.7%

- US Futures are down around -0.25%

- Reporting continues in the US tonight, stocks we own in our International Equities Portfolio expected to post numbers include Blackstone (BX US) & Freeport McMoran (FCX US)

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Lithium stocks hit

The Lithium sector was hit hard today after Bank of America joined the bearish chorus and downgraded large U.S Lithium stocks Albemarle Corporation (NYSE: ALB) and Sociedad Quimica y Minr de Chile SA (NYSE: SQM) to sell equivalent saying the market will shift from adequately supplied to oversupplied in 2024 and 2025, and therefore prices will fall further.

The spot price of lithium carbonate in China is already down 70% from its peak to $23,850/mt since last November, however, BofA thinks there is more pain to come. ALB dropped -9.9% last night and SQM slid -7.4%, and the negative vibe has permeated through the ASX names today, with Allkem Ltd (ASX: AKE) -5.45%, Pilbara Minerals Ltd (ASX: PLS) -5.39%, IGO Ltd (ASX: IGO) -2.73% & Mineral Resources Ltd (ASX: MIN) -3.95% all on the nose.

Not helping sentiment is UBS doing the rounds for Liontown Resources Ltd (ASX: LTR) which remains in a trading halt. They are looking for $400m in fresh equity with bids between $2.20 – $2.60 and a further $760m in debt. We suspect equity will be issued at the lower end of the range, and given Gina is at 19.9% of the company, she’ll only be able to participate on a pro-rata basis without launching a full tilt. Worth noting that LTR was at $1.52 in March prior to the Albemarle interest, and the sector has really struggled in recent months, with comps getting considerably cheaper.

Putting LTR to one side, clearly, there is significant pain in the sector, however, we can’t help but think the horse has bolted on many of these aggressive downgrades that we’re seeing. Last year we cautioned towards the crowded nature of the ‘ESG’ trade and now we’ve had a big shakeout on the downside. Some sort of supply disruption could send the market back into deficit fairly quickly, which when combined with the (now) bearish consensus, has us looking more on the buy side into this weakness.

- The bulge brackets are capitulating on the Lithium trade, which will be bullish at some stage soon we think.

China Lithium Carbonate $US – Source Bloomberg

Netwealth Group (NWL) $13.63

NWL -7.84%: Hit hard today after their quarterly Funds Under Administration (FUA) update showed slowing growth, though certainly not helped by a soft session on the broader market. FUA increased by $1.6b to $72b, driven by $2.1b of net inflows with a small detraction from a soft market.

This was down by ~35% on the prior quarter though which had the market guessing that the easy fruit ahs been picked and inflows become harder from here, particularly given the comment that outflows were elevated in the quarter blamed on investor concerns on the outlook.

It was a similar story for FUM which increased $0.5b despite $0.8b of net inflows.

Netwealth (NWL) share price

Broker Moves

- AMP Ltd (ASX: AMP): AMP Cut to Underweight at Barrenjoey; PT A$1.09

- 29Metals Ltd (ASX: 29M): 29Metals Raised to Overweight at Jarden Securities

- Abacus Storage King Stapled Securities (ASX: ASK): Abacus Storage King Raised to Overweight at JPMorgan Chase & Co (NYSE: JPM); PT A$1.25

- Charter Hall Retail REIT (ASX: CQR): Charter Hall Retail Raised to Overweight at JPMorgan; PT A$3.90

- James Hardie Industries plc (ASX: JHX): James Hardie GDRs Cut to Neutral at Jarden Securities

- Mirvac Group (ASX: MGR): Mirvac Group Raised to Buy at Citigroup Inc (NYSE: C); PT A$2.50

- Region Re Ltd (ASX: RGN): Region Group Raised to Neutral at JPMorgan; PT A$2.30

- Ramsay Health Care Ltd Fully Paid Ord. Shrs (ASX: RHC): Ramsay Health Raised to Outperform at RBC; PT A$67

- Stockland Corporation Ltd (ASX: SGP): Stockland Raised to Neutral at JPMorgan; PT A$4.20

- Telix Pharmaceuticals Ltd (ASX: TLX): Telix Pharma Cut to Accumulate at CLSA; PT A$11.45

- Vicinity Centres (ASX: VCX): Vicinity Centres Raised to Overweight at JPMorgan; PT A$2.10

Major Movers Today