Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.19% to 6856.90.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

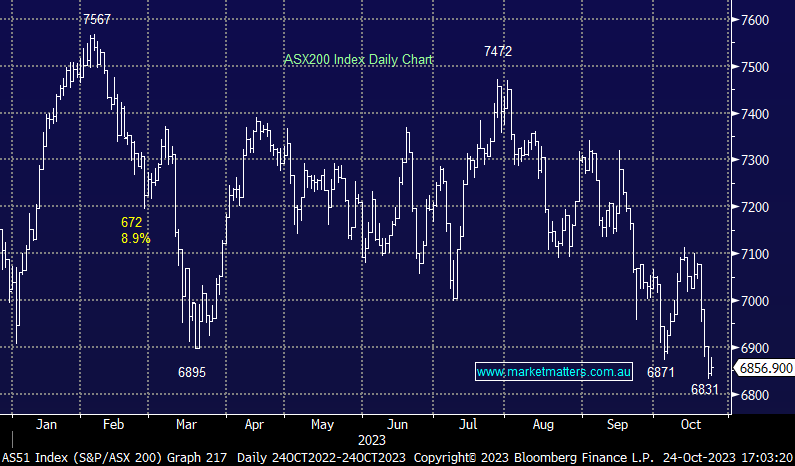

Some signs of buying helped support the local market today, driven in particular by the heavy-weight sectors of Materials and Financials. The support there helped put an end to a 3-day rout which had set the ASX 200 to an 11-month low.

Locally, the focus will turn to inflation data due out tomorrow morning, the next print to determine where rate expectations head in the short term.

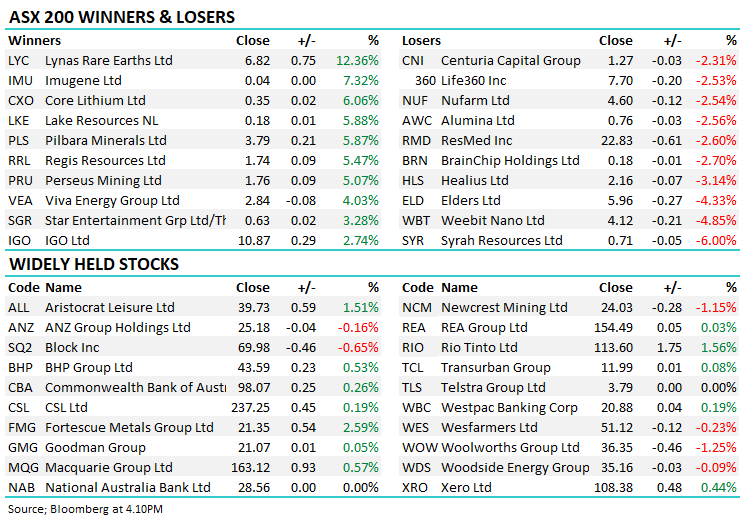

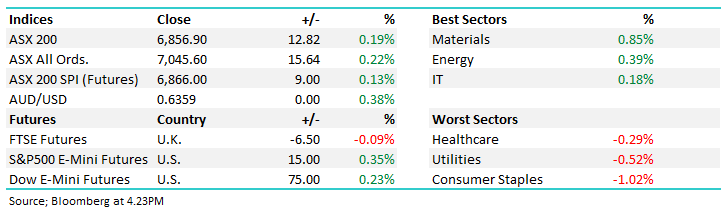

- The ASX 200 finished up +12pts/ +0.19% to 6856

- Materials (+0.85%) was best on ground today, followed by Energy (+0.39%) as the other notable gainer, though 6 sectors closed higher.

- Staples (-1.02%) was well and truly the weakest sector while utilities (-0.52%) also found it tough as the only other notable detractor.

- Audinate Group Ltd (ASX: AD8) -1.17% AGM today produced nothing new for the large part. They are well positioned post the recent cap raise and reiterated a record back log of orders providing solid visibility for FY24 earnings.

- Bowen Coking Coal Ltd (ASX: BCB) closed flat despite largely positive commentary from their quarterly update out yesterday afternoon. The company shipped more coal than it produced, reducing their significant stockpile levels and saw positive cashflow despite $4m in care & maintenance costs.

- Zip Co Ltd (ASX: ZIP) +6.67% quarterly showed improving metrics in the 1Q, positive cash earnings in the period and revenue and cash margins improving despite higher interest rates. Bad debts were also lower than expected which supported the stock

- Lynas Rare Earths Ltd (ASX: LYC) +12.36% ripped higher on headlines Malaysia has walked back its stance on the processing licence. More on this tomorrow in the Morning report.

- Perseus Mining Ltd (ASX: PRU) +5.07% performed well with solid numbers at the 1Q update. Gold production was down marginally to 132.8koz but costs were down and price received was up. The company maintained guidance for the half year.

- NB Global Corporate Income Trust (ASX: NBI) +6.67% rallied on plans to delist the trust given shares are trading well below NTA, still a 7.69% discount based on today’s close.

- Iron Ore found some support in Asia, up ~1%.

- Gold was up marginally, offsetting the slight weakness seen overnight.

- Indices in the region were mixed – Nikkei +0.46% and China +0.2% were the winners while Hng Seng -0.94% was weak.

- US Futures are currently trading between +0.2% to +0.5% higher at our close.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Broker Moves

- Breville Group Ltd (ASX: BRG) Rated New Positive at Evans & Partners Pty Ltd

- Next Science Ltd (ASX: NXS) Cut to Market-Weight at Wilsons

- Pilbara Minerals Ltd (ASX: PLS) Raised to Buy at Jarden Securities; PT A$4.70

- Liontown Resources Ltd (ASX: LTR) Raised to Overweight at Wilsons; PT A$2.30

- HMC Capital Ltd (ASX: HMC) Cut to Underweight at Barrenjoey; PT A$4.35

- Judo Capital Holdings Ltd (ASX: JDO) Rated New Add at Morgans Financial Limited

- BlueScope Steel Limited (ASX: BSL) Raised to Buy at Citigroup Inc (NYSE: C); PT A$21.40

- Telstra Group Ltd (ASX: TLS) Reinstated Accumulate at CLSA; PT A$4.20

- A2 Milk Company Ltd (ASX: A2M) Cut to Reduce at CLSA; PT NZ$4.77

Major Movers Today