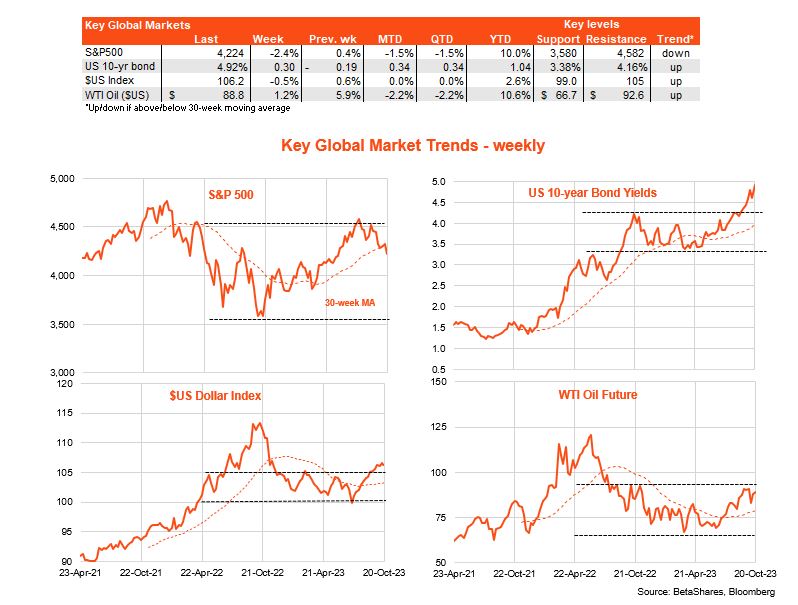

Global Markets

Global equities continued to sell-off last week on the back of a further rise in bond yields. After easing the previous week, US 10-year yields surged back to end the week at 4.91% while the S&P 500 (INDEXSP: .INX) index dropped 2.4%

Several factors drove the rebound in bond yields. For starters, oil prices remained firm as Middle East tensions continued to simmer, especially following the alleged bombing of a major hospital in Gaza.

Also unnerving the market were further signs of strength in the US economy (good news is bad news) with a much stronger than expected gain in September retail sales.

Somewhat reassuring however was the general thrust of Fed commentary – including from Fed chair Powell – playing down the risk of a November rate hike whilst retaining a tightening bias.

Indeed most Fed speakers pointed to the rise of long-term bond yields as reflecting a lift in long-suppressed bond duration risk premiums – rather than higher inflation expectations or higher short term policy rate expectations – which in itself implies a tightening in financial conditions and potentially less work for the Fed to do.

In other news from last week, China’s reports on GDP growth, retail sales and industrial production were reassuringly better than expected.

Again this backdrop key developments this week include likely solid 4% annualised growth in US Q3 GDP, a further easing in annual core inflation from 3.9% to 3.7% in the September private consumption price deflator, and reasonable ongoing earnings from some of America’s major technology companies such as Microsoft, Alphabet, Meta and Amazon.

Amongst this mix, only the inflation report is likely to be reassuring to the bond market – with any upside inflation surprise therefore at risk of creating a meltdown in both the bond and equity markets.

Of course, Middle East tensions will also simmer, with reports that Israel is preparing to mount a ground invasion of Gaza – which risks the Iran-backed Hezbollah in Lebanon getting into the action.

Central banks in both Europe and Canada meanwhile are expected to keep rates on hold.

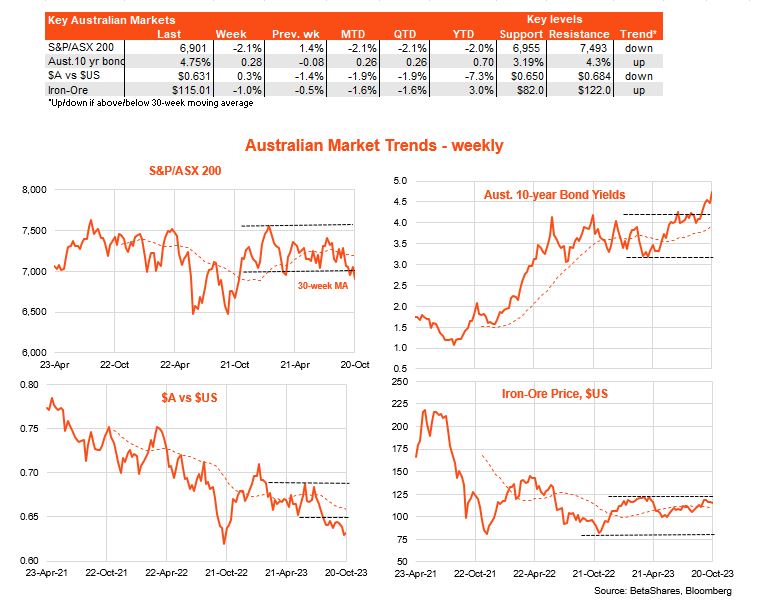

Australian Markets

Key developments in Australia last week included minutes to the RBA’s October policy meeting and the September labour market report.

The minutes were taken negatively by a nervous market with a key phrase being that the RBA would have a “low tolerance” for a slower than currently forecast return of inflation to the target band. This has heightened the focus on this week’s CPI release, as a higher than expected result may see the RBA raise interest rates in November.

Indeed, if market forecasts are correct – with the trimmed mean and headline CPI both expected to rise by 1.1% in the quarter – then it may be hard for the RBA not to revise up its inflation forecasts in the November policy statement. After all, a 1.1% gain in trimmed mean inflation in the September quarter means a gain of only 0.7% in the December quarter would be needed for the RBA’s current year-end annual trimmed mean inflation forecast of 4% to be met.

In short, even if this week’s inflation result is no worse than the market currently forecasts, the RBA may still feel under pressure to raise rates given that higher oil prices may be leading to a higher for longer inflation outlook, with risk to containment of inflation expectations. The strong rebound in house prices will only add to the pressure on the RBA to raise rates next month.

A partial counter to another near term rate hike are signs of further easing in labour demand, with last week’s labour market report revealing a much softer than expected 66k gain in employment during September – albeit with a drop in the unemployment rate back to 3.6% from 3.7%.

Have a great week!