Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.61% to 6812.30.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

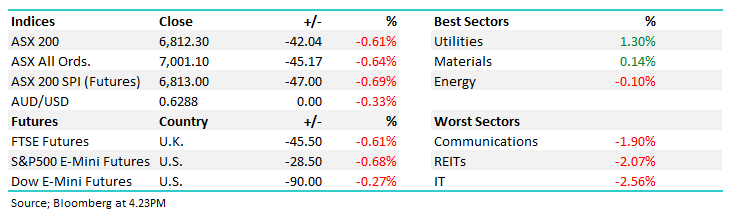

Shares were 1pt off a 12-month low intraday today with pain in the interest rate leveraged Tech and Real Estate sectors under the most pressure.

Tech was hit particularly hard following a soft session for the Nasdaq overnight and follow-through selling seen on its futures today.

Materials once again put up a reasonable fight thanks to support in Iron ore stocks, and the second biggest sector constituent for the local market finished marginally higher.

Financials also outperformed the fall despite some weakness across the banks.

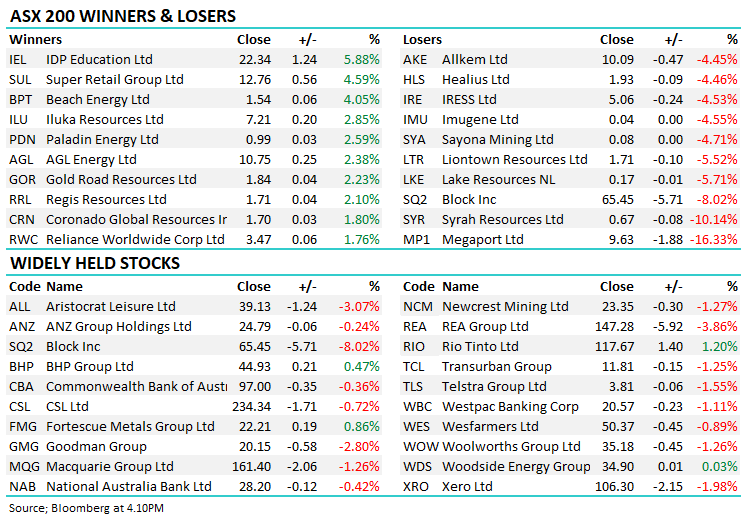

- The ASX 200 finished down -42pts/ -0.61% to 6812

- Utilities (+1.30%) was best on ground today, joined by Materials (+0.14%) as the only other sector in the black.

- Tech (-2.56%) was the hardest hit, followed by Real Estate (-2.07%), Telcos (-1.90%) & Industrials (-1.14%) being the 4 sectors more than 1% worse off today.

- Negative sentiment from the US spilt onto the local tech sector dragging it down over -2.5%, e.g. TechnologyOne Ltd (ASX: TNE) -2.35%, Nextdc Ltd (ASX: NXT) -2.47%, and Xero Limited (ASX: XRO) -1.98%.

- Bond yields continued to charge higher following yesterday’s strong CPI, Michele Bullock looks set to hike on Cup Day.

- The ASX had a tough day at the office with over 70% of stocks closing lower but fortunately another positive session by the resources kept losses under -1%, e.g. Iluka Resources Limited (ASX: ILU) +2.85%, Rio Tinto Ltd (ASX: RIO) +1.2%, and BHP Group Ltd (ASX: BHP) +0.47%.

- Westpac Banking Corp (ASX: WBC) -1.11% announced a net $173m notable item loss that will be recognized in their FY23 results on Monday the 6th. The bulk of the line relates to a $176m hit from customer refunds and litigation costs as well as a $140m hit from restructuring spend offset by a $256m profit on the sale of Advance Asset Management. Bank reporting just around the corner

- Fortescue Metals Group Ltd (ASX: FMG) +0.86% 1Q production numbers were a touch soft, with shipments off 4% on the quarter and higher costs. The company maintained FY24 guidance though annualizing today’s numbers has the company marginally below the low end.

- Wesfarmers Ltd (ASX: WES) -0.89% AGM update today was soft flagging higher costs though retail trade performance for the first 16 weeks has broadly been as expected and in line with what was flagged at their FY23 results in August.

- JB Hi-Fi Limited (ASX: JBH) -0.18% said Q1 sales were broadly in line with expectations. The Comparable sales for the Australian business was down -1.4% in the quarter, NZ -1% and The Good Guys -12.2%. Consensus expects a ~4% slide in revenue for FY24.

- G8 Education Ltd (ASX: GEM) -11.82% investor day today failed to inspire investors. They have agreed to offload 31 loss-making centres and pay a fee for the privilege. Occupancy has fallen by 1.4% in the 12 months to 22 October, down to 75.4%.

- Sandfire Resources Ltd (ASX: SFR) +0.17% 1Q production numbers were solid, if not better than expected. Copper production was up 44% in the quarter and costs have come down further while their new Motheo mine has come online as planned.

- Silver Lake Resources Ltd (ASX: SLR) +0.52% the gold company managed 65.4koz of sales in the first quarter, posting positive free cash flow of $13.3m. They maintained FY24 sales and cost guidance.

- Boral Limited (ASX: BLD) -0.65% said trading performance in the first quarter was solid. Price rises put through in FY23 have been well absorbed by customers and the company maintained FY24 EBIT guidance.

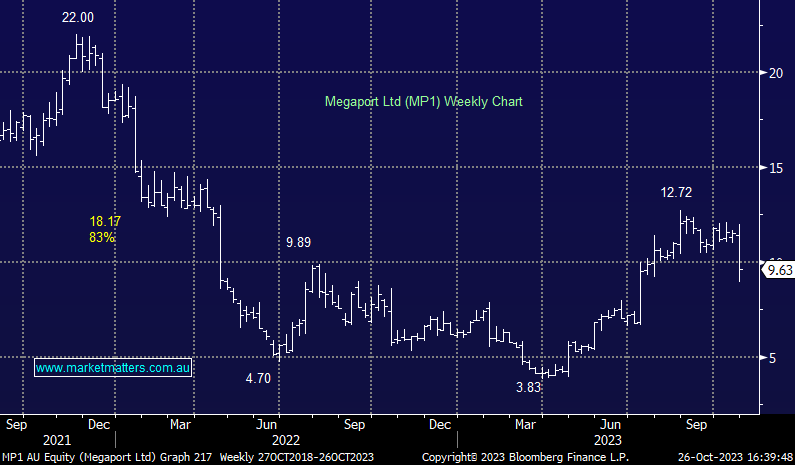

- Megaport Ltd (ASX: MP1) -16.33% fell to 3-month lows on softer customer growth despite posting record EBITDA numbers in Q1. More on that below.

- Iron Ore was flat in Asia today.

- Gold is trading at 5-month highs, up $US9, +0.45% to $US1988/oz. For the most part though, gold stocks couldn’t escape the weakness in equities today.

- Indices in the region were also weaker today. Hang Seng -0.65% and Nikkei -2.13%.

- US Futures continued to soften. S&P 500 (INDEXSP: .INX) futures point to a -0.7% fall tonight, Nasdaq Composite (INDEXNASDAQ: .IXIC) worse off expecting a -1.15% drop.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Megaport (MP1) $9.63

MP1 -16.33%: any sign of weakness in the Tech sector has been treated harshly recently, and connectivity company Megaport was no exception today despite maintaining FY24 guidance. The company hit record quarterly EBITDA of $15m which compares to the $1m EBITDA in 1Q23 and up 27% on the prior quarter.

Cashflow was also positive at $5.6m however it was the slow growth in customer numbers that had the market concerned. Annualized Recurring Revenue (ARR) was up 6% QoQ, largely driven by a 5% benefit from FX, and Customer Ports was up just 1%. Cost control has improved the underlying business substantially in the last 6 months however stagnating the top line growth had the market concerned.

Megaport (MP1)

Broker Moves

- Super Retail Group Ltd (ASX: SUL) Jumps as Jarden Raises to Neutral; PT A$12.90

- Reliance Worldwide Corporation Ltd (ASX: RWC) Raised to Buy at Jefferies; PT A$3.96

- Viva Energy Group Ltd (ASX: VEA) Raised to Overweight at Barrenjoey; PT A$3.74

- Brickworks Limited (ASX: BKW) Cut to Hold at Morgans Financial Limited; PT A$25.90

- Pilbara Minerals Ltd (ASX: PLS) Cut to Accumulate at CLSA; PT A$4.20

- Mineral Resources Ltd (ASX: MIN) Cut to Accumulate at CLSA; PT A$70

- Allkem Ltd (ASX: AKE) Cut to Reduce at CLSA; PT A$10.90

- Beach Energy Ltd (ASX: BPT) Raised to Hold at Canaccord Genuity Group Inc (TSE: CF); PT A$1.54

- Super Retail Raised to Buy at CLSA; PT A$15.25

- Super Retail Raised to Neutral at JPMorgan Chase & Co (NYSE: JPM); PT A$13

- Treasury Wine Estates Ltd (ASX: TWE) Raised to Neutral at Citigroup Inc (NYSE: C); PT A$12.20

- Mineral Resources Raised to Overweight at Barrenjoey; PT A$73.50

- Mineral Resources Raised to Buy at Jefferies; PT A$75

- Next Science Ltd (ASX: NXS) Cut to Speculative Buy at Canaccord

- Damstra Holdings Ltd (ASX: DTC) Raised to Equal-Weight at Morgan Stanley (NYSE: MS)

- ARN Media Ltd (ASX: A1N) Rated New Neutral at Evans & Partners Pty Ltd

- oOh!Media Ltd (ASX: OML) Rated New Positive at Evans & Partners Pty Ltd

- Beach Energy Raised to Neutral at Citi; PT A$1.55

Major Movers Today