It is no secret that infrastructure in the United States has long been in need of upgrading and repair.

There are countless images and videos showing crumbling highways, overrun and outdated airports, and communities lacking adequate Internet connections.

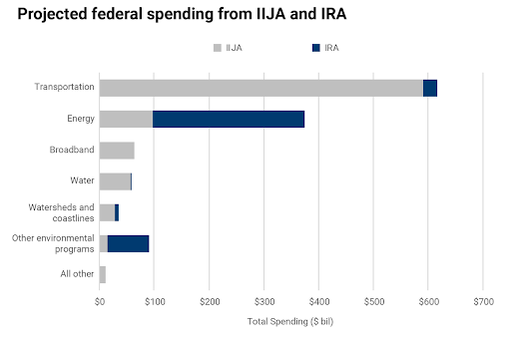

It is also no secret that the Biden administration has made infrastructure spending a statement of its tenure. Between the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA), the 117th Congress has committed US$1.25 trillion across the transportation, energy, water resources, and broadband sectors for the next five to 10 years.

The mammoth IIJA includes approximately US$550 million in new infrastructure, including US$350 billion specific to roads and bridges, and approximately US$650 million in renewed funding for the Department of Transportation.

In addition, the American Rescue Plan Act (a total funding package of US$1.9 trillion in COVID-19 relief funding for states, schools and local government) also includes US$194 billion directly allocated to U.S. states for funding infrastructure projects, including US$340 million for roadways and bridges.

Not to mention the various state programs, including the US$85 billion in funds from the Texas Unified Transportation Program, US$400 million from a leading Idaho funding bill and US$3 billion from Move Ahead Washington.

Source: Brookings Metro

This spending spree has not been without its criticism.

Large-scale infrastructure projects are usually left for economic downturns, with the government spending offsetting declines in private sector spending. Yet the U.S. economy has rebounded strongly from the pandemic and has proven surprisingly resilient despite more restrictive monetary policy (that is, the fastest pace of interest rate increases in history).

It has also been accused of spurring inflationary pressures, given the recent supply shortages of the pandemic and ongoing labour shortages throughout the country.

Putting these political issues aside, there is no doubt that this unprecedented level of fiscal stimulus can provide a substantial tailwind for companies focused on infrastructure development.

Importantly, there is often a significant lag between the announcement and actual benefit from such programs (as the funds are allocated, projects are designed and then implemented, etc.). The IIJA, for example, was passed in November 2021 and is now beginning to flow through to actual projects.

Let’s take a look at two companies that should benefit as projects are delivered.

Electric returns

Atkore Inc (NYSE: ATKR) is a small cap company in the U.S. (with a market capitalisation of approximately US$4.7 billion) that has two operating segments: Electrical and Safety & Infrastructure.

The Electrical segment manufactures products used in the construction of electrical power systems, including conduit, cable, and installation accessories. It mainly serves contractors in the non-residential construction and renovation markets.

The Safety & Infrastructure segment designs and manufactures solutions for protecting critical infrastructure, including metal framing, mechanical pipe, perimeter security, and cable management. These solutions are sold to contractors, original equipment manufacturers (“OEMs”) and end-users.

Atkore believes that it the vast majority of its products hold the #1 or #2 positions in the U.S. The company’s strategy is to combine these high-quality products with unmatched delivery and value, and to use the strengths of its scale, national presence and brands to drive profitable growth.

Similar to what we described with Danaher Corporation (NYSE: DHR) in a previous article, Atkore employs the Atkore Business System, a form of the Kaizen method – a Japanese concept for continuous improvement. As part of this strategy, the company has undergone a major transformation since its IPO – primarily the result of 7 major acquisitions within the Plastic Pipe, Conduit and Fittings category.

This has caused a more than doubling in both revenue, increasing from $1.5 billion in FY 2017 to $3.9 billion in FY 2022, and even more impressively, profit margins, with adjusted EBITDA margins rising from 15.1% in FY 2017 to 34.3% in FY 2022.

Importantly, these results have also translated to strong cash generation, with operating cash flow increasing approximately 52% YoY and cash conversion (that is, operating cash flow as a percentage of net income) of 103% in FY 2022, far above last year’s 54%. This is right in line with the company’s target, of cash flow from operating activities to be approximately 100% of net income over a 3-year rolling period. This has enabled the company to accelerate share repurchases, which have now risen to over US$915 million since the initial program was authorised in November 2021.

Despite Atkore’s impressive performance to date, the opportunity ahead remains substantial. Based on revenue of US$3.9 billion, the company’s market share is only around 10% of its estimated total addressable market (TAM) opportunity. It also has plenty of capacity to pursue this opportunity, with strong cash flow and net debt of only 0.4x operating earnings (EBITDA), far below the company’s normal range of 2.0x.

For FY 2023 onwards, Atkore’s priorities for capital allocation from FY 2023 onwards include organic growth (including capital expenditures and capacity investments), followed by M&A and then stock repurchases.

Building the future

Sterling Infrastructure Inc (NASDAQ: STRL) is another relatively small company for the U.S. (with a market capitalisation of approximately US$2.2 billion) that operates three distinct segments: E-Infrastructure Solutions, Transportation Solutions and Building Solutions.

E-Infrastructure Solutions projects include advanced, large-scale site development systems and services for things like data centres, e-commerce distribution centres, warehousing, transportation, and energy.

Transportation Solutions includes infrastructure and rehabilitation projects for highways, roads, bridges, airports, ports, light rail and storm drainage systems while Building Solutions projects include residential and commercial concrete foundations for single-family and multi-family homes, parking structures, elevated slabs and other concrete work.

Geographically speaking, Sterling operates primarily across the Southern, Northeastern and Mid-Atlantic U.S., the Rocky Mountain States, and Hawaii.

Similar to Atkore, Sterling Infrastructure has also undergone a form of strategic transformation. Prior to the introduction of the company’s “Strategic Vision”, it was exclusively a heavy civil business with just one service offering and extremely low margins (operating margins were in fact negative in both 2015 and 2016).

Since then, it has added a variety of higher-margin, stronger cash flow businesses in adjacent markets. Operating margins have climbed to 9.0% in 2022, predictability and free cash flow have both improved, and the company is now much more exposed to long-term secular growth trends.

In particular, Sterling’s E-Infrastructure Solutions is set to benefit from onshoring and federal incentives supporting EV, solar and battery manufacturing, while the Transportation Solutions is set to benefit from the IIJA and state funding for transportation.

These trends should fuel continued margin expansion, along with recovery of the supply chain and as inflation trends dissipate.

Funding for the future

American politics have received a lot of headlines recently, including for raising the debt ceiling, the potential government shutdown, removal of the Speaker of the House, and soon, the coming Presidential election campaign.

There has also been considerable coverage of interest levels, federal debt, and the country’s large (and growing) budget deficit. Yet for investors, one of the more crucial aspects is the benefits that are likely to accrue to those companies positively exposed to the substantial infrastructure spending that the Biden administration has enacted.

Approximately US$1.25 trillion have so far been committed across the transportation, energy, water resources, and broadband sectors for the next five to 10 years.

While the media and the public are distracted by the noise and negativity about the current state of discourse, prudent investors would be well-advised to seek out opportunities for this coming infrastructure boom.