Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.21% to 6826.90.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

Equities managed a modest gain into the weekend, bucking the weakness of US markets overnight, though largely tracking the gains seen on their futures today.

Investors were still wary of loading up too much risk today, highlighted by the weakness in the Tech sector today. Staples was a key winner, that sector hit 3-year lows yesterday but a broker upgrade for Coles (COL) saw some support. Banks and Resources both posted gains today to help stem the weakness this week.

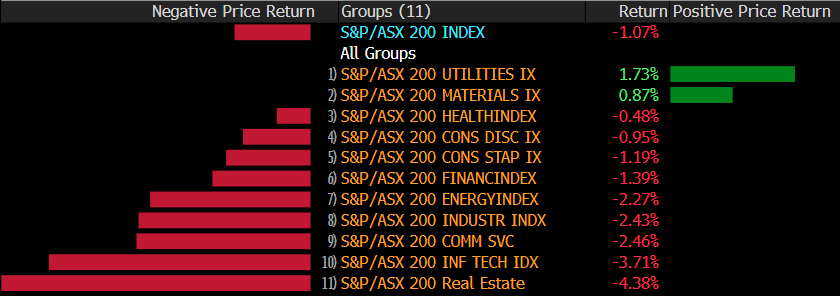

The ASX200 fell -73pts/-1.07% this week.

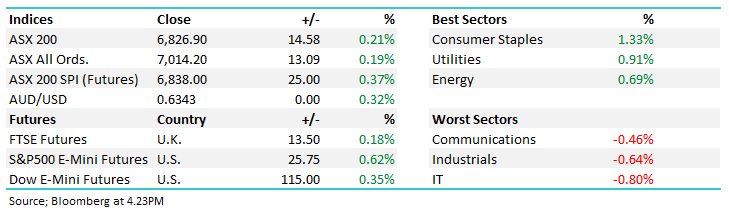

- The ASX 200 finished up +14pts/+0.21% at 6826.

- The Consumer Staples sector was best on ground today (+1.33%), followed by Utilities (+0.91%), Energy (+0.69%) and Materials (+0.64%)

- Tech (-0.80%), Industrials (-0.64%) and Telcos (-0.46%) were the weakest links

- Harvey Norman Holdings Limited (ASX: HVN) +4.79% 1Q sales looked a miss, down -10% at the group level on a comparable basis, and profit before tax was down -49%. Shares were up today though after they announced a buyback of 10% of shares on issue, worth around $450m.

- Resmed CDI (ASX: RMD) -4.01% 1Q numbers were broadly in line for Revenue and earnings, though margins continued to slide and were below analyst expectations. The key issue was only 2% growth in US device sales.

- Core Lithium Ltd (ASX: CXO) +1.43% produced 20.7kt of spodumene in Q1 with costs flat and maintained guidance, though grades were down.

- Pinnacle Investment Management Group Ltd (ASX: PNI) -1.04% said affiliate FUM had fallen 2% in the Sept quarter to $90.4b weighed on by softer equity markets and a challenging institutional market.

- Iron Ore was up +0.3% in Asia

- Gold edged higher trading at US$1987 at our close.

- Asian stocks were strong, Nikkei and Hang Seng adding more than 1%.

- US Futures are up strongly heading into the Friday session. S&P 500 (INDEXSP: .INX) Futures +0.6% and Nasdaq +0.87%.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Sectors this week – Source Bloomberg

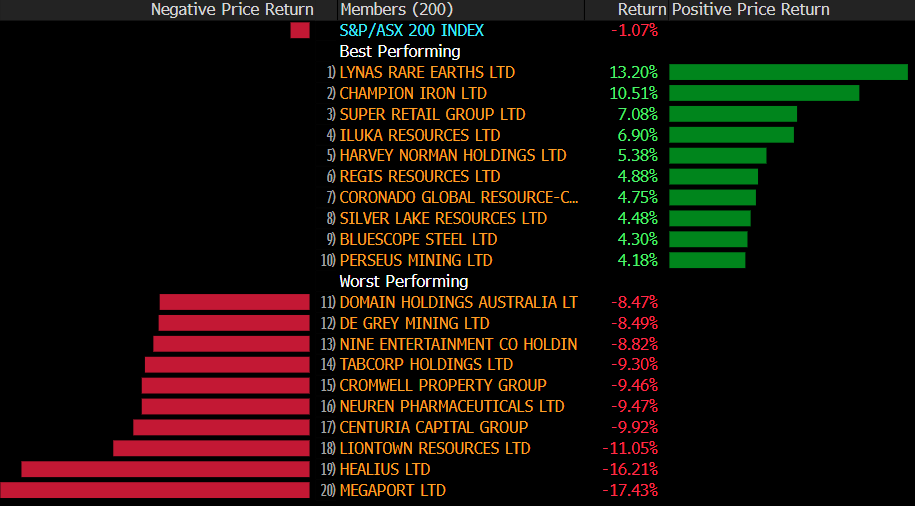

Stocks this week – Source Bloomberg

Broker Moves

- APM Human Services International Ltd (ASX: APM) Rated New Buy at Jefferies; PT A$2.40

- WA1 Resources Ltd (ASX: WA1) Rated New Speculative Buy at Canaccord Genuity Group Inc (TSE: CF); PT A$11.50

- Megaport Ltd (ASX: MP1) Raised to Outperform at RBC; PT A$13

- Champion Iron Ltd (ASX: CIA) Raised to Accumulate at CLSA; PT A$7.20

- Argosy Minerals Limited (ASX: AGY) Cut to Neutral at Macquarie Group Ltd (ASX: MQG)

- Brambles Limited (ASX: BXB) Cut to Sell at Citigroup Inc (NYSE: C); PT A$13.15

- Gold Road Resources Ltd (ASX: GOR) Cut to Underweight at JPMorgan Chase & Co (NYSE: JPM); PT A$1.60

- Coles Group Ltd (ASX: COL) Raised to Add at Morgans Financial Limited

- Megaport Raised to Overweight at Barrenjoey; PT A$11.50

- Liontown Resources Ltd (ASX: LTR) Raised to Speculative Buy at Bell Potter

- JB Hi-Fi Limited (ASX: JBH) Raised to Buy at CLSA; PT A$53

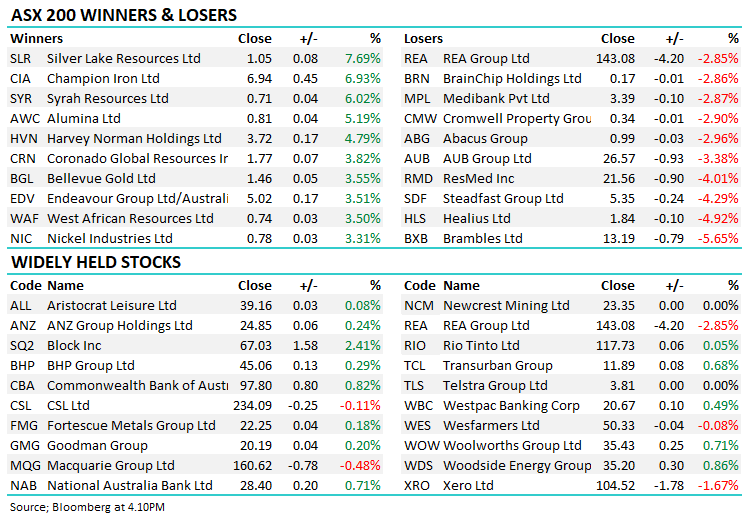

Major Movers Today