Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.79% to 6772.90.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

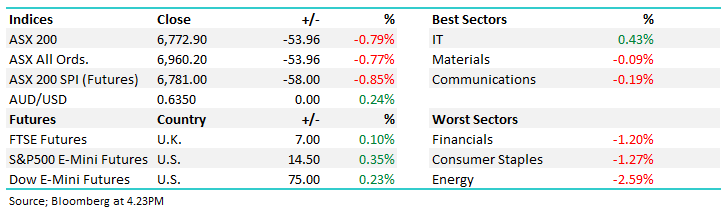

For the past week, it felt like “when” not “if” the ASX200 would set a new 12-month low. That question was answered today as the local index fell further into despair, weighed on by the Energy, Financials and Consumer sectors. Tech was the only area of the market to buck the weakness, a solid result considering bond yields were broadly higher throughout Monday.

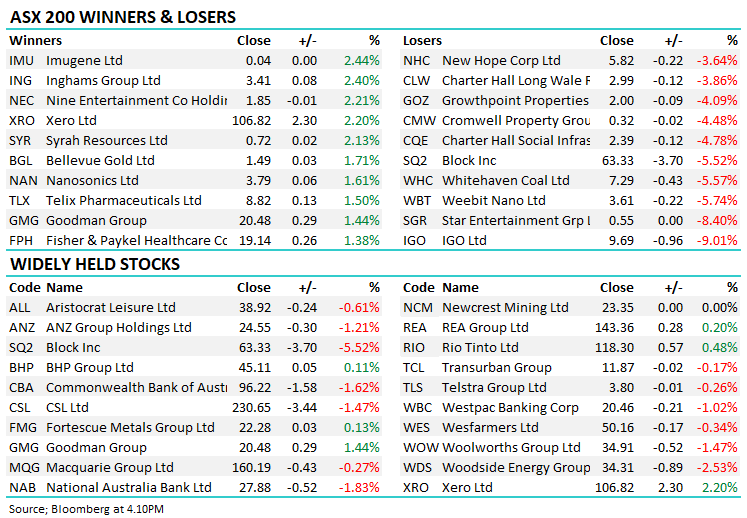

- The ASX 200 finished down -54pts/ -0.79% to 6772

- Tech (+0.43%) was best on ground today by default. Materials (-0.09%) finished lower after spending most of the session in the black.

- Energy (-2.59%) was the weakest sector today, joined by Staples (-1.27%) and Financials (-1.20%).

- Retail Sales for September printed well above expectations, jumping +0.9% vs +0.3% expected, and even the prior month had to be revised marginally higher.

- There was a sense of distrust in the numbers from equity markets with consumer stocks failing to embrace the print, particularly in the Staples sector which was the second weakest sector today.

- Energy markets remained under pressure today, with Crude falling ~1.5% in Asia as Israel’s military involvement in Gaza starts cautiously.

- Endeavour Group Ltd (ASX: EDV) -2.19% 1Q sales update today, total sales +2.1% with retail +1.9% and Hotels +2.8%. BWS & Dan Murphy’s remained strong but the company flagged consumers were trading down while gambling revenues were also soft.

- Aussie Broadband Ltd (ASX: ABB) +0.52% has completed due diligence on Symbio Holdings Ltd (ASX: SYM), lobbing a binding takeover bid for the telco-as-a-service business. The cash component was reduced slightly but the scrip portion was left unchanged, though ABB is trading lower than the price seen at the time of the original offer.

- Whitehaven Coal Ltd (ASX: WHC) -5.57% a block of 35m shares was traded mid-morning, confirmed as disgruntled activist investor BellRock reducing its equity portion to just 0.5%, though it still holds `5% of the company through derivative exposures.

- IGO Ltd (ASX: IGO) -9.01% was weak on a double hit to near-term lithium earnings. More on that below.

- Calix Ltd (ASX: CXL) -11.7% remains out of favour despite a new agreement with heirloom announced today.

- Regal Partners Ltd (ASX: RPL) -4.51% struggled after it confirmed reports it was in talks to buy PM Capital Global Opportunities Fund Ltd (ASX: PGF) which manages $2.7b.

- Iron Ore was up more than 2% in Asia today, helping Rio Tinto Ltd (ASX: RIO) add +0.48%.

- Gold fell -0.25% to test $US2k/oz, though gold stocks were broadly higher, even if only marginally so.

- Indices in the region were also weaker today. Nikkei -1.06%, Hang Seng -0.5% and China flat at the time of writing

- US Futures point to a positive start to their weak tonight. S&P 500 (INDEXSP: .INX) futures +0.36% and Nikkei futures +0.50%

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

IGO Ltd (IGO) $9.69

IGO -9.01%: A mixed bag in the 1Q update for the nickel and lithium company IGO today, though the market seemed to focus on the negatives and shares hit 12-month lows. EBITDA fell 42%, mostly on the back of lower profits from their Tianqi Joint Venture which was impacted by weaker lithium prices.

Profit was up though as the TLEA JV passed on a record $578m dividend. Spodumene production at their Greenbushes asset was up which helped lower costs as well. Nickel production was an issue with both Forrestania Resources Ltd (ASX: FRS) and Nova Minerals Ltd (ASX: NVA) seeing production fall more than 20% vs 4Q23, though the market was expecting Forrestania to be weak to start the year, Nova was worse than expected.

The company left guidance unchanged, however, it was noted that TLEA won’t be taking their full lithium spodumene allocation from Greenbushes which will have a double-whammy impact on IGO earnings.

IGO Ltd (IGO)

Calix (CXL) $2.49

CXL -11.7%: the green industrial technology company announced a licencing agreement with Bill Gates-backed Heirloom today, shares opened higher on the news however balance sheet concerns were only amplified by another deal which could drag the cash balance in the near term.

Heirloom will employ Calix’s Leilac technology in all future Direct Air Capture (DAC) while the former will also direct $3m to research & development. Calix will receive a royalty for all CO2 captured with a floor price ($US3/tonne) + a variable rate based on the prevailing carbon credit price less costs of capital.

The issue is that Calix requires near-term revenue, something this agreement is unlikely to provide and puts further pressure on a strained balance sheet.

Calix (CXL)

Broker Moves

- Azure Minerals Ltd (ASX: AZS) Cut to Speculative Hold at Bell Potter; PT A$4.85

- Austal Ltd (ASX: ASB) Raised to Buy at Argonaut Securities; PT A$2.45

- Harvey Norman Holdings Limited (ASX: HVN) Raised to Neutral at UBS; PT A$3.75

- Smartgroup Corporation Ltd (ASX: SIQ) Raised to Accumulate at CLSA; PT A$9.20

- McMillan Shakespeare Ltd (ASX: MMS) Raised to Buy at CLSA; PT A$20.20

- Janus Henderson Group CDI (ASX: JHG) GDRs Raised to Buy at Bell Potter; PT A$42.40

- Xero Limited (ASX: XRO) Raised to Buy at CLSA; PT A$134

- Resmed CDI (ASX: RMD) GDRs Raised to Overweight at Morgan Stanley (NYSE: MS); PT A$26

- ResMed GDRs Raised to Buy at CLSA; PT A$29.50

- Harvey Norman Raised to Hold at Jefferies; PT A$3.25

- Accent Group Ltd (ASX: AX1) Raised to Positive at Evans & Partners Pty Ltd

Major Movers Today