Global markets

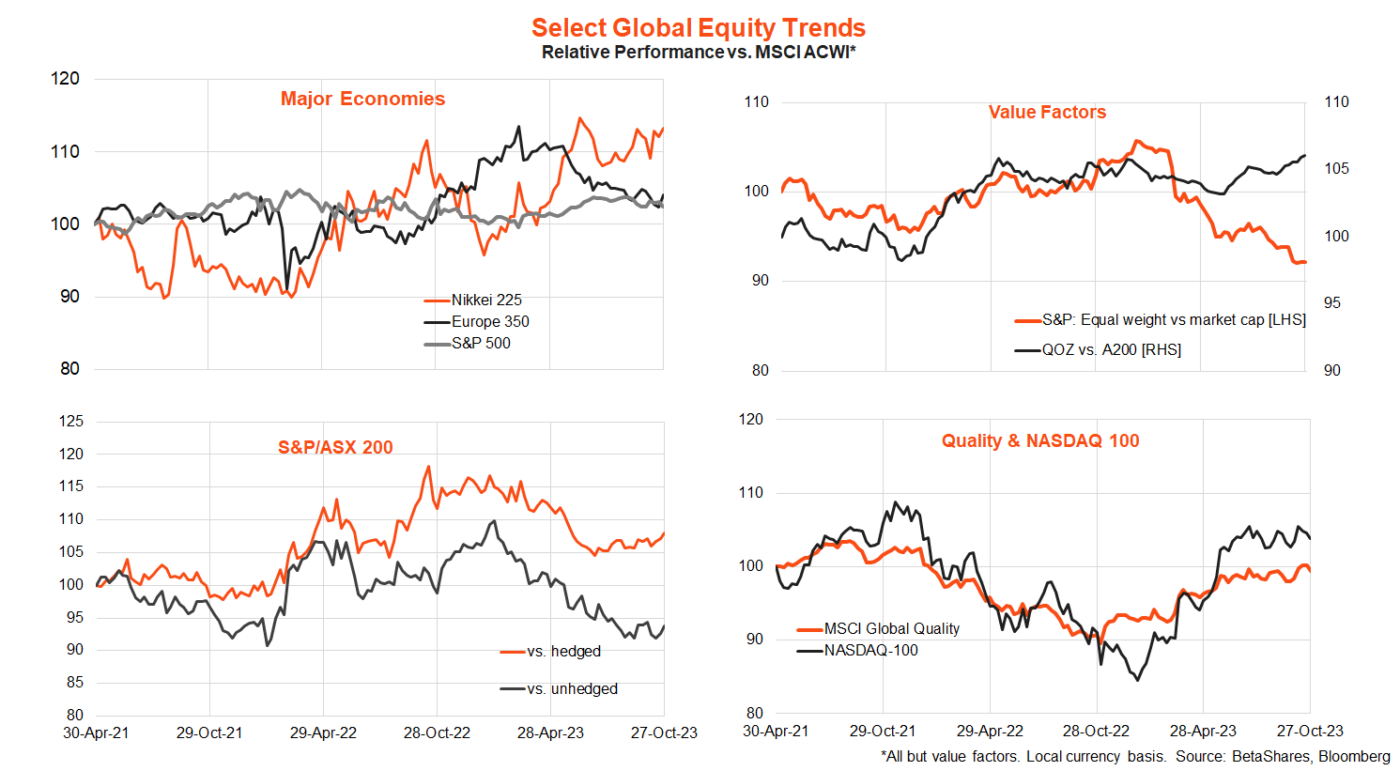

Global equities continued to sell off last week despite a fall back in bond yields and solid economic reports, with trigger-happy traders expressing disappointment with some tech earnings results.

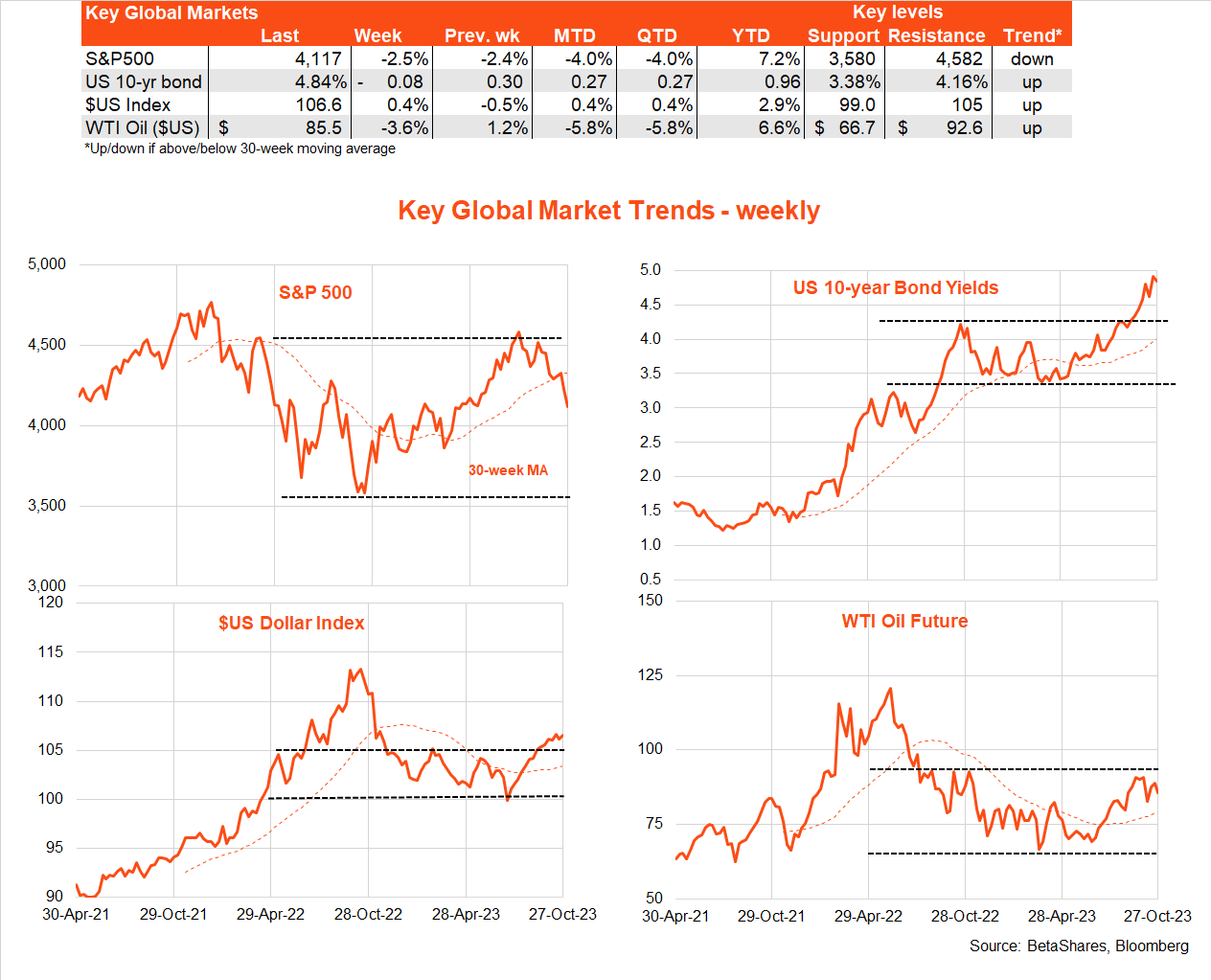

US 10-year yields tested 5% but ended the week at 4.84%. The S&P 500 (INDEXSP: .INX) dropped a further 2.5% after a 2.4% decline in the previous week. Oil prices dropped while the $US remained firm.

Key highlights last week were a blockbuster Q3 US GDP report, with the economy growing at a 4.9% annualised pace (market expectation 4.5%), underpinned by solid consumer spending.

At the same time, Friday’s key inflation report – the private consumption deflator – suggested pricing pressures continued to ease, though remain firm. While the 0.3% gain in core inflation was in line with expectations – helping annual core inflation ease to 3.7% from 3.8% – headline inflation was a touch stronger than expected at 0.4%, with annual headline inflation holding steady at 3.4%. Strong GDP and still firm inflation will not allow the Fed to ease up on its hawkish rhetoric this week (see below).

It could be that easing US inflation is actually helping boost real activity – by reducing the pressure on real incomes. This ‘sweet spot’ scenario might ordinarily be a good news story for both bond and equity markets, though Middle East tensions, public debt concerns, already stretched equity valuations and disappointment over the Fed’s unrelenting ‘high for longer’ rhetoric are currently overshadowing this relatively benign economic outlook.

Middle East tensions stabilised somewhat, with Israel delaying – at least for the moment – its anticipated ground operation into Gaza.

The other major highlight last week was Q3 earnings reports, with investors taking a dim view of any hint at future earnings disappointment. Amazon and Microsoft’s results pleased investors, while Alphabet and Meta’s did not – despite all playing the game and comfortably beating analysts’ quarterly earnings expectations. Alphabet’s soft cloud computing result and Meta’s warnings on a softening in ad spending saw nervous investors press the sell button.

Key highlights this week include Wednesday’s Fed policy meeting, at which rates are expected to remain on hold (though with a tightening bias and ‘higher for longer’ rhetoric persisting).

Tuesday’s US quarterly wage cost index is expected to show still firm – but not overly threatening – wage growth of around 4% annualised. Friday’s US October payrolls report is expected to show a slower but still firm pace of employment growth, with 180k new jobs expected to be created (after a 336k gain in September), and the unemployment rate is expected to hold steady at 3.8% with annual growth in average hourly earnings slowing to 4.0% from 4.2%.

On the earnings front, Thursday’s Apple result looms large. The market will also nervously keep a watch on the Middle East, with a focus on whether Israel’s anticipated move into Gaza sparks wider escalation.

Australian markets

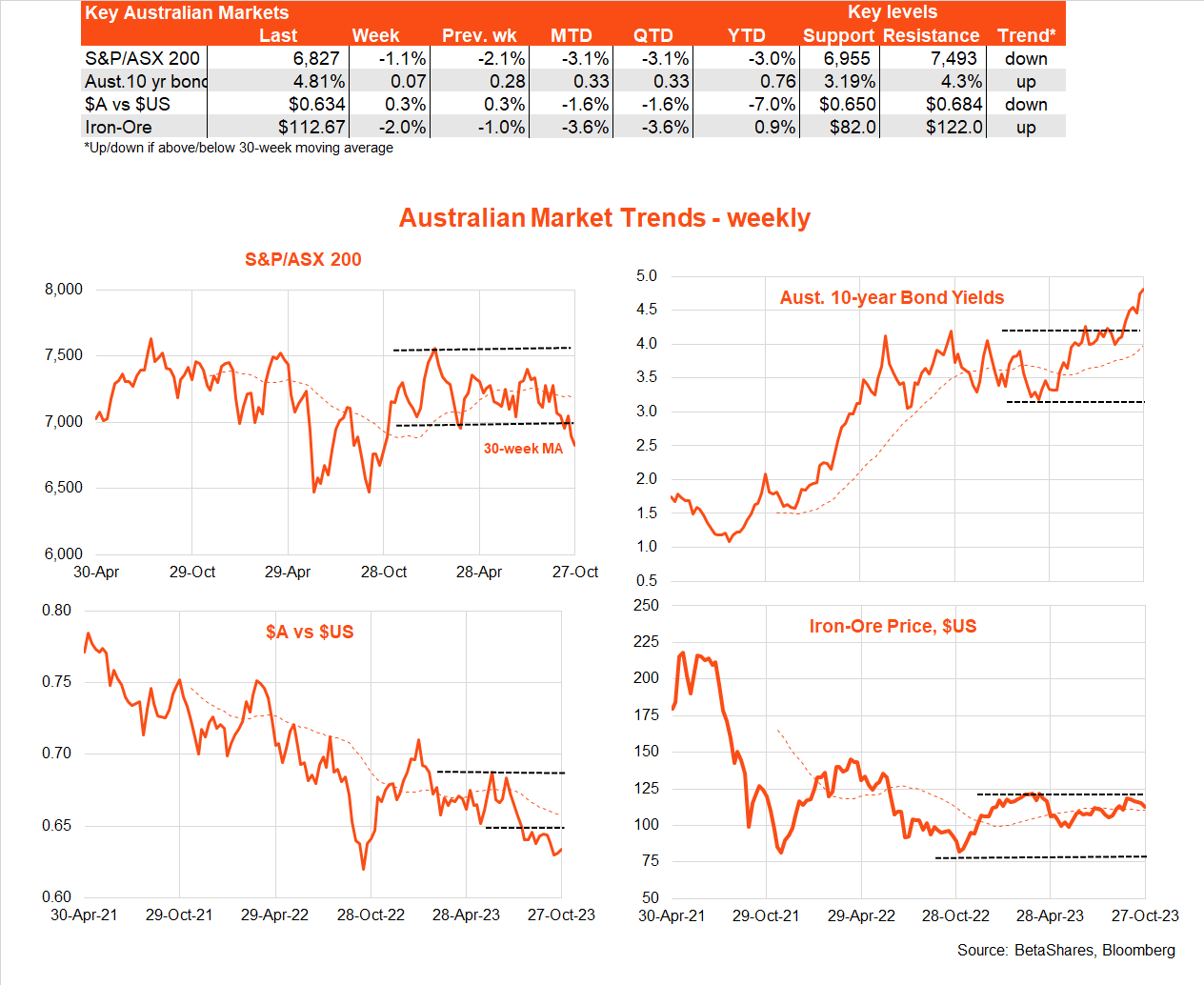

The local sharemarket fell in sympathy with global markets last week, and was not helped by a higher than expected CPI inflation result which has increased expectations of an RBA rate hike next week.

As evident in the chart set below, the S&P/ASX 200 (INDEXASX: XJO) has dropped below previous end-week support levels of around 7,000 in the past two weeks. Local 10-year bond yields have broken above their previous resistance levels of 4.3%, and the $A below previous support levels of US65c.

The key local development last week was the modestly higher than expected CPI outcome, with both the headline and trimmed mean indices rising by 1.2% (market expectations 1.1% for both). While this was only a modest upside miss, the issue was that market expectations were already high – and suggestive of the RBA potentially needing to upgrade its inflation forecasts in next week’s Statement on Monetary Policy.

While newly installed RBA Governor Michelle Bullock has talked tough on inflation in recent weeks, she was a little more equivocal under questioning last week. It turns out that while the Q3 CPI outcome was higher than the RBA expected, whether the RBA hikes or not next week turns on whether the likely upgrade to its inflation forecasts are ‘material’ or not. While the recent upsurge in Middle East tensions could cause the RBA to baulk at raising rates next week, my sense is that it will likely follow through on its threats lest it be seen as being soft on lingering inflation pressure.

Indeed, what is evident from last week’s CPI outcome is that pricing pressure in many sectors remains more pervasive than in the US despite softer consumer spending – which potentially reflects weaker local product market competition.

Against this background, the RBA will also be able to mull over September retail sales today and October house prices on Wednesday. Retail spending was surprisingly soft in August despite the Matildas bandwagon – so another soft result could add to RBA nervousness over raising rates next week. That said, another likely solid house price result on Wednesday could harden the RBA’s resolve.