Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.90% to 6899.70.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

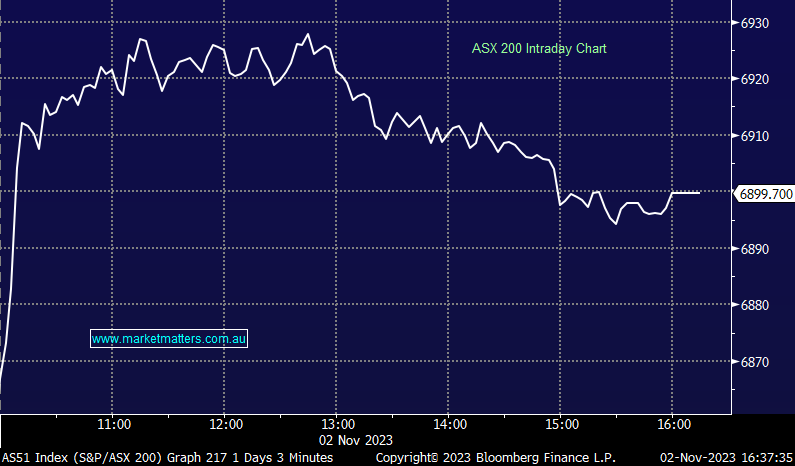

Dovish commentary out of the Fed overnight helped to support equity markets globally over the last ~12 hours, and the ASX was no exception.

Interest rate-leveraged sectors of Tech and Real Estate were the most significant beneficiaries as the rally in bond yields cooled off. The US 2-year yields fell back below 5% and Australian bond yields were also lower throughout our session.

Energy and Utilities skipped out of the rally for different reasons, but there was broad-based buying elsewhere with more than 80% of the ASX 200 in the black today.

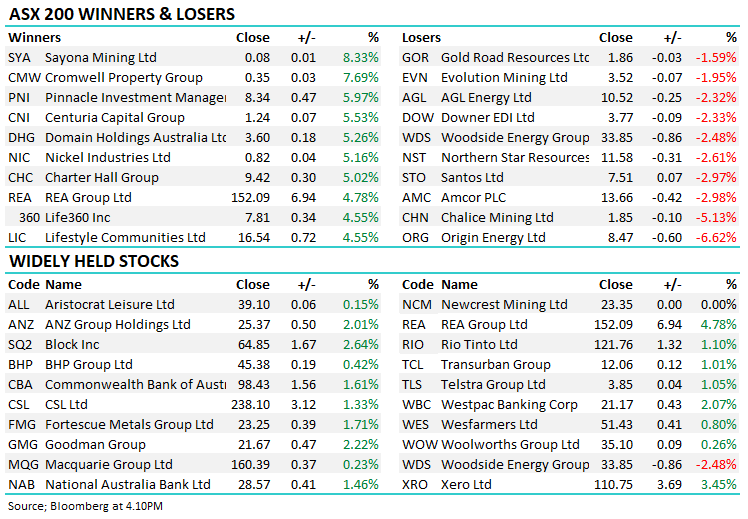

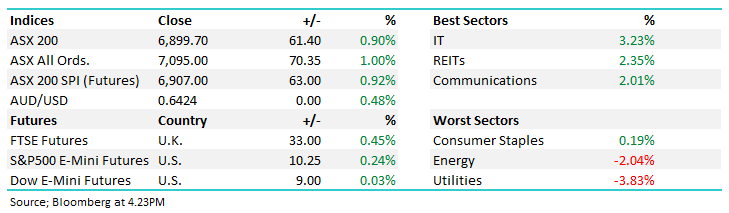

- The ASX 200 finished up +61pts/ +0.90% to 6899

- The Tech Sector was best on ground (+3.23%) while Real Estate (+2.35%), Telcos (+2.01%), Financials (+1.43%) and Healthcare (+1.38%) also did well.

- Utilities (-3.83%) & Energy (-2.04%) struggled today.

- Aussie Trade data today was soft with a significant rise in imports and a fall in exports. There was little reaction from the market at the time.

- CSR Limited (ASX: CSR) +0.71% a choppy session on 1H results that were broadly in line with expectations with the Building Products division carrying the result along with supportive commentary for the 2H, though offset by further softening in Aluminium.

- Origin Energy Ltd (ASX: ORG) -6.62% fell after AusSuper said they would still vote against the revised Brookfield bid price of $9.53, saying it still undervalues the company, ORG closed today at $8.47 with Brookfield declaring the offer best and final – clearly there is a growing chance the deal may fall over.

- Macquarie Group Ltd (ASX: MQG) +0.23% reports 1H24 results tomorrow, look for revenue for the half ~$7.8bn & a net profit of $1.7bn, however consensus for the FY24 is $4.1bn so they need a better 2nd half – guidance around that will be important.

- Catapult Group International Ltd (ASX: CAT) flat, giving up strong gains at the end of the day after announcing incremental improvements for their video product with additional capabilities and faster turnaround aimed at their Basketball clientele.

- Bowen Coking Coal Ltd (ASX: BCB) halted ahead of a cap raise. More to come on this tomorrow

- A suite of Uranium companies including Silex Systems Ltd (ASX: SLX) & Paladin Energy Ltd (ASX: PDN) presented at today’s uranium Conference at Shaw & Partners. The general takeaway that the space still sees plenty of upside and momentum continues to build.

- Iron Ore was 1% higher in Asia supporting the miners today, Fortescue Metals Group Ltd (ASX: FMG) +1.71% continues to grind higher, defying the bears.

- Gold was flat during our time zone, +$US2 higher at $US1984

- Asian stocks were up to varying degrees, Hong Kong +1%, Japan +1.1% while China edged up +0.05%.

- US Futures have edged higher during our time zone., Nasdaq futures seeing the best of the move, currently up +0.4%.

- US stocks we own in our International Equities Portfolio reporting this week include: Apple Inc (NASDAQ: AAPL) & Barrick Gold Corp (NYSE: GOLD)

- Overnight we bought back into HCA Healthcare Inc (NYSE: HCA) following its ~25% pullback from recent highs.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Broker Moves

- Data#3 Limited (ASX: DTL) Raised to Buy at Taylor Collison; PT A$7.50

- Symbio Holdings Ltd (ASX: SYM) Cut to Hold at Canaccord Genuity Group Inc (TSE: CF); PT A$3

- Janus Henderson Group CDI (ASX: JHG) GDRs Raised to Neutral at Jarden Securities

- Temple & Webster Group Ltd (ASX: TPW) Raised to Overweight at Jarden Securities

- Janus Henderson GDRs Raised to Accumulate at CLSA; PT A$38.60

- Siteminder Ltd (ASX: SDR) Raised to Overweight at Morgan Stanley (NYSE: MS); PT A$4.75

- Infomedia Limited (ASX: IFM) Raised to Buy at Bell Potter; PT A$1.75

- MMA Offshore Ltd (ASX: MRM) Rated New Buy at PAC Partners; PT A$1.65

- Amcor CDI (ASX: AMC) GDRs Raised to Add at Morgans Financial Limited

- Alcidion Group Ltd (ASX: ALC) Cut to Sector Perform at RBC

Major Movers Today