Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.29% to 6977.10.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

The RBA raised rates today by 0.25% to 4.35% inline with the majority of expectations and market pricing – we’re not surprised they did but we thought there was very little reason to do so.

The reaction in markets told the story, stocks initially lower but reversed quickly to trade up (+20pts) from pre-announcement levels, while the currency fell (-0.80%) and so did bond yields, the reaction you’d expect at the end of a hiking campaign.

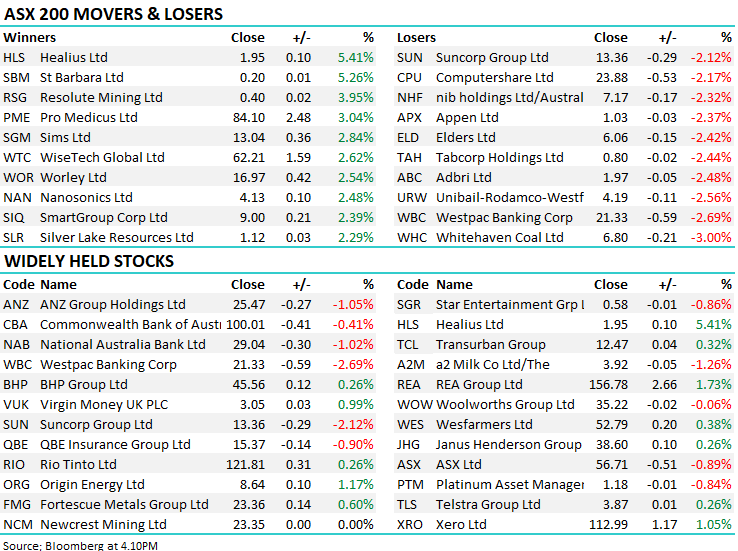

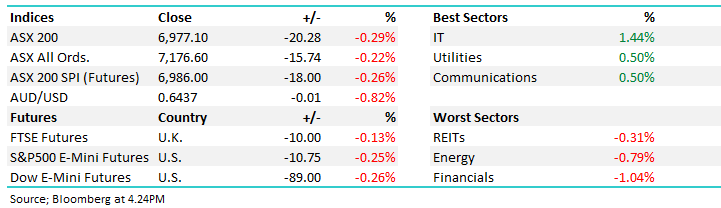

- The ASX 200 finished down -20pts/ -0.29% to 6977

- The IT sector was best on ground (+1.44%) while Utilities (+0.50%) and Communications (+0.50%) jostled for 2nd spot.

- Financials (-1.04%) fell, so too did Energy (-0.79%) and Property (-0.31%).

- The RBA commentary implied Governor Bullock & Co are near an end, today’s hike in their words was warranted as to be “more assured that inflation would return to the target in a reasonable time frame”, while they also softened some other language which implies they could well be done.

- Market pricing now shows another ~10bps of tightening to come, but that prices a distribution of expectations – in our view, there is a very high chance that today marks the peak in local interest rates.

- The Melbourne Cup was run and won by Without a Fight paying $6.50 (2nd favourite).

- Macquarie Group Ltd’s (ASX: MQG) quant team finally picked the winner in their traditional model, however, they also included picks from an AI-driven model with help from Evolved Reasoning to aid their recent form slump, and that had the winner running 2nd.

- Worley Ltd (ASX: WOR) +2.54% had a good session and has held up extremely well over a tough 3-months for the market – we continue to expect new highs from WOR driven by the ongoing demand from the energy transition – we own Worley in the Active Growth Portfolio.

- Origin Energy Ltd (ASX: ORG) +1.17% was higher after Institutional Shareholder Services recommended investors to vote in favour of the Brookfield-led consortium’s bid – while there is still a very slight chance this could get through without the support of AusSuper, it’s a long shot.

- GQG Partners Inc (ASX: GQG) –1.82% fell after it recorded a $US1.9bn drop to its funds under management in October.

- Westpac Banking Corp (ASX: WBC) -2.69% fell as brokers downgraded earnings expectations in aggregate following yesterday’s result – consensus EPS for FY24 now $1.81 down from $1.86 prior – it was $2.19 at the start of the year.

- National Australia Bank Ltd (ASX: NAB) -1.02% the next cab off the rank reporting on Thursday.

- Xero Limited (ASX: XRO) +1.05% edged higher ahead of their results, also due for release on Thursday.

- Not a lot else happening at a stock level today as the office feels very empty, no doubt like the majority of firms around the city.

- Iron Ore was 0.4% lower in Asia but the miners edged higher.

- • Gold was down $US6 trading at $US1971 around our close.

- • Asian stocks were all down to varying degrees, Hong Kong -1.5%, Japan -1.24% while China slipped -0.7%.

- • US Futures are down around -0.20%

- • Stocks we own in our International Equities Portfolio that report this week include UBS Group AG (SWX: UBSG) tonight, Trade Desk Inc (NASDAQ: TTD) and Yeti Holdings Inc (NYSE: YETI).

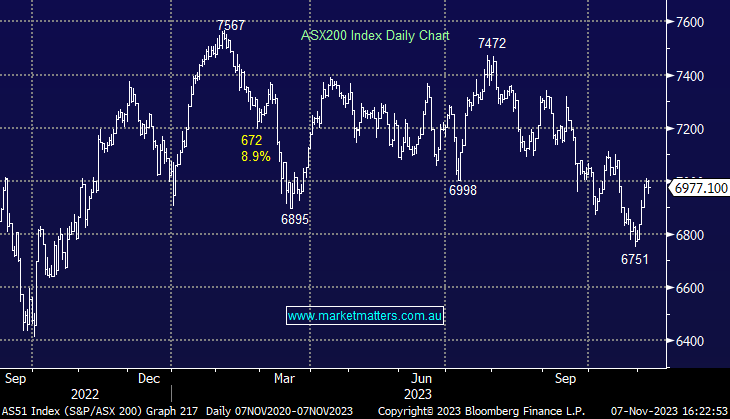

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Bond Yields & Equities

A good chart from Bloomberg on why bond yields are important for equities. We write a lot about bond yields and appreciate it can get repetitive, however, this chart outlines why.

Broker Moves

- Integral Diagnostics Ltd (ASX: IDX) Raised to Buy at Ord Minnett; PT A$2.50

- Integral Diagnostics Raised to Overweight at JPMorgan Chase & Co (NYSE: JPM); PT A$2.50

- Sigma Healthcare Ltd (ASX: SIG) Rated New Add at Morgans Financial Limited

- Sims Ltd (ASX: SGM) Raised to Accumulate at CLSA; PT A$13.90

- Karoon Energy Ltd (ASX: KAR) Rated New Buy at Citigroup Inc (NYSE: C); PT A$3

Major Movers Today