Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.26% to 6995.40.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

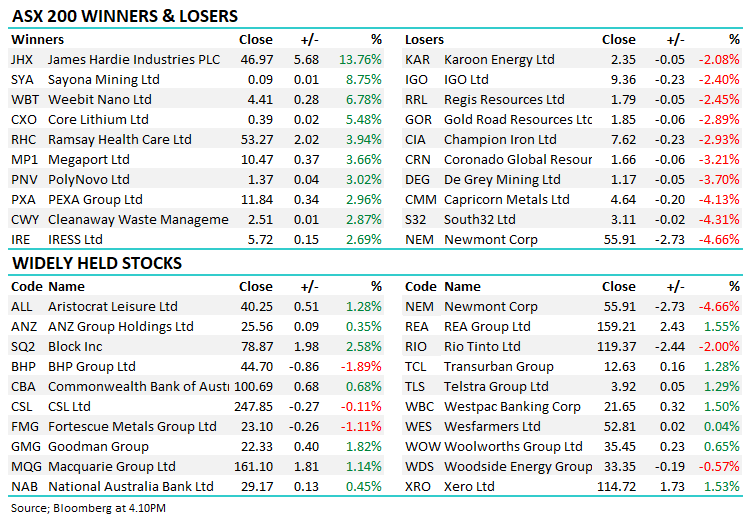

A mildly positive session for the ASX with 65% of the main board higher, if it hadn’t been for widespread weakness across commodities the market would have pushed up through 7000 with a bullish vibe, only 24 hours after the RBA hiked rates again.

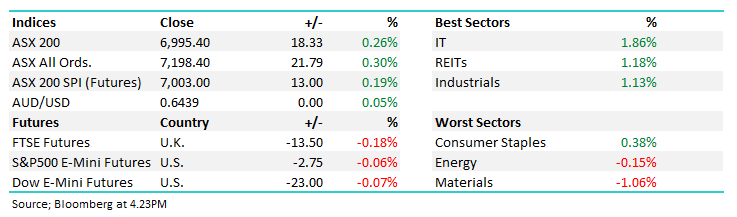

- The ASX 200 finished up +18pts/ +0.26% to 6995

- The IT sector was best on ground (+1.86%) while Property (+1.18%) and Industrials (+1.13%) also did well.

- Materials (-1.06%) and Energy (-0.15%) the only sectors in the red.

- James Hardie Industries plc (ASX: JHX) +13.76% rallied on strong 3Q guidance, expect upgrades a plenty for JHX following today’s quarterly, more on this below.

- Magellan Financial Group Ltd (ASX: MFG) +0.58% held their AGM today following last month’s departure of the CEO – which we view as a positive move towards getting their existing business right in the first instance.

- National Australia Bank Ltd (ASX: NAB) +0.45% edged higher ahead of their FY23 results tomorrow, look for NPAT of $7.82bn and a 2H dividend of 85cps.

- Xero Limited (ASX: XRO) +1.53% rallied ahead of their 1H24 results, also due tomorrow, which could also include a re-cut of their US strategy.

- This is potentially a very big day for XRO with the market focussing on the potential for a re-jigged effort in the US which has been burning cash. At a high level look for revenue of $810m, EBITDA of ~$200m and a profit of ~$50m with total subs approaching 4m, each paying above $35 per month.

- Woodside Energy Group Ltd (ASX: WDS) -0.57% held its annual investor day, and we took away two key points: 1. Demand is not falling as fast as supply, and it is becoming increasingly difficult to build new supply which should support prices 2. Woodside is currently going through a capex peak – with capex falling, the capacity for increased shareholder returns is better from here.

- Telstra Group Ltd (ASX: TLS) +1.29% had a good session on a broker upgrade + benefitted from the Optus debacle today that saw their network down.

- Rio Tinto Ltd (ASX: RIO) -2.00% CEO is in China at the same time as Albo, saying….“The fact that the infrastructure projects are still happening and the automotive sector is booming does offset the challenges in the property sector. Steel production is up 4.4 per cent in the 12 months ended September – that’s not bad. The economy is not booming, but it’s doing OK,”

- China holding up better than many feared is what’s keeping iron ore well supported, Chinese steel mills have not cut back capacity.

- Copper on the other hand has been weak, we suspect this is not so much about China, but probably more to do with recession fears in the US and demand weakness in Europe.

- Coincidentally, we also had the IMF upgrade its China’s growth forecasts overnight on a stronger-than-expected performance in the third quarter, they now think China’s GDP will expand 5.4% in 2023 and 4.6% in 2024,

- Iron Ore was flat in Asia.

- Gold was down a touch at $US1966.

- Asian stocks were a touch lower today, Hong Kong -0.04%, Japan -0.09% while China fell -0.08%.

- US Futures are flat.

- UBS reported overnight and rallied – our take can be viewed here

- Tomorrow night sees portfolio stocks Trade Desk Inc (NASDAQ: TTD) & Yeti Holdings Inc (NYSE: YETI) report results in the US.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

James Hardie (JHX) $46.97

JHX +13.76%: the building products company posted an inline 2Q update today, though shares surged to 2-month highs on strong guidance. NPAT of $US179m was as expected, EBIT was a small miss at $US240m mostly on R&D and corporate costs but margins were strong thanks to successful cost control elsewhere.

James Hardie said 3Q earnings were expected to come in at $US165-185m, a huge $US40m beat to consensus driven by market share gains and higher margins. James Hardie has worked on reducing input costs, helped by falling freight costs, which is driving operational leverage. If this run rate can continue through the rest of the year, JHX could produce FY24 NPAT ~10% ahead of consensus expectations.

Shareholders also enjoyed the new $US250m buyback – a top update overall and shows the business is accelerating.

James Hardie (JHX)

Broker Moves

- Telstra Rates New Buy at Jarden Securities

- Nido Education Ltd (ASX: NDO) Rated New Overweight at Wilsons; PT A$1.32

- Altium Limited (ASX: ALU) Cut to Accumulate at CLSA; PT A$46

- Westpac Banking Corp (ASX: WBC) Raised to Neutral at Jarden Securities; PT A$21.60

- TPG Telecom Ltd (ASX: TPG) Rated New Overweight at Jarden Securities; PT A$5.40

- Westpac Cut to Hold at Morgans Financial Limited; PT A$21.58

- TechnologyOne Ltd (ASX: TNE) Rated New Neutral at JPMorgan Chase & Co (NYSE: JPM); PT A$15.30

- Chrysos Corporation Ltd (ASX: C79) Raised to Overweight at Barrenjoey; PT A$8.20

Major Movers Today