The parallels between managing our physical health and financial wellbeing are striking. Just as many of us seek a robust workout routine targeting different muscle groups, we desire a well-rounded approach to our financial health.

Despite exchange-traded funds (ETFs) helping to make this process easier, the conventional process of investing can be cumbersome – involving manual transfers to a brokerage account, logging in, completing forms, and executing trades.

Wouldn’t it be convenient if this entire process could be automated? Welcome to the concept of investing on ‘autopilot’ – an efficient method to diversify your portfolio and grow wealth.

This approach empowers investors to automate the complexities of investment research, significantly reduce time spent on brokerage accounts, and minimise the risks associated with market timing and the temptation to deviate from a disciplined investment strategy.

Let’s look at why having a consistent investing plan is the cornerstone of financial fitness.

Unlocking the secret to financial fitness: A hypothetical analysis

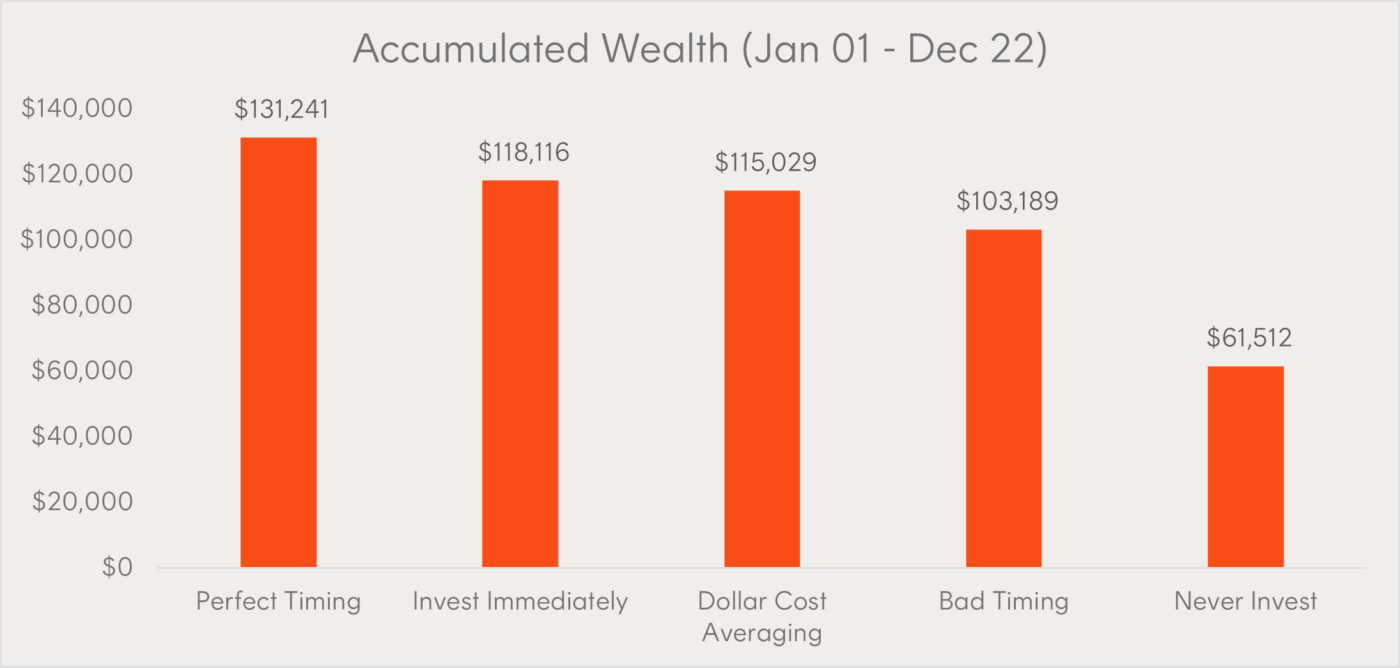

To underscore the efficacy of autopilot investing, we conducted an analysis of five hypothetical investors who employed five simplistic strategies to invest in the Australian sharemarket over 22 years (Jan 2001 – Dec 2022). The purpose of the study was to unravel the mystery behind the best time to invest. The analysis is covered in detail here but is summarised below.

Each investor was given $2,000 at the beginning of each year and invested that amount as follows:

- Lucky Leo: He timed the ASX’s low point to perfection each year, investing his full $2,000 at the bottom of the market.

- Rapid Riley: Invested the $2,000 immediately when it became available on the first trading day, without timing attempts.

- Steady Eddy: Used dollar cost averaging (DCA) – investing $2,000 in 12 equal parts at the start of each month.

- Hopeless Harry: Unlike Leo, Harry couldn’t time the market and always invested at each year’s market peak, succumbing to the fear of missing out (FOMO) on further gains.

- Hesitant Hayley: Left money in the bank account due to procrastination, only earning interest.

And the winner is…

The chart below shows the accumulated value of each strategy at the end of 2022.

Leo, who remarkably managed to time the market perfectly every year, emerged as the top performer. It’s essential to recognise that Leo’s success was primarily a stroke of luck. We have previously discussed why attempting to time the market is a futile endeavor for most individuals.

What’s remarkable is that despite their diverse approaches, the first four investors significantly outperformed Hayley, whose returns languished due to her hesitancy to invest at all.

Additionally, Riley’s strategy to invest immediately when the funds became available on the first trading day of the year, and Eddy’s DCA approach were notably hands-off. This meant they could focus more of their time on other pursuits rather than attempting to time the market, while still benefiting from the overall long-term growth in the market.

Are investors are their own worst enemy?

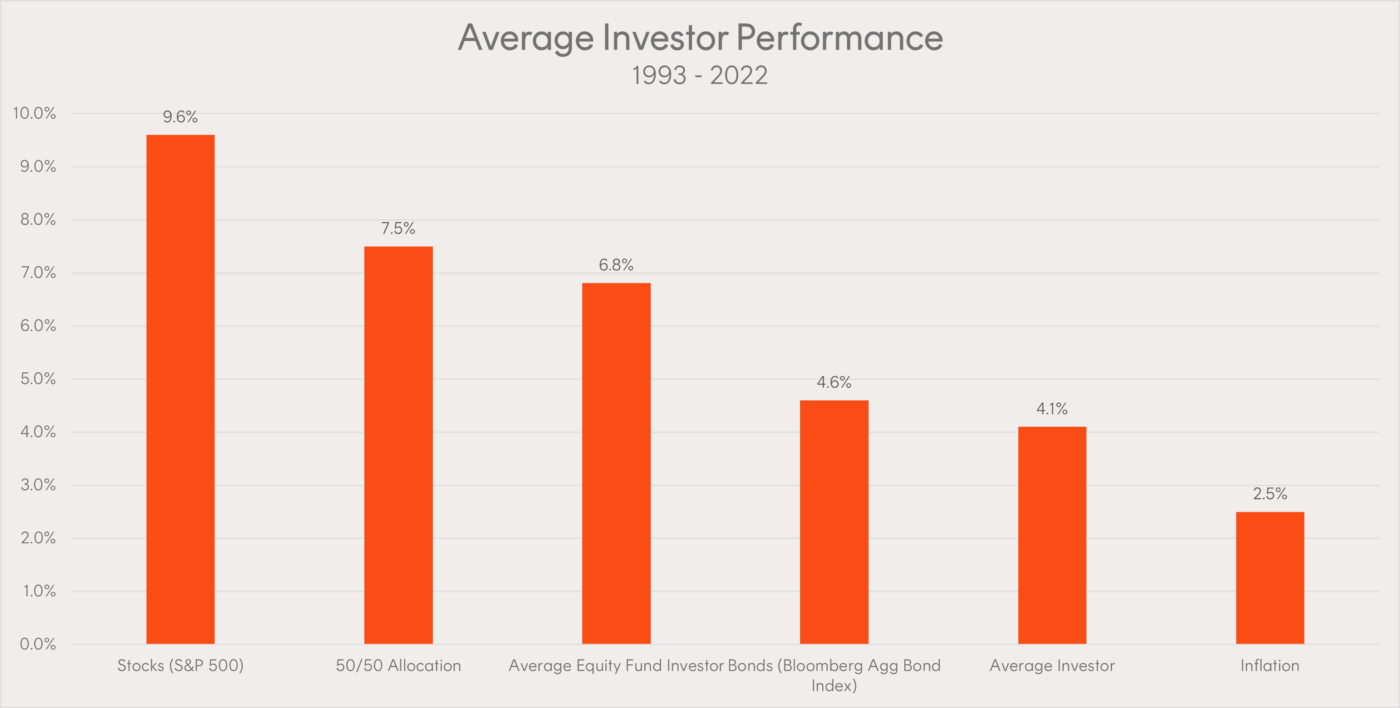

For nearly 40 years now, Dalbar – a US-based research firm – has published its Quantitative Analysis of Investor Behaviour (QAIB). Despite the dry and academic title, the report offers fascinating insights into how investors behave in the real world.

The QAIB study compares the returns of investors with the returns of the relevant indices. Last year was no different. Dalbar found that in 2022, the ‘Average Equity Fund Investor’* lost 21.17%, versus the S&P 500 Index, which lost 18.11%.

According to Dalbar, over the last 30 years, the ‘Average Investor’* has underperformed the S&P 500, the Bloomberg Aggregate Bond Index, and a 50/50 allocation to the two.

Investing on autopilot made easy with Betashares Direct

Having underscored the significance of a consistent financial approach, it’s time to address the challenge faced by Australians – finding accessible, cost-effective platforms that enable investing in robust portfolios on autopilot.

Enter Betashares Direct, a new solution designed to seamlessly bridge the gap between theory and action. Here’s what sets it apart:

All ASX-traded ETFs

- Invest in any ETF traded on the ASX – issued by Betashares and other providers

- Enjoy zero brokerage and no account fees

- Automatically reinvest ETF distributions, or elect to receive cash

Automate your investing with AutoPilot

- Access professionally constructed pre-built portfolios or build your own custom portfolio, for low monthly fees

- Set up recurring investments

- Automatic monitoring and rebalancing of your portfolio.

Conclusion

The principles of physical and financial fitness share remarkable similarities. Just as a toned physique requires a robust plan, consistent habits, and a variety of exercises, financial success demands a solid strategy, regular commitment to invest, and a diversified portfolio.

Investing on autopilot streamlines this process, making it effortless and efficient. Automating your investments reduces the risk of straying from your long-term strategy and succumbing to fads and FOMO.

With autopilot investing and the right tools, you can build a brighter financial future without the hassle of constant monitoring and decision-making.

*Average investor and average equity fund investor returns are based on an analysis by DALBAR, Inc., which utilises the net of aggregate mutual fund sales, redemptions and exchanges each month as a measure of investor behavior. Average investor returns are based on a blend of stock and bond funds, while average equity fund investor returns are based on equity funds only.