Global markets

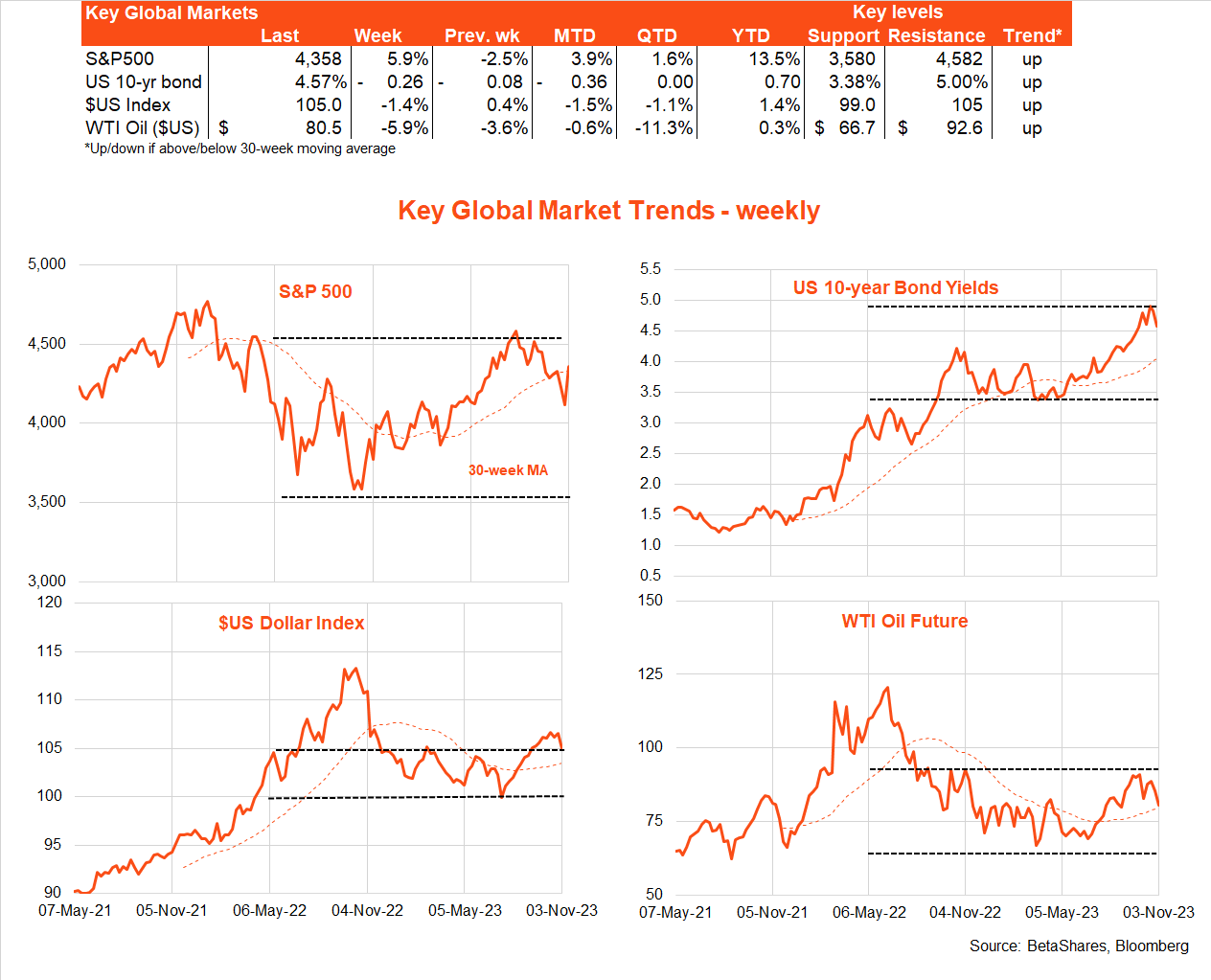

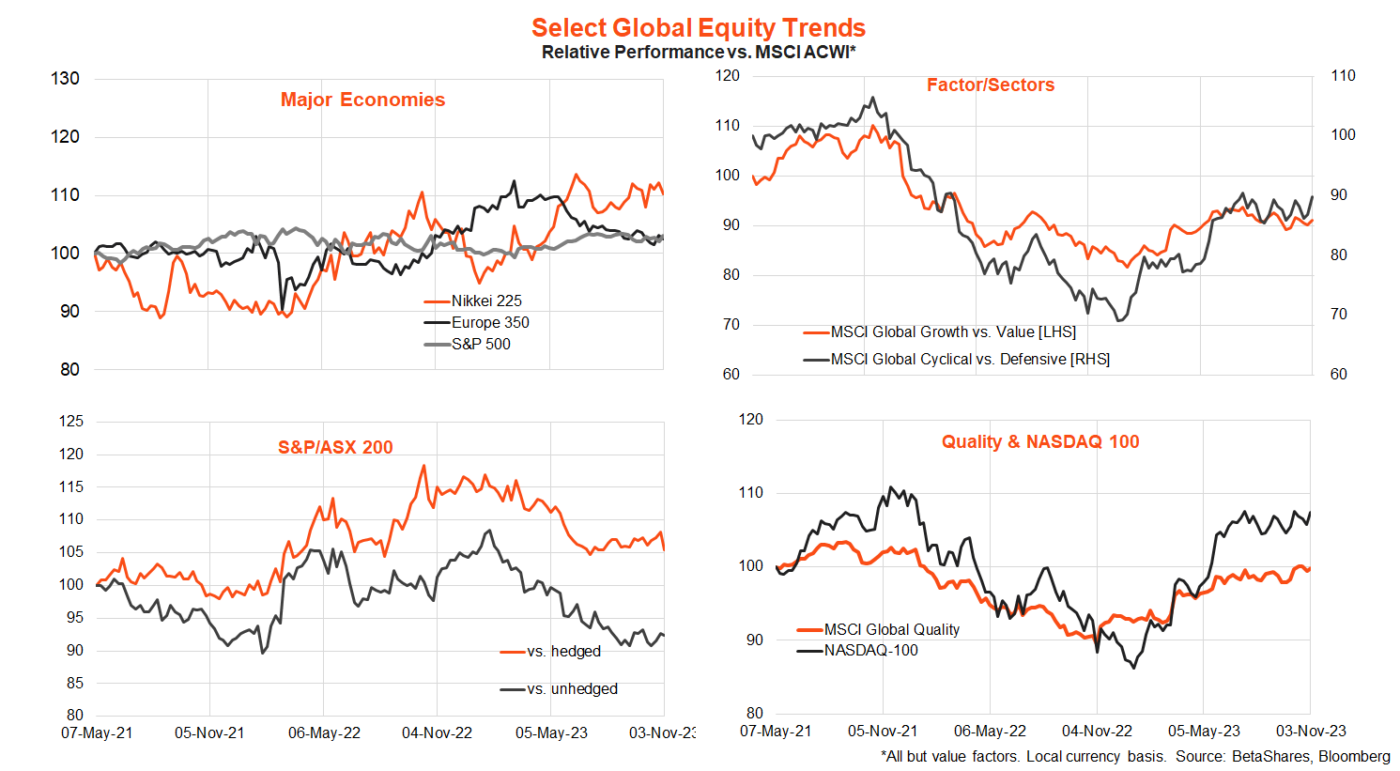

What a week! Softer-than-expected US economic data, reduced Treasury issuance, Middle East containment and a somewhat more dovish Federal Reserve saw bond yields plummet last week and equities bounce back.

US 10-year yields dropped a lazy 0.26% to 4.57%, while the S&P 500 (INDEXSP: .INX) rebounded by an equally lazy 5.9%.

Helping the positive market vibe, oil prices dropped 5.9% as fear of a Middle East war escalation eased.

Somewhat ironically, it was the sharp rise in bond yields in recent weeks that helped the Fed sound more dovish following last week’s policy meeting at which rates were left on hold as widely expected.

In keeping with Fed comments in the lead up to the meeting, Powell noted the tightening in financial conditions brought about by higher bond yields was effectively doing some of the Fed’s work in trying to slow growth and bring down inflation.

His comments have now sparked an easing in financial conditions – if he’s uncomfortable about that he may say so in a mid-week appearance at an IMF panel discussion.

As it stands, the market now attaches only a 5% chance on a December Fed rate hike.

Other market-supportive news last week was a lower than feared schedule of new Treasury issuance, with the Treasury deciding to issue fewer bonds at long maturities (it was the decision to issue more long duration bonds back in August that appears to have helped spark the recent bond sell-off).

Softer economic data, thought partly influenced by auto strikes, was also market supportive, with a smaller-than-expected October payrolls gain of only 150K (market 180k), a lift in the unemployment rate to 3.9% and soft 0.2% gain in average hourly earnings.

Indeed, some are starting to note that the US unemployment rate has now lifted by 0.5% from its 3.4% low earlier this year – according to the “Sahm rule” US recessions have typically started when the 3-month moving average of the unemployment rate has lifted by 0.5% from its 12-monthly low. We’re not there yet (this measure is 0.33% from its low), and October’s results were likely distorted by 33k auto workers going out on strike. Weekly jobless claims also remain very low.

There’s little key global data this week, with some interest in tonight’s Fed survey of lending conditions – given these have tightened in recent months to a degree suggestive of a notable economic slowdown (which so far, I might add, has not materialised). Otherwise, what Fed chair Powell might say in light of last’s week sharp drop in bond yields will be of interest – will he revert to being hawkish or tacitly condone the bond market’s euphoria.

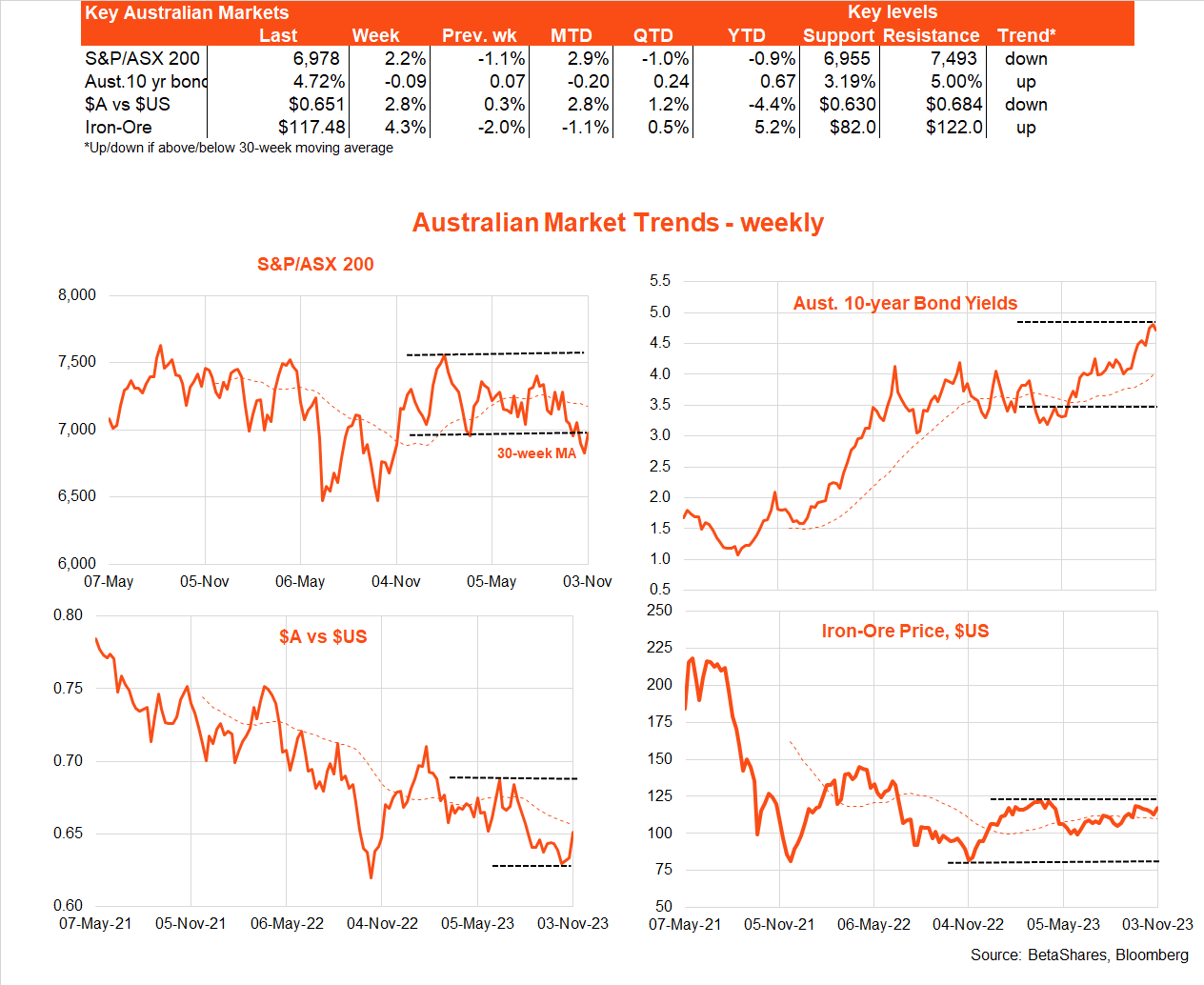

Australian markets

The S&P/ASX 200 (INDEXASX: XJO) is likely to open stronger this morning following Wall Street’s post-payrolls positive end to the week. That said, bond yields have so far not rallied as much as those in the US due to a lingering fear the RBA will raise interest rate tomorrow.

Indeed, last week’s local economic data was not supportive of the RBA remaining on hold. Retail sales rose by a perky 0.9% in September as did national house prices in October. Credit growth, particularly for business, was also firm.

As I noted last week, the RBA decision effectively turns on whether the Bank feels the recent higher-than-expected Q3 CPI result warrants a “material” upgrade to its inflation forecasts which will be published in Friday’s Statement on Monetary Policy.

To my mind, at least a modest upgrade from 4.0% to 4.25% will be required for the December 2023 forecast for trimmed mean annual inflation as it would require an unlikely low Q4 quarterly gain of 0.6% for the current forecast to be realised.

Is such an upgrade material? Maybe, maybe not. But were the RBA not to raise rates its credibility would likely be hurt given that only a few weeks ago the minutes from the previous policy meeting promised us the Board had a “low tolerance” for a slower than currently forecast decline in inflation back to the target zone. Holding rates steady – given the unseemly campaigning for such an outcome by Treasurer Chalmers – would only add to the credibility problem.

Of course, the RBA could hold rates steady and upgrade its December 2023 inflation forecast – while still holding to its expectation of inflation returning to the target band by mid-2025. But I still think that would be squibbing, and RBA credibility demands otherwise. Indeed – not that it has mattered in the past – but polls suggest a strong majority of economists expect the RBA to hike.

Against this backdrop, my base case is that the RBA will raise rates tomorrow – if only to burnish in the public’s mind its independence from the Government. In this regard, the Treasurer’s irresistible need to comment on policy in recent weeks has likely made a rate rise more likely than not.

Economically, moreover, I also maintain what I said last week – what is evident from the Q3 CPI outcome is that pricing pressure in many sectors remains more pervasive than in the US despite softer consumer spending – which potentially reflects weaker local product market competition.

In the absence of an overnight boost to price competition, the RBA needs to hike to ensure consumer spending remains subdued and thereby hopefully crimps current business pricing power across vast swathes of the economy.