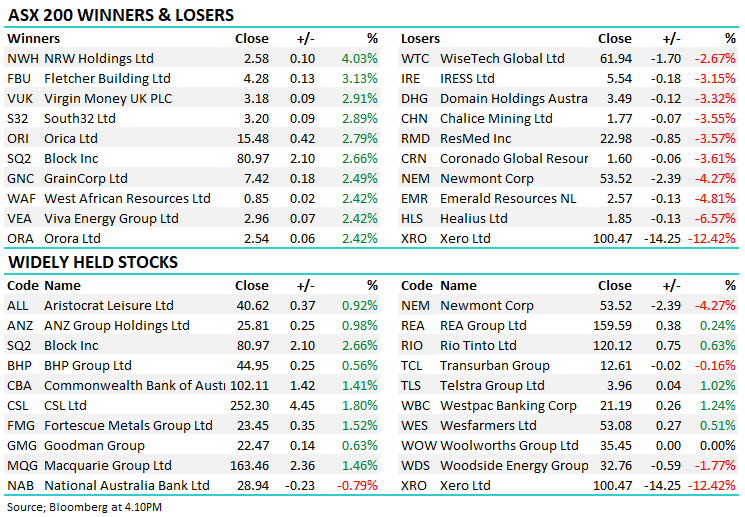

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.28% to 7014.90.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

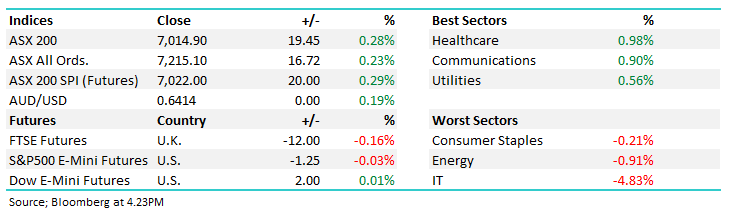

The ASX200 hit a 3-week high around midday today on hopes that we have seen “peak rates” locally and in the US. The run home was a little tougher this afternoon though, finishing in positive territory but falling ~30pts from the high. The Energy sector continues to struggle, Crude oil hitting a 3-month low overnight feeding into further weakness today, offset by a reasonable performance by Financials and Materials.

- The ASX 200 finished up +19pts/ +0.28% to 7014

- Healthcare (+0.98%) was best on ground today, followed closely by Telcos (+0.90%)

- Tech (-4.83%) was the hardest hit on a soft Xero Limited (ASX: XRO) result. Energy (-0.91%) and Staples (-0.21%) were the only other sectors that fell today.

- The S&P 500 (INDEXSP: .INX) is on their best winning streak in 2-years as investors place bets on-peak rates, now the consensus view for the States but still some chance of another hike being priced in locally.

- National Australia Bank Ltd (ASX: NAB) -0.79% announced an OK Fy23 result, largely in line with expectations but noting continued competition for loans and deposits.

- Xero -12.42% fell to 5-month lows on a softer-than-expected 1H today. We cover this below.

- Nine Entertainment Co Holdings Ltd (ASX: NEC) +0.26% only marginally higher, though comments at the AGM suggest the media landscape is running better than feared.

- Centuria Capital Group (ASX: CNI) +0.8% said Group FUM was up marginally to $21.1b and had completed $335m in gross transactions in the period, pretty solid given the doom and gloom in property at the moment.

- Origin Energy Ltd (ASX: ORG) +1.49% more hope of the takeover bid vote getting up, a second proxy voter has pledged their support for the Brookfield offer.

- Orica Ltd (ASX: ORI) +2.79% a small beat for FY23 results, notably a lack of pushback on price hikes helped margins improve.

- Iron Ore was up 1.5% in Asia today but did ease from highs.

- Gold was flat in today, hanging around the $US1,950/oz level.

- Indices in the region were mixed – Nikkei +1.57% but the Hang Seng -0.2%.

- US Futures are largely flat – a 50/50 chance to extend the 8 day winning streak for the S&P 500.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

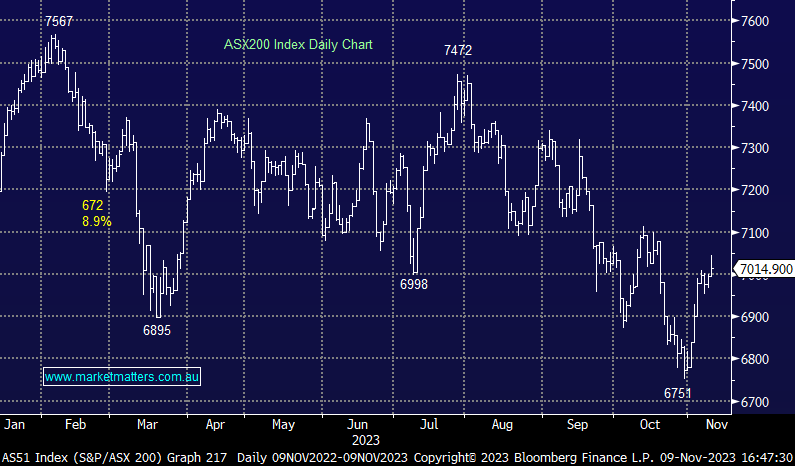

National Australia Bank (NAB) $28.94

NAB -0.79%: the second major bank to report FY23 numbers this period, NAB shares underperformed today on a slight miss.

Cash Profit was up 9% to $7.73b, slightly below estimates of $7.8b, mostly on lower markets income rather than the core result. Net Interest Margin (NIM) fell 6bps in the 2H to 171bps, though this was as expected.

As were higher costs on wages, inflation and a higher depreciation and amortization charge. Credit quality remains solid with Bad and Doubtful Debts (BDD) around ~10% below expectations and although mortgage arrears were higher, Non-Performing Loans (NPL) remain resilient.

The bank said competition for mortgages and deposits remains fierce which is expected to keep NIMs low for now, however, they are confident Australia will avoid a significant downturn, which would support earnings – talking their own book.

NAB will pay an 84cps final dividend, once again in line with expectations.

- NAB’s FY23 result was largely as expected, we continue to have a preference for ANZ & NAB in the Big 4, with CBA for income

National Australia Bank (NAB)

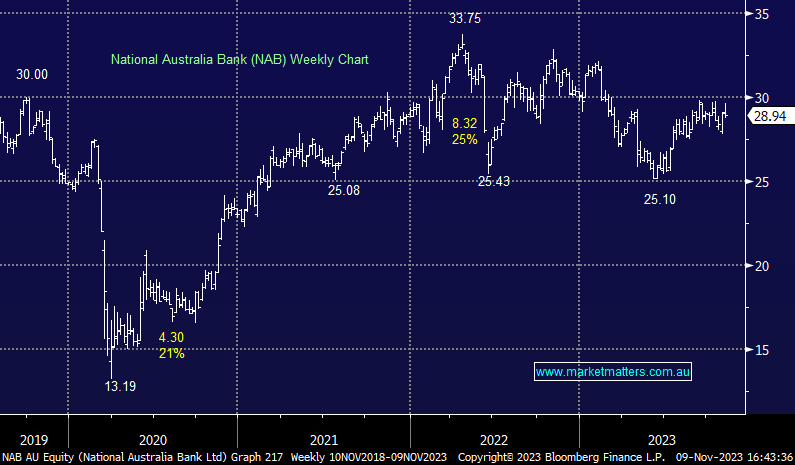

Xero (XRO) $100.47

XRO -12.42%: accounting software company fell more than 10% today for the first time in 2 years on a small miss at the 1H result.

The good news was a great core Australia & NZ result with a combined 139k subs added and a small revenue beat. Average Revenue Per User (ARPU) was a small beat but this looked to be carried by an FX tailwind. Free Cash Flow (FCF) at $NZ107m was a big beat to consensus at $NZ49m, though this was driven by lower capex in the period as shown by the ~5% EBITDA miss.

The company maintained FY24 guidance for 75% operating expenses to revenue, though we suspect the market was looking for an upgrade here given the focus on costs at the FY23 result in May.

They talked to an improved strategy around the US market which will be key to growth longer term but may case some short-term pain.

- A small miss, even with the help of FX, XRO was dealt with harshly by the market

Xero (XRO)

Broker Moves

- PEXA Group Ltd (ASX: PXA) Raised to Neutral at Jarden Securities; PT A$11.95

- Lottery Corporation Ltd (ASX: TLC) Raised to Outperform at Macquarie Group Ltd (ASX: MQG); PT A$4.95

- Woodside Energy Group Ltd (ASX: WDS) Raised to Positive at Evans & Partners Pty Ltd

Major Movers Today