Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.55% to 6976.50.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

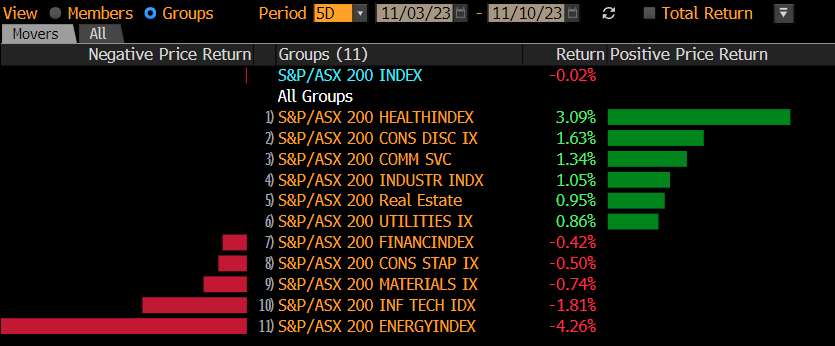

A week of consolidation at the index level comes to a close, and while the index was little changed (ASX -0.02%), a lot was happening under the hood with two banks reporting and several other stocks out with updates, by in large, we were on the wrong side of them headlined by Xero Limited (ASX: XRO) which we hold in our large cap growth strategy – more on this below.

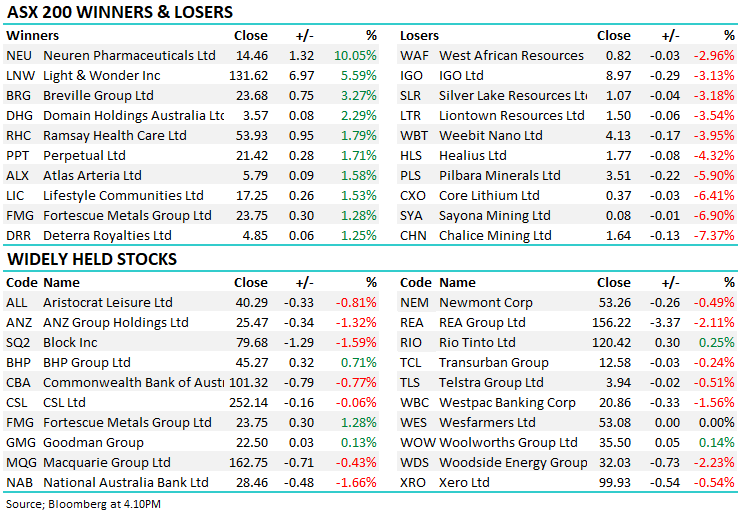

- The ASX 200 finished down -38pts/ -0.55% to 6976

- The Healthcare sector was best relative performer (-0.06%) while Materials (-0.15%) and Property (-0.28%) did better than the market, but all still finished in the red.

- Utilities (-1.70%), Energy (-1.51%) and Financials (-0.95%) all struggled.

- It’s been a week we’re glad to see the back of from a relative performance perspective, with underperformance largely across the board.

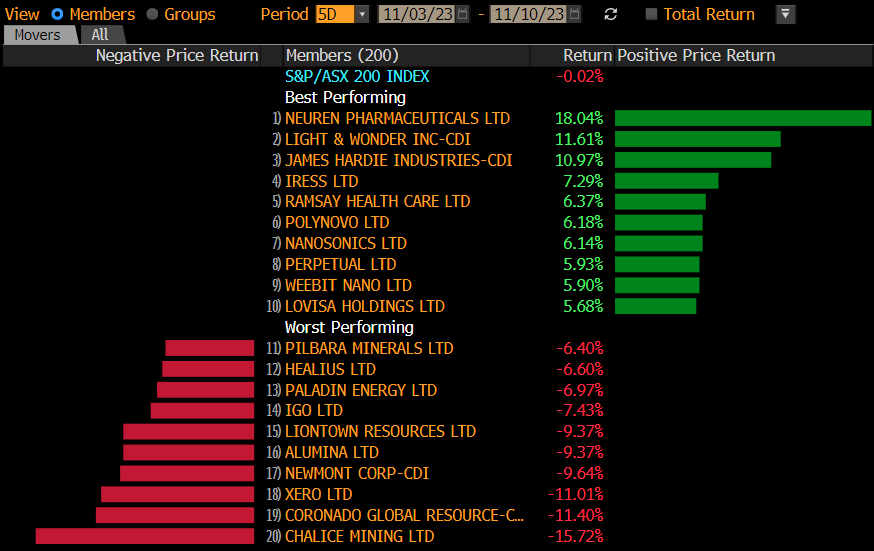

- The Active Growth Portfolio has felt the brunt from a position in Xero (XRO), which fell 11% after reporting 1H24 results yesterday.

- Some resources we hold have also lagged, underperformers including Whitehaven Coal Ltd (ASX: WHC), Paladin Energy Ltd (ASX: PDN), Mineral Resources Ltd (ASX: MIN) & Sandfire Resources Ltd (ASX: SFR) pushing that portfolio ~1.5% below the market.

- On the flipside, relative performers included Ramsay Health Care Ltd Fully Paid Ord. Shrs (ASX: RHC), Evolution Mining Ltd (ASX: EVN) & Northern Star Resources Ltd (ASX: NST), while Goodman Group (ASX: GMG) also had a solid week.

- In our Income Portfolio Dexus (ASX: DXS) showed some fight, Telstra Group Ltd (ASX: TLS) also benefitted from an upbeat broker report + the Optus outage but New Hope Corporation Ltd (ASX: NHC) was soft.

- Michelle Bullock & Co headlined the economic calendar on Tuesday, pushing rates up for the 13th time in this cycle to 4.35%. Some mixed opinions around this, however George Tharenou, the chief economist for UBS who has a very good handle on interest rate policy is echoing what markets are now largely pricing, that the RBA is probably done lifting rates.

- But, George’s base case is that rates will stay at their current 12-year high for the next year i.e. rates have peaked, but will stay higher for longer.

- Rea Group Ltd (ASX: REA) -2.11% fell today after reporting revenue of $341m for the September quarter, while adjusted earnings came in at $198m, up 13%.

- Imugene Limited (ASX: IMU) -4.55% had a very volatile session, having been up 34% at its best after the clinical stage immuno-oncology company said Azer-cel, a type of cell therapy, hit major milestone with first patient dosed in Phase 1b Allogeneic CAR T Clinical Trial.

- Mineral Resources (MIN) -2.57% fell after paying up to $60 million plus royalties to secure lithium, nickel, copper and cobalt rights to Pantoro Norseman gold project in WA.

- Iron Ore was up +1.7% in Asia supporting the major miners, Fortescue (MFG) +1.28% the best of them.

- Gold was flat, trading at $US1957/oz at our close.

- Asian stocks fell, Hong Kong -1.5%, Japan -0.21% while China lost -0.45%.

- US Futures are mixed

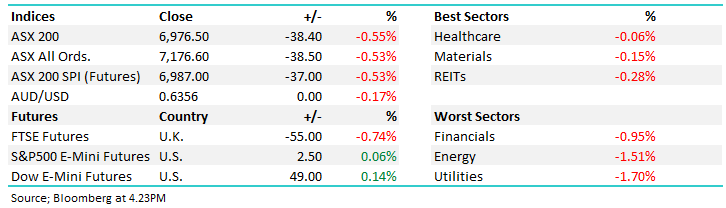

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

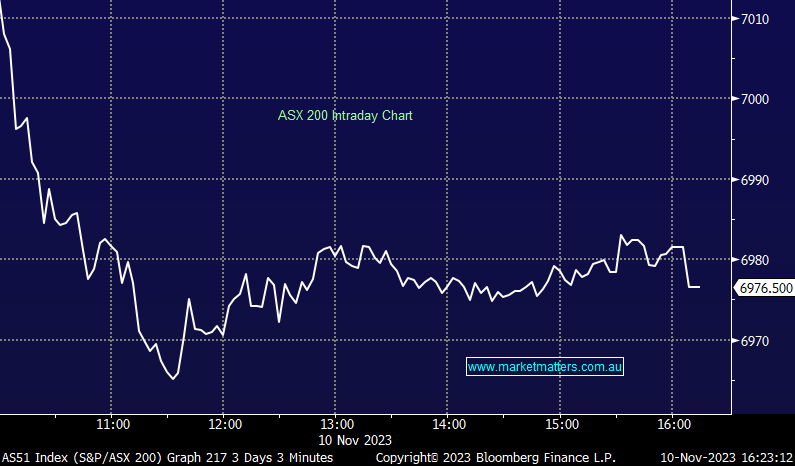

Xero (XRO) $99.93

XRO -0.54%: We’ve fielded a few questions on our holding in Xero in the past 24 hours, and whether or not we should hold or fold, so here’s our latest view as we wrap up the week.

The simple answer at this stage is yes we are holding but we are not considering averaging which could be interpreted negatively. As we said on both Thursday Afternoon and Friday Morning we believe the reaction to the miss has been overdone and primarily driven by the market being long/overweight the stock after May’s strong earnings report, however, we are looking to reduce our tech exposure in 2024 which compounds why we don’t want to fade this initial knee jerk to the downside.

A surface breakdown of the numbers:

- Revenue of $799m was only a shade below expectations, consensus for example was at $805m.

- The difference here was mostly due to lower growth in Average Revenue Per User (ARPU) – which was up 6%, we were expecting more. i.e. XRO are raising prices but they’re balancing this out with growth, but it’s a tough act.

- They did beat on free cash flow (FCF), partly due to less capex – this was a positive.

We were also very keen on seeing the outcomes of their US review, and to that end, average annual net investment in the US has been ~$30m over the last 10 years, in line with US VC backed businesses; but also, that looking ahead, it will be targeted and invest at a reasonable rate relative to top line growth generated. Our takeaway being a more measured approach, but some in the market were thinking they would do more here, that a silver bullet on the US push would be unveiled, but alas, it was not.

Ultimately, some disappointment, but we do think the business is moving towards a more solid, balanced footing as they leverage the nearly 4m customers they have globally. The main question mark in the short term comes around valuation which is key to share price, and with this week’s update, we think XRO will struggle to push meaningfully higher in the short term.

Brokers have had a mixed response, Macquarie took a knife to their forecast and became the most bearish on the stock, while the majority of others are not swayed by yesterday’s update.

Xero (XRO) – Broker Calls – Source Bloomberg

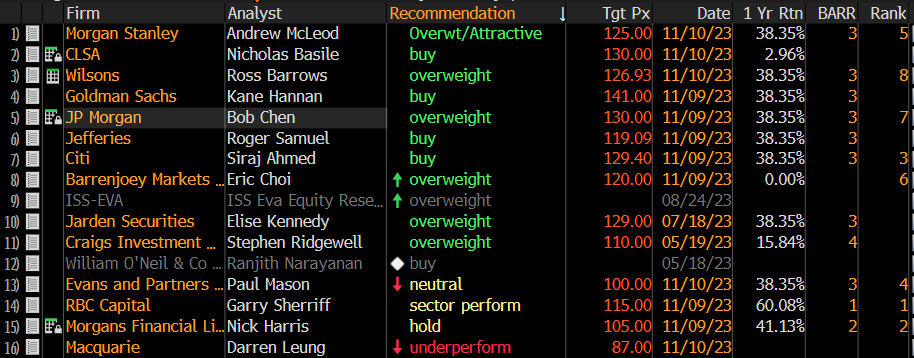

Sectors this week – Source Bloomberg

Broker Moves

- National Australia Bank Ltd (ASX: NAB) Cut to Sell at Citigroup Inc (NYSE: C); PT A$25.75

- Incitec Pivot Ltd (ASX: IPL) Raised to Neutral at Citi; PT A$2.90

- Xero Cut to Neutral at Evans & Partners Pty Ltd; PT A$100

- Xero Cut to Underperform at Macquarie Group Ltd (ASX: MQG); PT A$87

- Xero Raised to Overweight at Barrenjoey; PT A$120

- Nufarm Ltd (ASX: NUF) Cut to Neutral at Citi; PT A$4.65

Major Movers Today