Howdy investor,

Every cat, dog and their economist was expecting the RBA to increase interest rates this week.

For once, they were right.

The official interest rate is now around 4.35%.

That means a good mortgage interest rate is about 6%. Get my broker on your side if you want someone to hustle for you. It only takes 2 minutes to book a call with my chosen mortgage brokers.

But here’s the thing about this week’s interest rate rise… I’m really worried the RBA made a big mistake.

Here are two charts to tell you why…

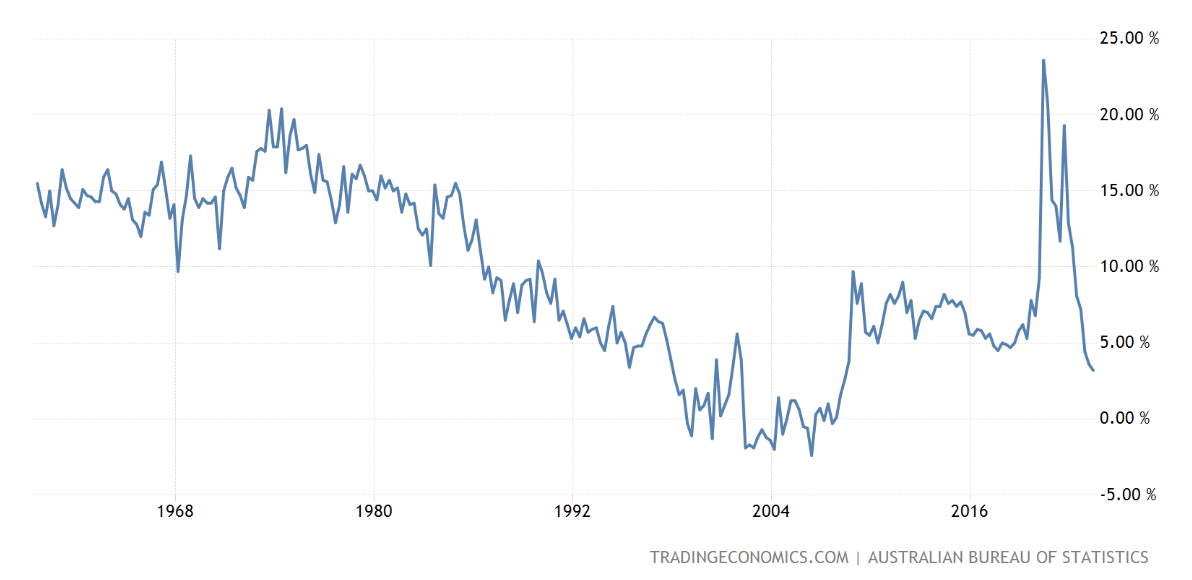

Household savings rate – now below GFC levels

Higher interest rates can take as long as 6-9 months to impact households. Meaning, the rate rise this week might not bite your finances until April next year.

Typically…

However, the chart above shows you that during Covid, when people were stuck at home and couldn’t spend on anything but Uber Eats, the savings rate went way up to record highs.

The average household was saving nearly 25% of their income!

With heaps of cash to splash and a few years of us (and Qantas) binging on European holidays, is it any wonder inflation has been so high?

Did you know international travel inflation is up 38%?

Since Covid, clearly, the evidence is pointing to more Australians saving far less.

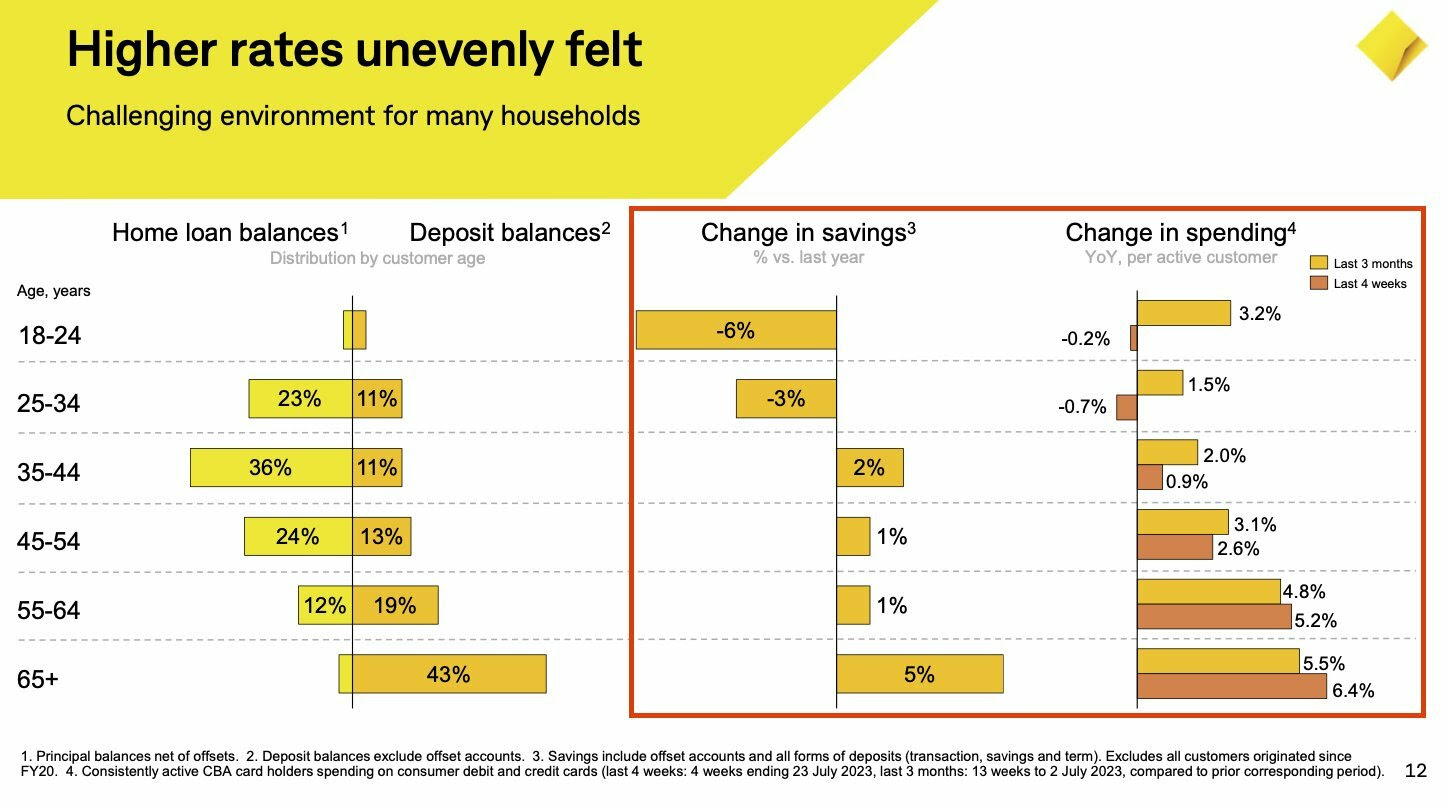

But who exactly are interest rates slowing down?

Not everyone is equal. In fact, it’s far from it…

Older Aussies are spending MORE

Higher interest rates are supposed to slow down the economy (so they say).

But in Australia, most of the cash in the bank is held by older Australians. Which makes sense, since they’ve worked hard, their assets have inflated over 30+ years of falling interest rates, and they’ve saved well.

Mind you, younger people (i.e. those under 55) are typically in net debt positions (more debt than cash). The mortgages are real, they’re often single income families, and they are younger so compounding hasn’t yet awarded them a free kick.

As the CBA data, above, suggests, older Australians are spending more – much more, not less – than they were before interest rates went up.

Huh?

Think about it.

If you have $1 million in Super earning 1%, that’s $10,000. But at 5.5%, it’s $55,000 -typically, tax free! – so why not spend a little bit more at the Italian restaurant?

I don’t blame them for splurging — they deserve it!

But the unfortunate reality is that raising interest rates is a really blunt tool.

It affects the have-nots far more negatively than the haves. And without anything to slow down the haves, it makes me wonder if higher interest rates *could* cause more spending and accelerate problems in inflation, housing and long-term inequality…

Someone smarter than me will figure it out. I hope.

In other news…

Long-term investing wins (surprise, surprise)!

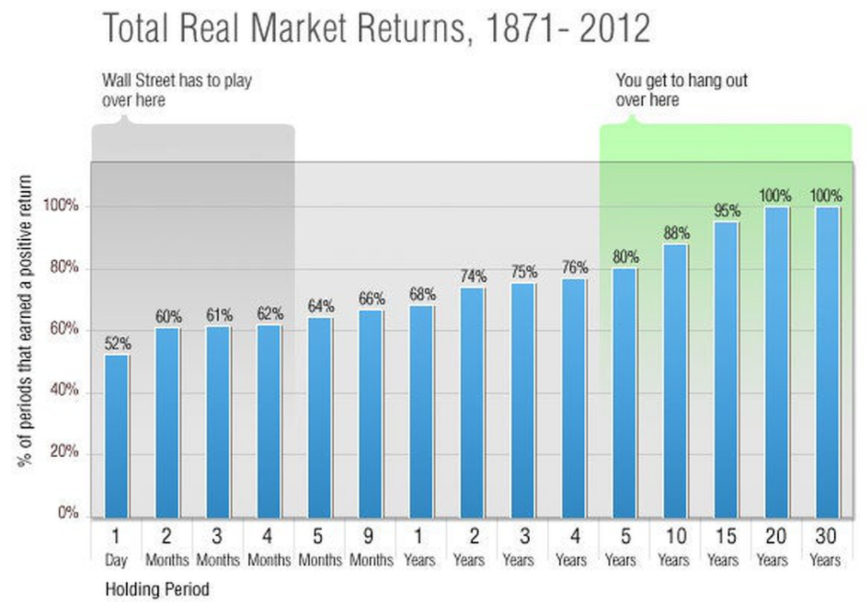

Finally, for something less dense, here’s a chart from Morgan Housel.

The chart above shows the returns of the US stock market between 1871 and 2012, based on the probability you get a positive return.

It shows, very simply, the longer you invest, the less chance of a negative return.

For example, at any time in that 100+ year period there was an 88% chance you got a positive return – if you just invested in an index portfolio for 10+ years.

If you own the portfolio for 20+ years, it was impossible to get a negative return.

However, if instead of sensible long-term investing, you tried to ‘play the market’ with day trading, it’s basically the flip of a coin.

In short, build a properly diversified portfolio then buy. Hold. Buy. Hold. Buy. Hold… repeat until rich.

See you next week!

P.S. Want to invest in AI? Catch my Australian Finance Podcast episode with Kate.