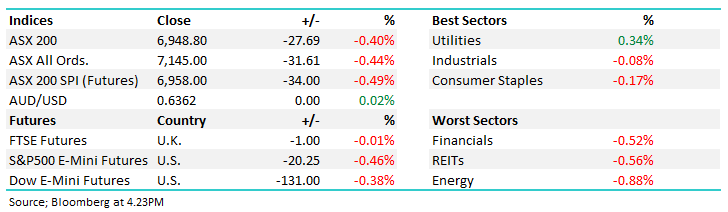

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.40% to 6,948.80.

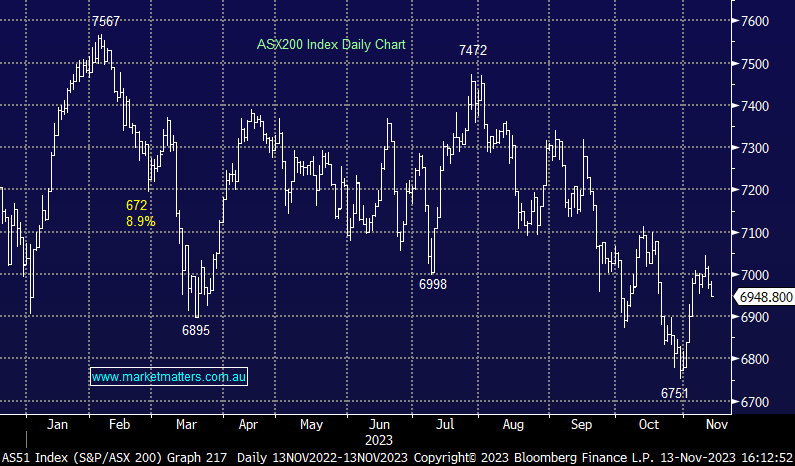

A poor session to kick off the new trading week with the ASX snubbing the strength in the US on Friday night while latching onto any negative rhetoric locally that progressively weighed on the index throughout the day – finishing smack on session lows, not a great look!

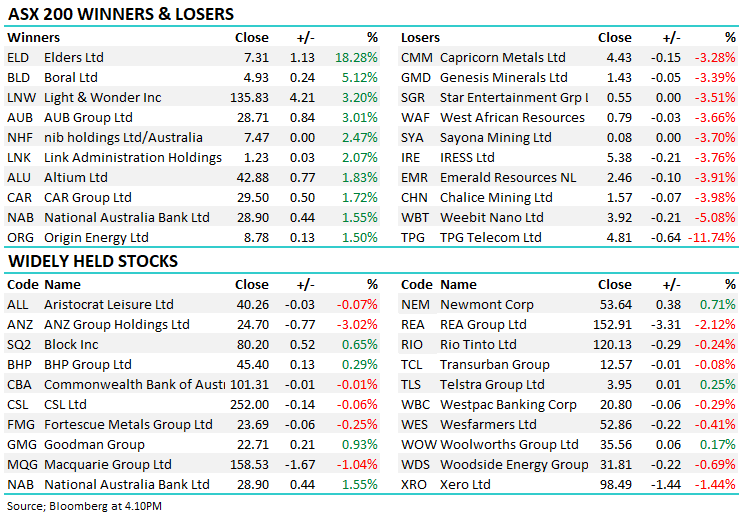

- The ASX 200 finished down -27pts/ -0.40% to 6948, although it felt worse!

- The Utilities sector was the only one in the green (+0.34%%) while Industrials (-0.09%) and Staples (-0.17%) outperformed.

- Energy (-0.88%), Property (-0.56%) and Financials (-0.52%) the weakest links.

- US Futures pulled back during our time zone to compound weakness locally.

- More hawkish comments from the RBA’s Marion Kohler in a speech this morning saying that Australia’s inflation rate is “still too high” and the next stage in bringing it back down to target is likely to be more drawn out than the first phase.

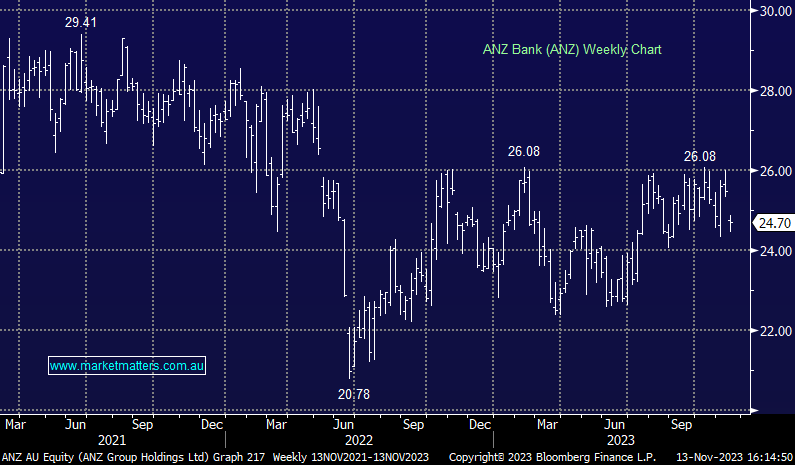

- ANZ Group Holdings Ltd (ASX: ANZ) -3.02% fell after reporting a slight miss at their FY23 results, not major but a few things that were less than we had hoped. More on that below.

- Elders Ltd (ASX: ELD) +18.28% stormed higher on a small beat on FY23 results which met very bearish market positioning i.e. ~7% of the register held short = short covering.

- Boral Limited (ASX: BLD) +5.12% upgraded FY23 earnings guidance.

- NIB Holdings Limited (ASX: NHF) +3% enjoyed broker upgrades from both Citigroup Inc (NYSE: C) & Morgans

- TPG Telecom Ltd (ASX: TPG) -11.74% was hit after Vocus walked away from their $4.2bn offer to buy TPGs fibre assets, with debt levels at TPG now back front and centre.

- Ramsay Health Care Ltd Fully Paid Ord. Shrs (ASX: RHC) -2.76% fell despite announcing the sale of their Sime Darby JV, with proceeds of the sale ($935m pre-tax) earmarked to pay down debt.

- Origin Energy Ltd (ASX: ORG) +1.5% edged higher after Brookfield offered AusSuper the option to join them as buyers of Origin – they have said no.

- Metcash Limited (ASX: MTS) -0.27% said that it was increasing its ownership of Total Tools to 100% from 85%.

- Incitec Pivot Ltd (ASX: IPL) +1.38% after reassuring investors that its plan to demerge the explosives and fertiliser businesses remained on track

- Iron Ore was up +1.4% in Asia, though the miners were mixed – BHP Group Ltd (ASX: BHP) +0.29% and Fortescue Metals Group Ltd (ASX: FMG) -0.25%.

- Gold was down US$3 in Asia, trading at $US1937/oz at our close.

- Asian stocks fell, all down 0.2-0.25%

- US Futures are lower, they pulled back ~0.40% during our session today putting the kibosh on the positive moves from Friday.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

ANZ Bank (ANZ) $24.70

ANZ -3.02%: Reported FY23 results this morning which were around 1.5% below consensus in terms of cash profit. Net Interest Margin (NIM) was weak, about 6bps below expectations but a more significant -33bps half on half for Australian retail NIM which highlights how hard ANZ went to gain market share (via low rates which compress margins). It did work to a large degree with ANZ growing home loans well above system, CEO Shayne Elliot today was unapologetic for prioritising growth, but there is an offset and we saw that in these results.

The dividend was solid, and around 15% above consensus although it was only partially franked. At 81cps for the half 65% franked + an unfranked 13cps one-off dividend to account for the lower franking means that investors are getting $1.16, smack on what a fully franked 81cps dividend is worth. ANZ remains cheap trading on 1.1x book value and a PE of 10x, both below historical norms.

- We continue to like ANZ from a relative perspective, seeing the most upside across the sector.

ANZ Bank (ANZ)

Elders (ELD) $7.31

ELD +18.28%: the agricultural services business jumped to 3-month highs on a small beat for FY23 despite some notable headwinds. Sales fell 4% to $3.3b, slightly ahead of consensus, while EBIT was just above the midpoint of guidance, the $170.8m was down 26% on FY22 but ~2% ahead of expectations. Cash conversion was a big tick, operating cash flow ~50% above consensus helping the company to pay a 23cps div (30% franked), 7cps above expectations.

Softer retail and wholesale markets and falling soft commodity prices weighed on FY23, but while those headwinds are expected to continue into FY24, the company has managed costs far better than expected. Around 7% of ELD shares were short-sold heading into the result, and the share price had more than halved in the last 12 months highlighting how negatively positioned the market was heading into this result.

- A decent set of numbers was enough to see the share price rip on the day.

Elders (ELD)

Ramsay Healthcare (RHC) $52.44

RHC -2.67%: Announced today the sale of their Sime Darby JV, with proceeds of the sale ($935m pre-tax) earmarked to pay down debt, reducing gearing to 2.5x and interest costs by about $55m annually. We thought this announcement was a positive one on a number of fronts, a better balance sheet, and lower gearing, while potentially removing one of the variables/complicating factors that negatively impacted corporate interest last year.

- Overall, we thought this was a more positive update than the market gave them credit for.

Ramsay Healthcare (RHC)

Broker Moves

- Data#3 Limited (ASX: DTL) Cut to Neutral at Goldman Sachs Group Inc (NYSE: GS); PT A$7.65

- Fisher & Paykel Healthcare Corporatn Ltd (NZE: FPH) Cut to Underperform at Forsyth Barr; PT NZ$19.30

- Mach7 Technologies Ltd (ASX: M7T) Rated New Buy at Jefferies; PT A$1.10

- NHF AU: Nib Raised to Buy at Citi; PT A$8.35

- NHF AU: Nib Raised to Add at Morgans Financial Limited; PT A$8.38

- Rea Group Ltd (ASX: REA) Raised to Neutral at Barrenjoey; PT A$155

Major Movers Today