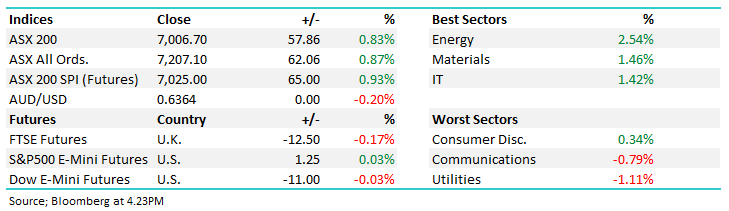

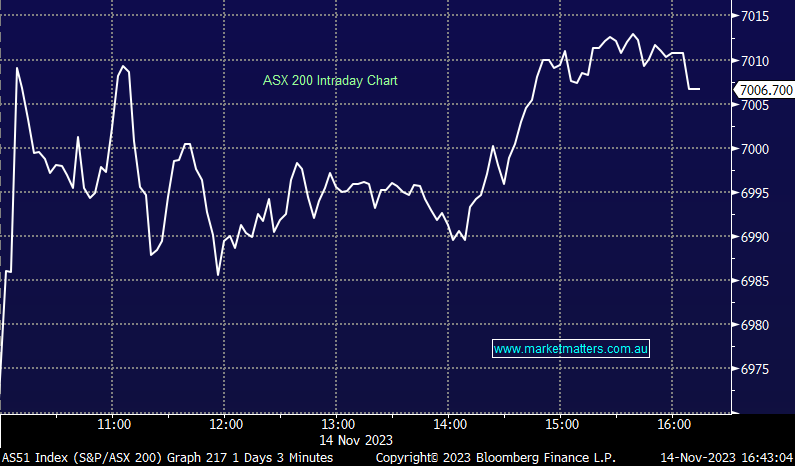

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.83% to 7,006.70.

Equities regained their mojo today after two softer sessions either side of the weekend, the ASX200 popping back above the 7000 an a broad-based rally with more than 80% of the index finishing higher though strong contributions from the resources sectors was key. Energy in particular was strong following OPEC releasing forecasts for oil demand to increase by 2.5mbboe a day helping to stem the weakness in a sector that has been under pressure.

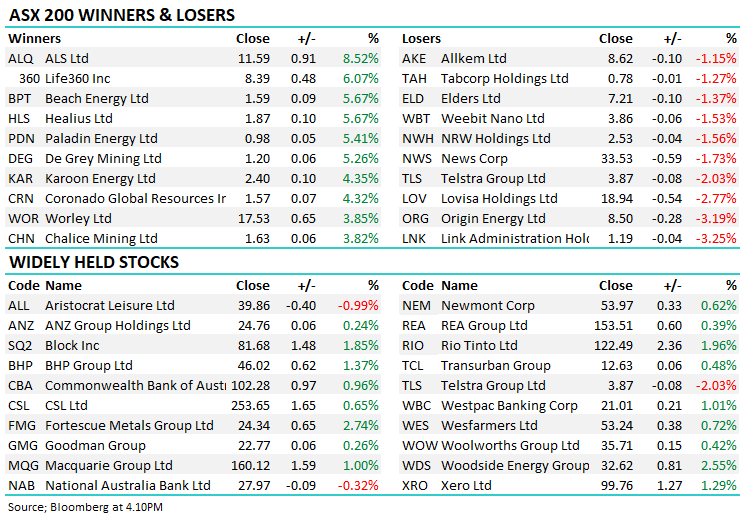

- The ASX 200 finished up +57pts/ +0.83% to 7006

- The Energy sector was best on ground (+2.54%) while Materials (+1.46%), Tech (+1.42%), Real Estate (+1.27%) and Industrials (+1.12%) also did well.

- Utilities (-1.11%) and Telcos (-0.79%) were the only sectors fell today.

- A mixed bag for local data printing this morning Consumer Confidence continuing to fall, as are Business Confidence but Business Conditions was up last month.

- Universal downgrades for ANZ Group Holdings Ltd (ASX: ANZ) today, most pulling back to a neutral rating after yesterday’s result – of note UBS were bulls on the stock but now pulled back PT to $25.00, losing conviction.

- The result was softer than expected in terms of profit, and clearly it was a bit messy, lower margins are the main reason for the associated cut to earnings but they have grown their book above system while they could – now more sanity prevailing. We continue to hold ANZ in our Growth Portfolio, but remain underweight the banks collectively.

- Worley Ltd (ASX: WOR) +3.85% had a good session and has been incredibly resilient in recent months. We continue to see WOR as a major beneficiary of the energy transition.

- National Australia Bank Ltd (ASX: NAB) -3.22% traded ex-dividend today for 84cps fully franked, worth $1.20 grossed for franking – the stock fell 93c

- Commonwealth Bank of Australia (ASX: CBA) +0.96% 1Q update was slightly better than expected, CBA faring the best of the Big 4 with Cash NPAT of $2.5b.

- ALS Ltd (ASX: ALQ) +8.52% 1H numbers for the analytical testing came in slightly ahead of expectations, though the market was positioned fairly bearishly heading into the result. Guidance for FY24 UNPAT of $310-325m was in line with consensus.

- Telstra Group Ltd (ASX: TLS) -2.03% Investor Day today, the telco announcing plans to install more fibre routes, particularly across the Pilbara region. The telco maintained FY24 guidance but did note a small bump in demand had been seen following the Optus outage last week.

- Catapult Group International Ltd (ASX: CAT) +15.05% sports-tech business had positive FCF in the 1H with strong revenue growth and falling costs supporting earnings. We will discuss the Emerging Companies Portfolio holding in tomorrow’s Morning Report.

- Iron Ore was marginally higher in Asia.

- Gold was flat at $US1,945/oz.

- Asian stocks were mixed today, Nikkei faring the best +0.55%, China flat and the Hang Seng is marginally lower.

- US Futures are mostly flat except for Nasdaq futures which are up +0.15%.

- Tonight the focus will be on US Inflation numbers. The market is expecting +0.3% MoM for the Core, and +0.1% MoM for the Headline rate.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Commonwealth Bank (CBA) $102.28

CBA +0.96%: 1Q numbers out for the biggest of the Big 4, CBA shows it remains the quality pick of the banks with a strong start to FY24.

Cash NPAT of $2.5b was around a 3% beat to consensus expectations championed by what looks like better-than-expected Net Interest Margins (NIM) despite some upward pressure on deposit pricing.

Costs were up 3%, in line with expectations, while credit quality remains strong with a bad debt charge of just $198m or 9bps.

Capital remains in a strong position with CET1 of 11.8% despite the 2H23 dividend impact of 86bps.

- CBA posted the best numbers of peers this period, on track to beat expectations at the HY result early next year.

Commonwealth Bank (CBA)

Broker Moves

- Elders Ltd (ASX: ELD) Cut to Hold at Moelis & Co (NYSE: MC); PT A$7.92

- MMA Offshore Ltd (ASX: MRM) Rated New Buy at Moelis & Company; PT A$1.65

- Elders Raised to Neutral at Citigroup Inc (NYSE: C); PT A$7.30

- Deep Yellow Limited (ASX: DYL) Rated New Speculative Buy at Canaccord Genuity Group Inc (TSE: CF); PT A$1.44

- ANZ Group Cut to Neutral at UBS; PT A$25

- ANZ Group Cut to Neutral at JPMorgan Chase & Co (NYSE: JPM); PT A$25.40

- ANZ Group Cut to Neutral at Citi; PT A$26

- Fleetpartners Group Ltd (ASX: FPR) Raised to Overweight at Morgan Stanley (NYSE: MS)

- Ramsay Health Care Ltd Fully Paid Ord. Shrs (ASX: RHC) Cut to Reduce at CLSA; PT A$56.50

- Elders Cut to Accumulate at CLSA; PT A$7.95

Major Movers Today