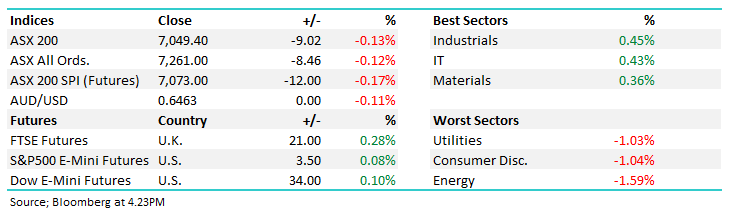

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.13% to 7,049.40.

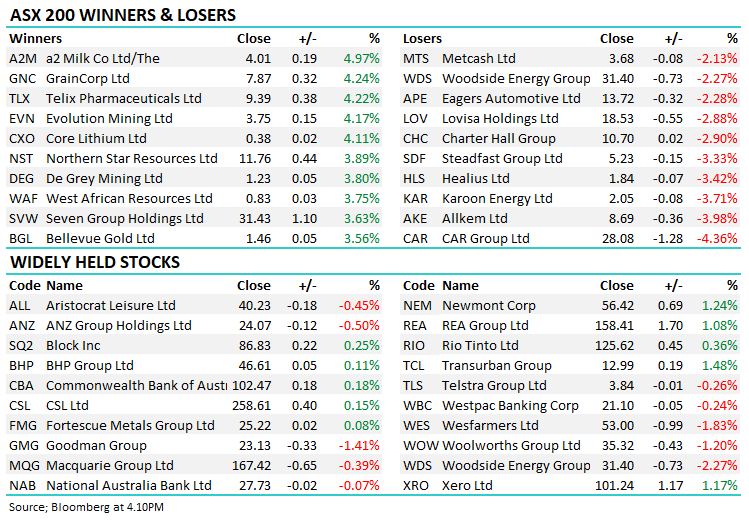

A muted finish to the week with winners and losers split fairly evenly on the ASX200.

Materials were on the winning side, supported by strength in iron ore and gold, offset by further weakness in Energy which continued to slide on higher crude inventory levels in the US.

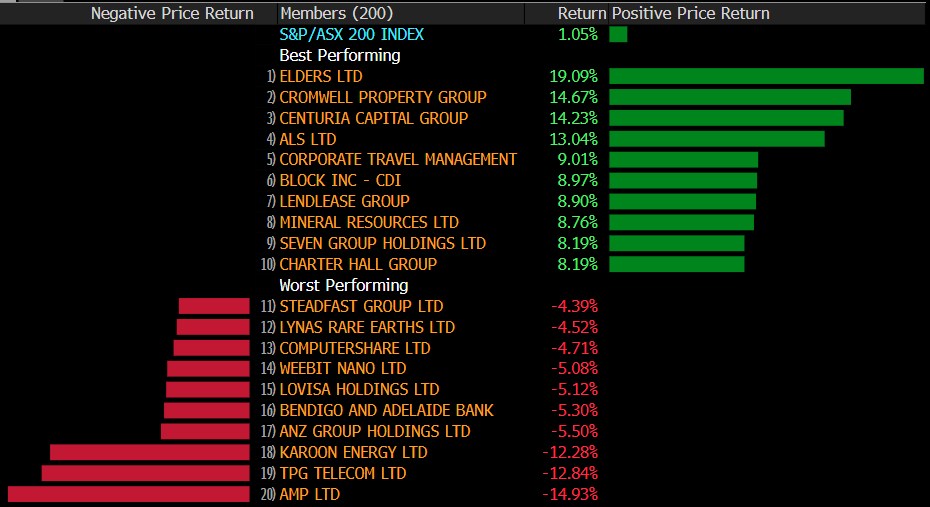

The main index finished the week up +72pts / +1.05%, a strong result particularly given the sizable ex-dividends from National Australia Bank Ltd (ASX: NAB) & ANZ Group Holdings Ltd (ASX: ANZ).

- The ASX 200 finished down -9pts/ -0.13% to 7049

- The Industrials sector was best on ground (+0.45%), joined in the black by Tech (+0.43%), Materials (+0.36%) & Healthcare (+0.30%)

- Energy (-1.59%) once again struggling. Consumer Discretionary (-1.04%) and Utilities (-1.03%) were the other notable underperformers.

- The yearly Sohn Hearts & Minds conference was held in Sydney today with many fund managers calling out their top picks for equities. Cancer diagnostics and treatment firm Telix Pharmaceuticals Ltd (ASX: TLX) +4.22% & global Uranium company Nexgen Energy (Canada) CDI (ASX: NXG) +4.84% were two key ASX stocks called out by presenters.

- Nuix Ltd (ASX: NXL) -7.17% struggled ahead of their court date with ASIC kicking off on Monday. The regulator is claiming the investigative data analytics company fell short of their disclosure obligations in 2021.

- Lendlease Group (ASX: LLC) +2.24% held their AGM today, highlighting the changing nature of their business, moving to a lower risk, higher return investment-led operation that we expect will double earnings in FY24. We increased our LLC position this week in the Active Growth Portfolio

- Steadfast Group Ltd (ASX: SDF) -3.33% after completing a $280m institutional placement at $5.14, the stock closed today at $5.23.

- Centuria Capital Group (ASX: CNI) +2.93% capped off a good week with their AGM, reaffirming guidance. Shares are up 14% this week while UBS highlighted them as one of their top 5 highest-ranked property stocks for exposure to the ‘peak rates’ thematic.

- Iron Ore rallied ~1% in China despite pressure from regulators announced yesterday.

- Gold was up 0.25% at $US1,985/oz in Asia, continuing overnight’s $US20 rally.

- A mixed bag for stocks across the region today. Japan’s Nikkei was up 0.25% but China fell -0.2% and Hong Kong -2.15%.

- A mixed session is also expected tonight based on US futures – Nasdaq is marginally weaker but the S&P500 expected to start with a small gain.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

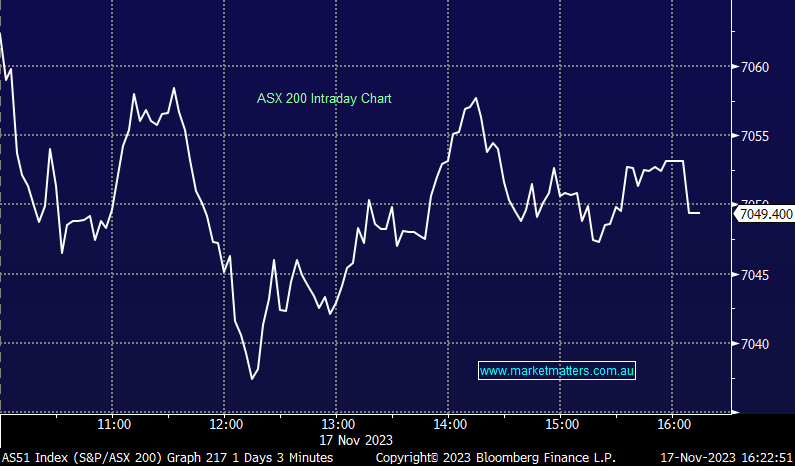

Sectors this week – Source Bloomberg

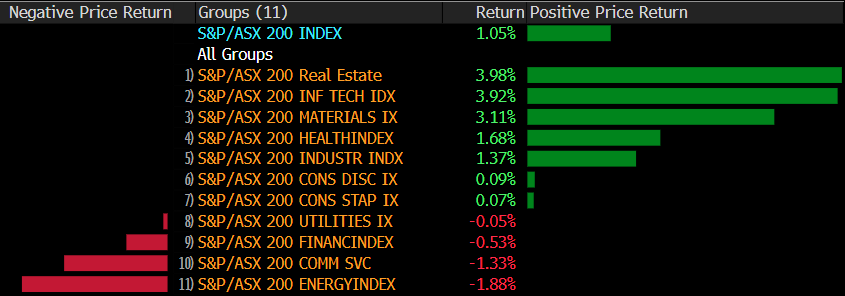

Stocks this week – Source Bloomberg

Broker Moves

- Duratec Ltd (ASX: DUR) Rated New Buy at Moelis & Co (NYSE: MC); PT A$1.50

- A2 Milk Company Ltd (ASX: A2M) Raised to Outperform at Forsyth Barr; PT NZ$5.20

- A2 Milk Raised to Buy at Citigroup Inc (NYSE: C); PT NZ$5.20

- Karoon Energy Ltd (ASX: KAR) Raised to Overweight at Barrenjoey; PT A$2.53

- A2 Milk Raised to Neutral at Goldman Sachs Group Inc (NYSE: GS); PT NZ$4.25

- Graincorp Ltd (ASX: GNC) Raised to Buy at Jefferies; PT A$9.25

- Altium Limited (ASX: ALU) Cut to Hold at Jefferies; PT A$47.08

- AMP Ltd (ASX: AMP) Cut to Hold at Jefferies; PT 97 Australian cents

- Woodside Energy Group Ltd (ASX: WDS) Cut to Sell at Citi; PT A$26.50

Major Movers Today