The Nasdaq-100 (INDEXNASDAQ: NDX) has grown to be one of the most widely recognised indices in the world.

Measuring the performance of the 100 largest non-financial companies listed on the Nasdaq exchange, the index has become synonymous with the world’s largest technology companies including Apple Inc (NASDAQ: AAPL), Microsoft Corp (NASDAQ: MSFT), and Alphabet Inc Class A (NASDAQ: GOOGL).

While its early notoriety came in the late 1990’s during the dot-com bubble, which was characterised by unjustified valuations for unprofitable technology companies, the Nasdaq has since evolved into an index comprising global businesses with strong fundamental growth supporting their impressive returns.

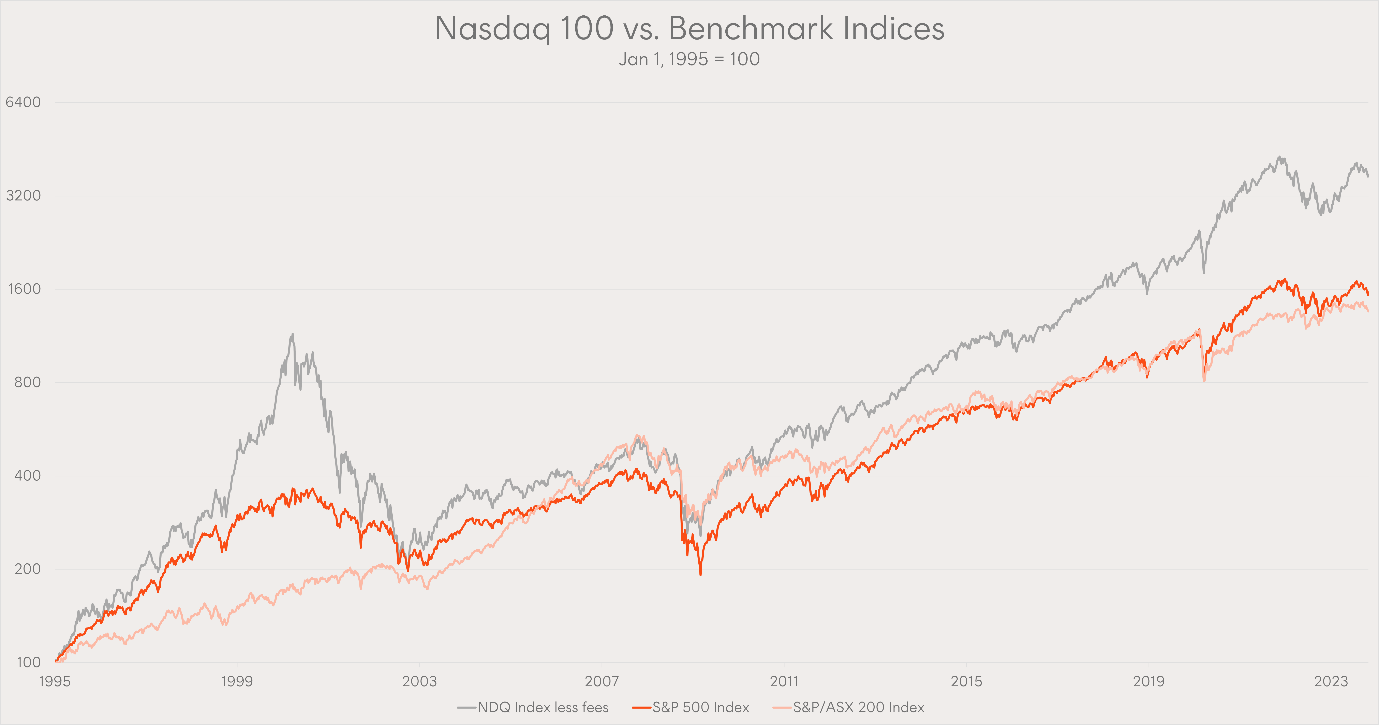

Over the 20 years to October 2023 the Nasdaq 100 has returned 13% p.a. compared to 8% p.a. and 6% p.a. for the S&P 500 and S&P/ASX 200 respectively.

Chart 1: Nasdaq 100 vs. Benchmark Indices. Total return Jan 1, 1995 = 100.

Innovation driven growth

In the 12 months to June 2023, companies in the Nasdaq 100 spent 7x the amount on R&D as companies in the S&P 500 (INDEXSP: .INX) (excluding Nasdaq listed companies). This level of investment into areas of potential future growth has been a hallmark of the Nasdaq 100 over the past two decades. Attracting the biggest names in global technology, companies listed on the Nasdaq have emerged as leaders in gaming, search, big data and cloud computing.

More recently as markets shift their focus to machine learning and artificial intelligence (AI), the Nasdaq 100 again has a head start. With the ability to leverage their existing competitive advantages, companies listed on the Nasdaq like Microsoft (whose partnership with ChatGPT provider OpenAI started in 2016), Google (who acquired AI startup DeepMind in 2014), and NVIDIA Corp (NASDAQ: NVDA) (who started laying the foundations to become the engine room for AI hardware in 2006) have already been investing in AI for a long time with the aim of becoming leaders in the area.

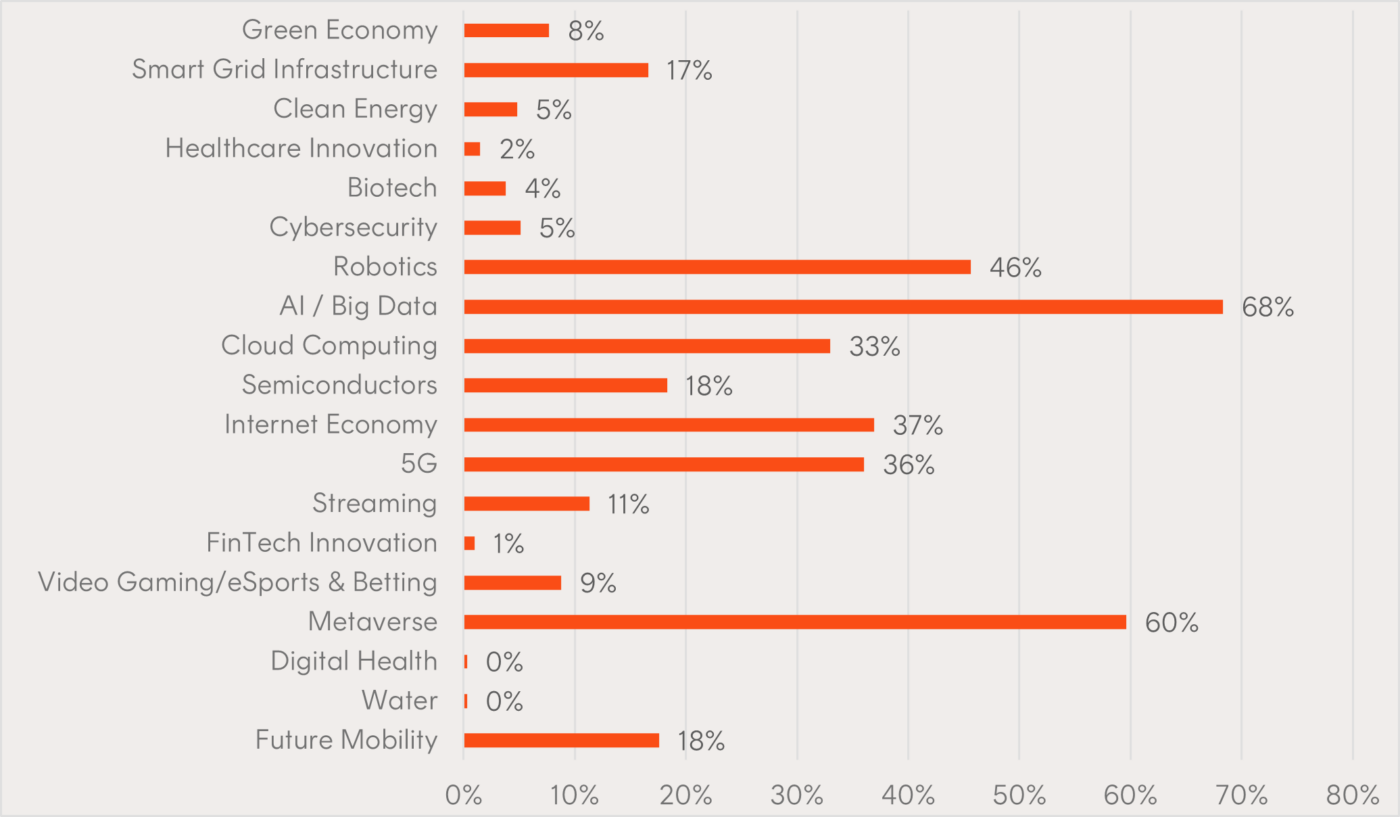

Breaking down the index into its constituent’s exposure to areas of future growth potential, we find that the Nasdaq 100 provides exposure across a broad subset of potentially promising investment themes. Most notably to AI, robotics, and cloud computing.

Chart 2: Nasdaq 100 exposure per theme

Solving the innovator’s dilemma

A great example of this innovation driven growth is Nasdaq giant Microsoft. In 2013, many questioned if Microsoft would survive as the business looked to be the latest victim of the “innovator’s dilemma” – describing an established business’s failure to risk disrupting themselves in response to competitive innovators. A Bloomberg article from that year titled “Microsoft’s Useful Life May Be Near Its End” proposed this very hypothesis.

These commentators failed to appreciate the groundwork being done by Microsoft to successfully embrace innovation once again, as they did with their original enterprise software. Two years earlier Microsoft ranked 5th globally for R&D spending. Of this, 90% or $US8.6 billion was being spent on cloud computing technology seeking to disrupt their own locally stored enterprise model.

Fast forward to 2023’s US Q1 reporting season and Microsoft made headlines as sales in its cloud division were up 24% to $US32 billion. Investors took this a sign that the company was ahead in not only the highly profitable cloud computing space, but also poised to capitalise on surging demand for AI technology.

Microsoft has ridden a wave of R&D led growth over the past two decades. This has been a shared trait of Nasdaq 100 companies.

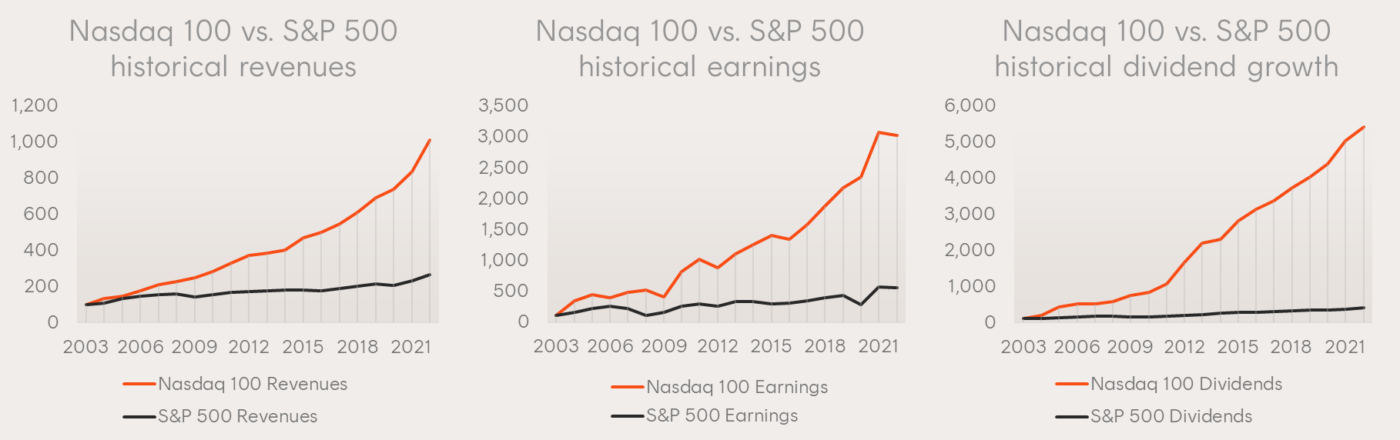

Today, five of the largest seven R&D spenders globally are in the Nasdaq 100. Their success has translated into impressive revenue, earnings, and dividend growth.

Chart 3: Nasdaq 100 and S&P 500 historical revenue, earnings, and dividend growth. 2003 to 2023. 31 Dec 2003 = 100

Betashares proudly offers Australian investors exclusive access to the Nasdaq 100 Index through Betashares Nasdaq 100 ETF (ASX: NDQ) with a currency hedged option which is Betashares NASDAQ 100 ETF-Currency Hedged (ASX: HNDQ). NDQ is Betashares’ largest ETF with over $3 billion in funds under management.