Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.62% to 7,029.20.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

Weakness across resources weighed on the ASX200 today with Iron ore taking a breather from its recent rally and oil markets on the back foot as OPEC uncertainty weighs on Energy markets.

Volume was light and is expected to remain so into the weekend given the US Thanksgiving Holiday takes place tonight.

With little reason to make a conviction call today and a large portion of the index facing a commodity headwind, the index closed on session lows.

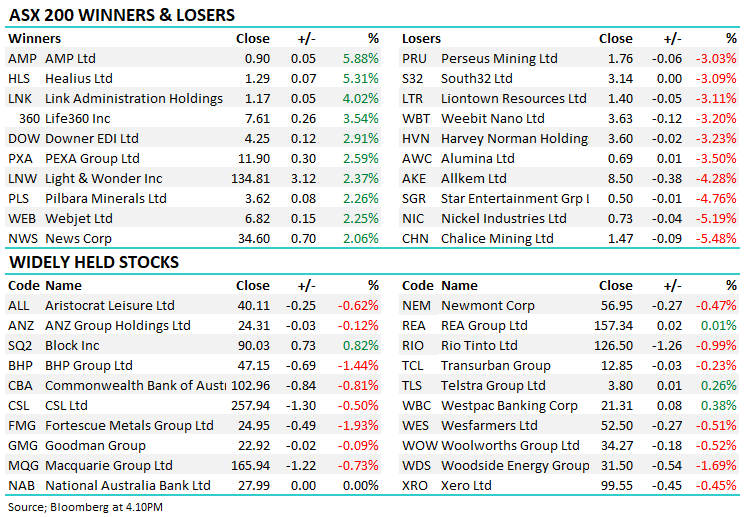

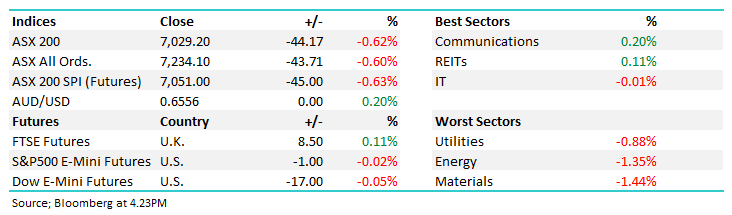

- The ASX 200 finished down -44pts/ -0.62% to 7029

- The Telcos Sector (+0.20%) was best on ground while Real Estate (+0.11%) was the only other sector in the black

- Materials (-1.44%) was the weakest area of the ASX, followed by Energy (-1.35%).

- AMP Ltd (ASX: AMP) +5.88%% finally putting to bed their disastrous buyer of last resort (BOLR) facility, settling with claimants for $100m. Despite being double what the company had provisioned for, the deal is a win for AMP, finally putting the issue to bed.

- Nick Scali Limited (ASX: NCK) -6.71% MD Anthony Scali sold a good chunk of stock this morning, 4.6m shares worth just over $50m. He remains the biggest shareholder with ~8% of shares on issue despite selling around 40% of his holding. The trade was done at $11/sh, which was a ~5% discount to yesterday’s close but NCK finished below that today.

- Origin Energy Ltd (ASX: ORG) +1.07% has delayed the shareholder vote on Brookfield’s takeover that was due this afternoon. The suitor is pressing their case, even offering a few different paths – $9.43/sh in cash or scrip in the new entity, or splitting the energy markets business out. The vote is now scheduled for December 4, more uncertainty weighed on shares today.

- TPG Telecom Ltd (ASX: TPG) -0.21% increased their mobile coverage spectrum, adding 3.7 GHz spectrum to their 5G coverage for $128m

- Austal Ltd (ASX: ASB) +3.22% hit a 3-month high after it announced a deal with the Australian Government as a strategic partner in WA and picking up 2 new orders totalling $157m of work.

- Iron Ore fell -1.6% in China, taking a breather after hitting long-term highs yesterday.

- Gold was up 0.25% today, $US1995/oz though most gold stocks struggled.

- Asian stocks were mixed with Japan’s Nikkie closed. Hang Seng was marginally higher but China is marginally lower.

- US Futures are flat at our close. The US market is closed tonight for the Thanksgiving holiday.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Broker Moves

- Netwealth Group Ltd (ASX: NWL) Raised to Positive at Evans & Partners Pty Ltd

- Praemium Ltd (ASX: PPS) Cut to Market-Weight at Wilsons; PT 40 Australian cents

- Pacific Smiles Group Ltd (ASX: PSQ) Cut to Underweight at Wilsons

- Gold Road Resources Ltd (ASX: GOR) Rated New Hold at Moelis & Co (NYSE: MC); PT A$1.90

- Red 5 Limited (ASX: RED) Rated New Hold at Moelis & Company; PT 35 Australian cents

- Genesis Minerals Ltd (ASX: GMD) Rated New Buy at Moelis & Company; PT A$2

- Silver Lake Resources Ltd (ASX: SLR) Rated New Buy at Moelis & Company; PT A$1.45

- Alkane Resources Limited (ASX: ALK) Rated New Buy at Moelis & Company; PT A$1.05

- Fisher & Paykel Healthcare Corporatn Ltd (ASX: FPH) Rated New Underperform at Jefferies; PT NZ$19.50

- Anteris Technologies Ltd (ASX: AVR) Rated New Buy at CLSA; PT A$28

- City Chic Collective Ltd (ASX: CCX) Raised to Speculative Buy at Evans & Partners Pty Ltd

- EVT Ltd (ASX: EVT) Reinstated Accumulate at CLSA; PT A$12.65

Major Movers Today