On 18 November Australian time, news broke that Sam Altman, CEO and co-founder of OpenAI, the company behind ChatGPT, had been fired by the Board. In response, Greg Brockman, President, Chair, and co-founder, announced he’d quit the company.

The news surprised staff and investors alike.

Microsoft Corp (NASDAQ: MSFT) CEO, Satya Nadella, was reportedly “blindsided and furious” with the decision.

Microsoft share price

Microsoft invested US$10 billion in OpenAI earlier this year at a valuation of US$29 billion3.

Meanwhile, several senior researchers quit the company, while hundreds more – including Ilya Sutskever, the chief scientist who was blamed for the coup against Altman – signed an open letter threatening to quit if Altman was not restored to his position.

Thrive Capital was reportedly in talks to purchase shares in OpenAI at a valuation of US$86 billion before the announcement, which would make it one of the most valuable private companies in the world.

While there was some speculation over the weekend that Altman may return to his position, on Monday afternoon Australian time, OpenAI announced that Emmett Shear, co-founder of Twitch, was being appointed as the new CEO.

Shear recently stated on X (formerly Twitter) that he would like to see the development of AI slowed down.

“If we’re at a speed of 10 right now, a pause is reducing to 0. I think we should aim for a 1-2 instead.”

Just hours later, Microsoft CEO and Chair, Satya Nadella, announced on X that Altman and Brockman had been hired by Microsoft, with Altman to lead “a new advanced AI research team”.

Time will tell whether OpenAI is able to move past these issues, or whether it will offer an opportunity for their competitors to overtake them.

The Microsoft link

While OpenAI is not currently listed on any stock exchange, Microsoft holds a 49% stake in the company.

Based on the price Thrive Capital was reportedly planning to pay for shares, Microsoft’s stake would be worth around US$43 billion. Given Microsoft’s market capitalisation exceeds US$2.7 trillion10, US$43 billion is a relatively small part of its overall business.

More importantly for Microsoft though, their ownership stake allowed them to licence OpenAI’s technology, which underpins Microsoft’s new ‘AI companion’ called Copilot.

Microsoft has described AI as “the defining technology of our time”, and OpenAI’s technology is key to their software.

The trouble with picking stocks

Identifying a structural trend such as AI and automation is relatively easy. But picking the winners among these trends is much more difficult.

One possible analogy is the US auto industry.

Around 3,000 auto companies have existed in the US since the dawn of the automobile, but today just a handful of automotive giants dominate the industry.

For anyone witnessing the explosion in popularity of cars in New York City in the early 1900s, it wouldn’t have been a huge stretch to predict the growth of the automotive industry in the decades ahead, but identifying that Ford Motor Co (NYSE: F), Chrysler, and General Motors Co (NYSE: GM) would become the “Big Three”?

Not so easy.

While equities outperform bonds and cash on average, averages can be deceiving.

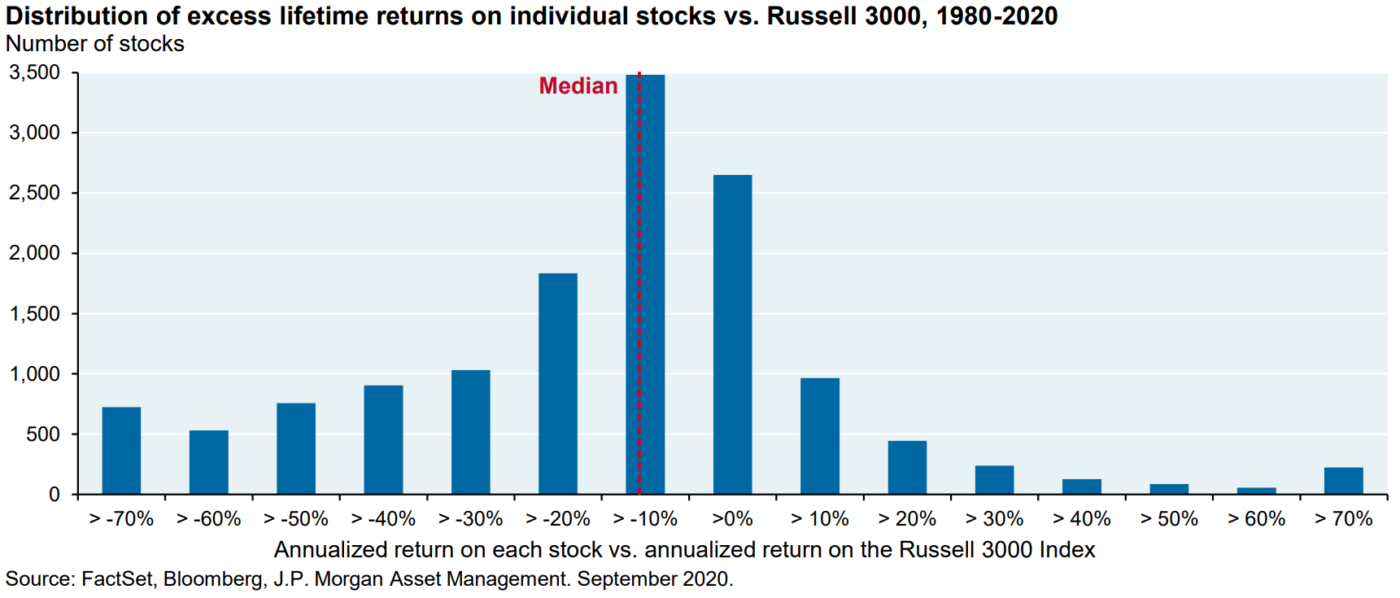

Research by JPMorgan Chase & Co (NYSE: JPM) Asset Management has shown that between 1980 and 2020, 42% of companies experienced negative returns, 66% underperformed the Russell 3000 Index (INDEXRUSSELL: RUA), and just 10% of “Megawinners” generated excess returns.

Research by Hendrik Bessembinder from Arizona State University supports this, with his 2017 paper finding that 58% of listed companies underperformed one-month US Treasury Bills over their lifetime. Those don’t seem like great odds.

An alternative approach

If most listed companies have underperformed Treasury Bills, but listed stocks in aggregate have outperformed bonds over the long term, then how can investors capture this performance?

Rather than trying to pick the few winners, taking a diversified approach can help to reduce the risk of putting all your eggs in the wrong basket.

ETFs can also help to reduce complexity, providing a simple, low-cost way to gain exposure to equity performance.

A broad-market ETF such as Betashares Nasdaq 100 ETF (ASX: NDQ) allows investors to gain exposure to the top 100 non-financial companies listed on the Nasdaq Stock Exchange.

While a thematic ETF, such as Betashares Global Robotics and Artificial Intelligence ETF (ASX: RBTZ), provides exposure to a basket of companies involved with AI and robotics, without taking on the stock-specific risk inherent in trying to pick winners.