Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.39% to 7,015.20.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

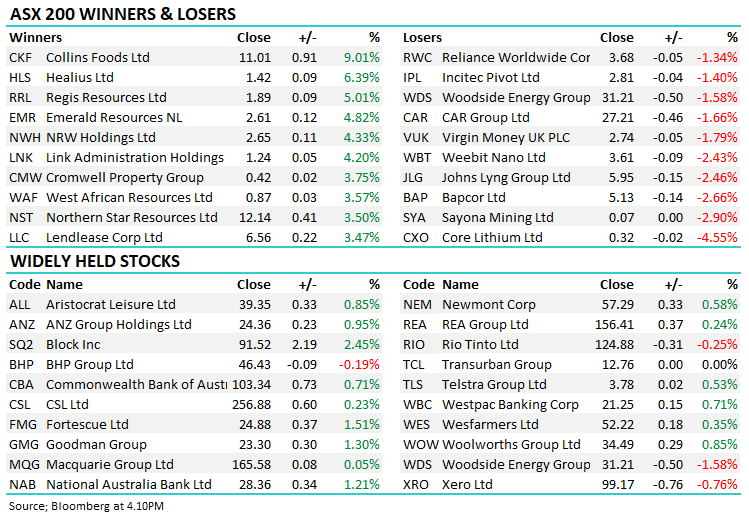

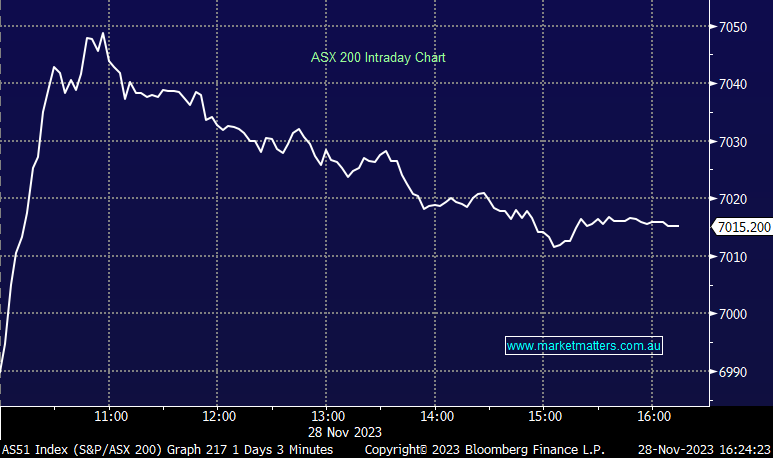

A similar sort of session to yesterday played out today with the best of it seen early, although we started from a higher level with strong buying on open seeing the index +60 points not long after the bell, before sellers emerged cutting those gains in half.

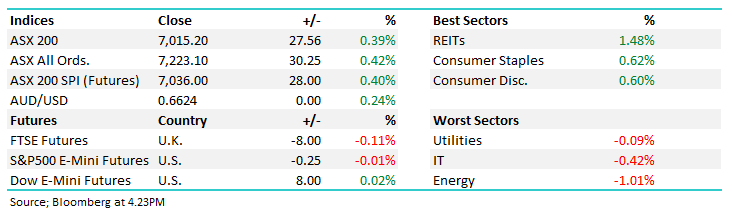

- The ASX 200 finished up +27pts/ +0.39% to 7015.

- The Property sector (+1.48%) was the standout, while Consumer Staples (+0.62%) and Consumer Discretionary (+0.60%) finished higher.

- Energy (-1.01%), IT (-0.42%) and Utilities (-0.09%) struggled.

- Retail sales came in softer than tipped in October, down -0.2% from September, missing forecasts of a 0.1% rise

- Clearly higher borrowing costs are starting to bite in retail land as consumers tighten their belt.

- Weaker data reduces the chance of further interest rate hikes, now only around 16bps of tightening priced in by futures.

- Pointsbet Holdings Ltd (ASX: PBH) +5.48% was strong after confirming they were on track to deliver revenue growth of between 10-20% in FY24.

- Imugene Limited (ASX: IMU) +9.89% rallied after being granted Fast Track designation from the US FDA for the clinical evaluation of its metastatic advanced solid tumours program against a new form of cancer.

- Collins Foods Ltd (ASX: CKF) +9.01% reported strong results and increased dividend, declaring 12.5c for the half.

- AGL Energy Limited (ASX: AGL) -0.61% continued to dip taking their 5-month pullback to ~20% after a ~75% rally from the lows – a volatile ride. We continue to own a small position in our Active Income Portfolio.

- AGL’s CFO presented at a conference today and talked about future demand for electricity – they expect a doubling of demand in electricity between now and 2050 with electric vehicles underpinning a 30% increase in home electricity consumption.

- Link Administration Holdings Ltd (ASX: LNK) +4.2% was up on positive AGM commentary, winning new business and on track for a strong 1H.

- They upgraded FY24 guidance for revenue growth of more than 6.5% and EBIT growth of 7-9%, up from at least 6%.

- Gentrack Group Ltd (ASX: GTK) +9.85% hit 4-year highs as the billing and customer management software business released strong FY23 results, Revenue +7% above the midpoint of guidance and EBITDA beat by 12% at $24.6m. FY24 guidance was also positive underpinning a very strong move in their shares.

- Plenti Group Ltd (ASX: PLT) +64.71% ripped after signing a deal with National Australia Bank Ltd (ASX: NAB) for co-branded EV and Renewable Energy loans. We wonder what this means for the alternative financing sector of the market, banks may now be looking for their share of the pie?

- Orora Ltd (ASX: ORA) +2.43% upgraded at Morgan Stanley to buy equivalent and $3.50 PT, this is our latest purchase in the Active Income Portfolio, switching out of Wesfarmers Ltd (ASX: WES).

- Iron ore fell, futures down 2% in Singapore to $US131/mt, although Fortescue Ltd (ASX: FMG) +1.5% bucked the trend.

- Gold edged higher, now trading US$2015/oz at our close. Evolution Mining Ltd (ASX: EVN) +2.93% was outshone by Northern Star Resources Ltd (ASX: NST) +3.5%, two stocks we hold in the Growth Portfolio.

- Asian stocks were mixed, Hong Kong -0.12%, Japan -0.87% while China +0.04% edged higher.

- US Futures are little changed.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Broker Moves

- Clean Seas Seafood Ltd (ASX: CSS) Cut to Hold at Bell Potter

- PeopleIn Ltd (ASX: PPE) Cut to Market-Weight at Wilsons; PT A$1.39

- Life360 Inc (ASX: 360) GDRs Rated New Buy at Ord Minnett; PT A$8.84

- Meteoric Resources NL (ASX: MEI) Rated New Speculative Buy at Canaccord Genuity Group Inc (TSE: CF)

- Orora Raised to Overweight at Morgan Stanley (NYSE: MS); PT A$3.50

- Service Stream Ltd (ASX: SSM) Reinstated Accumulate at CLSA; PT A$1

- Aeris Resources Ltd (ASX: AIS) Cut to Neutral at Macquarie Group Ltd (ASX: MQG)

- Monadelphous Group Ltd (ASX: MND) Reinstated Reduce at CLSA; PT A$14.40

- NRW Holdings Limited (ASX: NWH) Reinstated Buy at CLSA; PT A$2.90

- Perenti Ltd (ASX: PRN) Reinstated Buy at CLSA; PT A$1.50

- Downer EDI Ltd (ASX: DOW) Rated New Reduce at CLSA; PT A$4.15

Major Movers Today