Collins Foods Ltd (ASX: CKF) share price is up by more than 8% today. Luke Laretive of Seneca Financial Solutions explains how Collins Foods and their peer, Yum! Brands, Inc. (NYSE: YUM), made this significant increase in share price.

The Collins Foods share price is up by 8% in morning trade after reporting its HY2024 interim results, with underlying NPAT from continuing operations up 28.7% to $31.2 million, from $24.2 million in HY23.

Collins Foods operates and manages franchises of fast-food outlets, primarily KFC. CKF has been an outperforming share since listing on the ASX in 2011 with a strong brand portfolio and a growing franchise network.

HY24 results shine, margins the key

Revenue was 14% higher than last year at $697 million driven by strong same store sales growth across the CKF network, although this was largely expected by the market, with peer Yum! Brands, Inc. reporting 3QCY23 sales growth of 11% for the total Australian KFC system, a good read-through for Collins Foods.

The positive surprise was expanding profit margins, leading to a bottom line beat for Collins Foods.

Underlying EBITDA from continuing operations increased by 17% to $109.9 million, beating market consensus of $98.8 million. Amidst pressure on the consumer, underlying (pre AASB 16) EBITDA margins in Australian KFC stores increased to 16.1% (from 15.8%) and in Europe to 6.9% (from 5.2%).

Strong balance sheet capacity, with net debt reduced to $173 million from $191 million a year ago, allowed the company to lift its interim fully franked dividend to 12.5 cents per share from 12 cents per share last year.

The reduction in net leverage ratio from 1.31 to 1.12 reflects the strong cash generation of the group.

We think that the market missed the forest for the trees when it comes to CKF, with analysts too bearish based on selective data points, such as fixed supply contracts for canola oil, while failing to appreciate the disciplined price increases across the menu, favourable product mix shift, and falling cost inflation in key ingredients like chicken.

Outlook

We outlined our CKF buy thesis in June to weekly not readers, and called the rally to $9.00+. I said at the time that I thought CKF could rally to $11.00 on the cyclical recovery and you can get paid a 3.5% fully franked dividend yield to finance a Zinger combo while you wait.

Collins Foods core drivers

The Collins Foods core drivers remain the same:

- Resilient demand, stronger than analyst expectations due to consumer preference for cheap, fast-casual dining. Continued rate hikes mean that families and mortgage holders more broadly will look to stretch their savings when dining.

- Modest price increases to the menu to offset cost pressures, which should continue to abate in FY24.

Management reported a strong start to 2HFY24, with KFC same stores sales in the first 6 trading weeks increasing by 2.9% in Australia, 8.1% in the Netherlands, and 8.6% in Germany. Taco Bell same store sales are also up by 8.7%.

Valuation

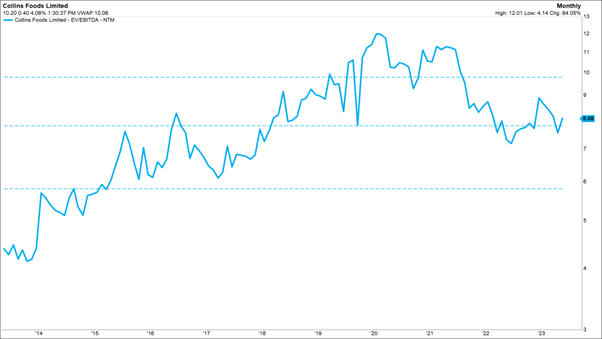

Shares traded on 8x EV/EBITDA prior to the result, in line with historical averages, despite earnings having been depressed due to margin pressures. With growth optionality in Europe from continued store rollout and the potential for margin expansion, we see scope for analysts to revise earnings forecasts higher in the medium term for CKF.