Eliza Clarke of Firetrail Investments highlights 3 things that has impacted the global stock market and the Australian share market, including the best way to lower your carbon footprint with Kelsian Group Ltd (ASX: KLS). How will this revolution affect the Australian share market?

1. The EV revolution has stalled…

The electric vehicle (EV) revolution has stalled over the past 12 months.

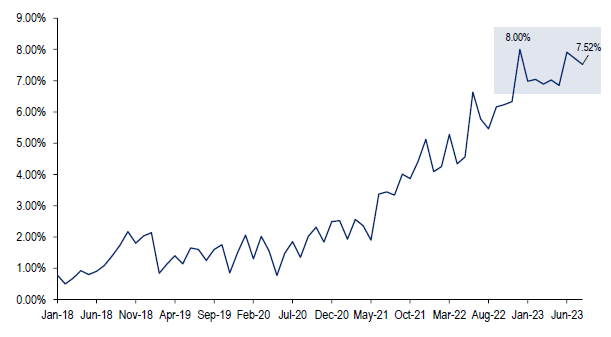

EV share of the total US car market has declined from 8% a year ago to 7.5% today. While the US Inflation Reduction Act is doing its best to jumpstart sales through big subsidies, cyclical headwinds are pulling the handbrake.

While prices are coming down over time, there is still limited choice of EVs in the sub-$40,000 price range.

High inflation and interest rates are causing mid-to-high income earners to dial back big-ticket purchases.

At the same time, internal combustion engine (ICE) vehicles are being sold at a discount due to excess inventory in the system.

EV Penetration in the US

2. Deepening divide between China and the West…

Economic integration between the West and China has continued to detach in recent years.

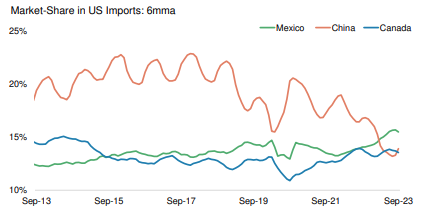

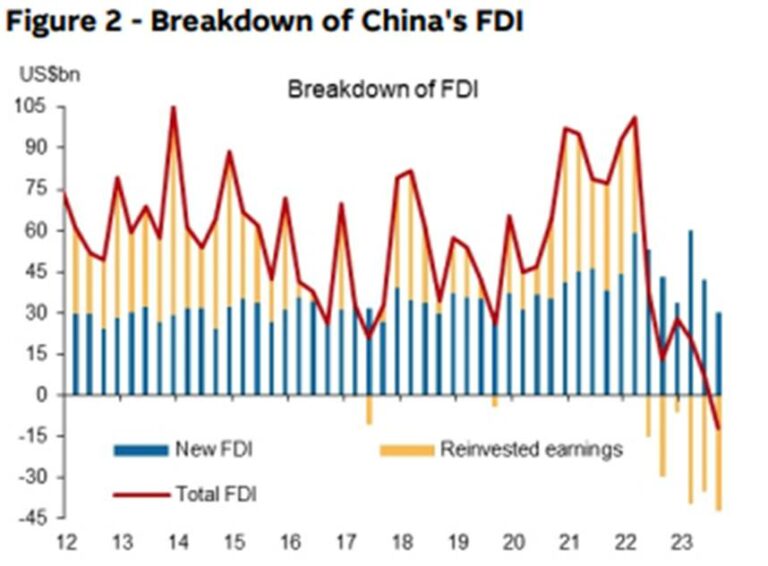

China’s share of US imports has fallen from ~23% to ~13% since 2017. Foreign direct investment into China has also fallen off a cliff.

The deepening economic divide has created exciting new opportunities in countries like Mexico, who are taking increasing share of importance in western supply chains.

3. The best way to lower your carbon footprint? Get the bus!

Firetrail Small Companies Fund portfolio manager, Matt Fist, spent a day with key portfolio holding Kelsian Group this week.

Kelsian is Australia’s largest operator of public transport. While buses might sound boring, the investment opportunity looks very exciting!

One of the best ways to lower Australia’s carbon footprint is to use cars less, and public transport more.

The Federal Government realises that meeting transport decarbonisation targets will require 3.5x the number of public transport services over the next decade.

To accelerate the decarbonisation benefits, NSW is pushing to increase the proportion of electric buses on the roads from 25% of buses today, to 100% by 2026.

Kelsian will be a key beneficiary of increased bus services and the shift to electric. It owns the largest fleet of electric buses in Australia.

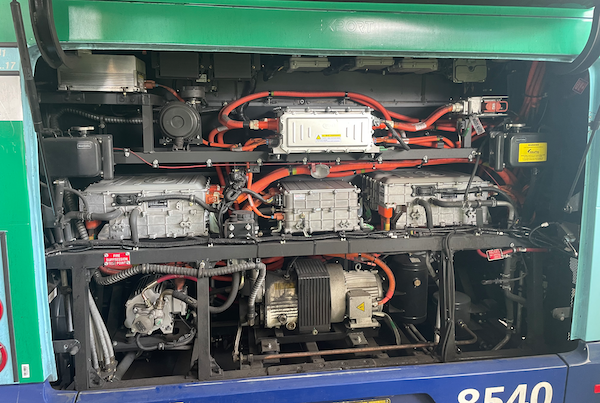

The maintenance requirements of electric buses are also much lower than ICE buses. You might be able to see why comparing the two pictures below!

Electric bus engine

ICE bus engine