There are a lot of yield traps in the share market and understanding yield traps is an important step. Daniel Ortisi of Stock Doctor tells us how to avoid yield traps, with Peter Warren Automotive Holdings Ltd (ASX: PWR), Telstra Group Ltd (ASX: TLS), APA Group (ASX: APA), and Commonwealth Bank of Australia (ASX: CBA) as key examples.

As an investor, it is crucial to differentiate attractive dividend-paying stocks and yield traps.

What is a yield trap?

Yield traps are stocks with an appealing dividend yield primarily due to a declining share price, but underlying business fundamentals are weak, that is, at risk of earnings downgrades.

These companies are often financially unhealthy and burdened with excessive debt, making it unlikely they can sustain their dividend payments.

We will explore key financial ratios and strategies that investors can utilise to evaluate the income potential of their investments and avoid falling into dividend yield traps.

The importance of financial health

In simple terms, financial health assesses a company’s risk of insolvency by determining whether the quality of its cash flow and profits can service its debt obligations.

With slower economic growth and rising interest rates, many companies are facing high-interest cost payments and cash flow issues. This, in turn, increases the risk that companies cannot sustain dividend payments.

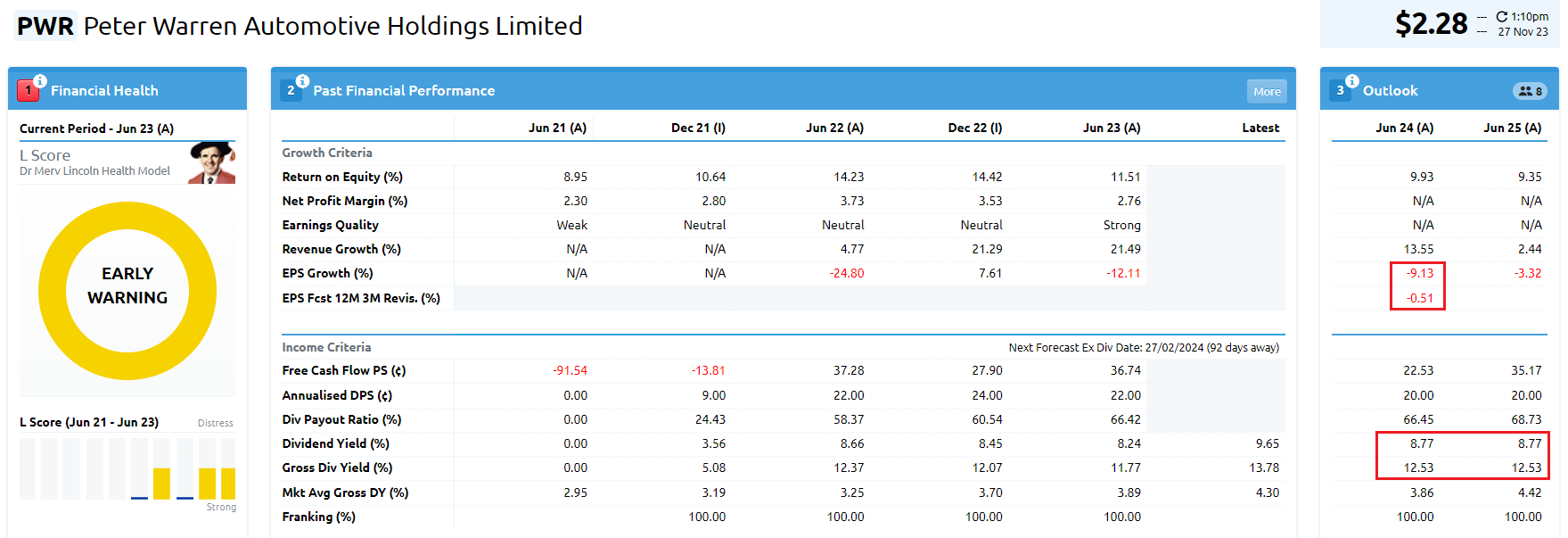

The example below displays Peter Warren Automotive Holdings (PWR) – a dealership with some commercial property ownership. Peter Warren Automotive Holdings is laden with significant debt (net debt to equity over 100%) and intangible assets (>20%).

Monitoring share price sentiment and earnings revisions

One effective method to avoid yield traps is closely monitoring earnings revisions and share price sentiment (this is Golden Rule 3 and 4 of Stock Doctor’s methodology and algorithm). Negative earnings revisions and declining share prices often signal that the seemingly attractive yield might be unsustainable.

Additionally, companies facing such circumstances tend to have high levels of short interest, indicating potential risks associated with their dividends.

Investors can protect themselves from falling into yield traps by staying vigilant and analysing these factors.

In the same example below with PWR, there has been a significant decline in the share price over the last two years, corresponding with a decline in forecast earnings per share.

The significance of free cash flow

For investors focusing on Industrial and Resources companies, analysing the free cash flow trend is instrumental in assessing a company’s cash-generating ability.

Free cash flow represents the net cash flow from operations after deducting capital expenditure.

It is essential to look for companies with sufficient free cash flow margins above dividend payments, as this indicates their ability to sustain dividends in the long term.

The example below with Telstra (TLS) shows a significant margin between free cash flow and dividend payments, despite the payout ratio at over 100%.

Even though there has been a decline in free cash flow per share from the last period, the wide margin ensures sufficient buffer to pay dividends.

However, declining free cash flow does not always indicate an imminent dividend cut.

Some companies may be making substantial investments to bolster future cash flows and possess sufficient cash reserves to maintain dividends in the near term.

In such cases, a qualitative assessment becomes crucial for understanding the sustainability of the yield.

Stock Doctor‘s research team can provide valuable insights into evaluating these risks and assessing yield sustainability.

Different approaches for different sectors

In the case of Infrastructure, Utilities, and Real Estate Investment Trusts (REITs), free cash flow may not be a practical measure due to maintenance expenditure (capex) requirements, interest expenses and asset purchases, which often leads to free cash flow variability.

Instead, investors should focus on assessing the consistency of operating cash flow, which represents the regular income from the business, such as rental income for REITs or toll fees from freeways.

By considering this alternative measure, investors can better evaluate the income potential of these specific sectors.

In the example below with the APA Group, you can see that dividend payments have been fully covered by operating cash flow.

In addition, the trend in operating cash flow has been stable.

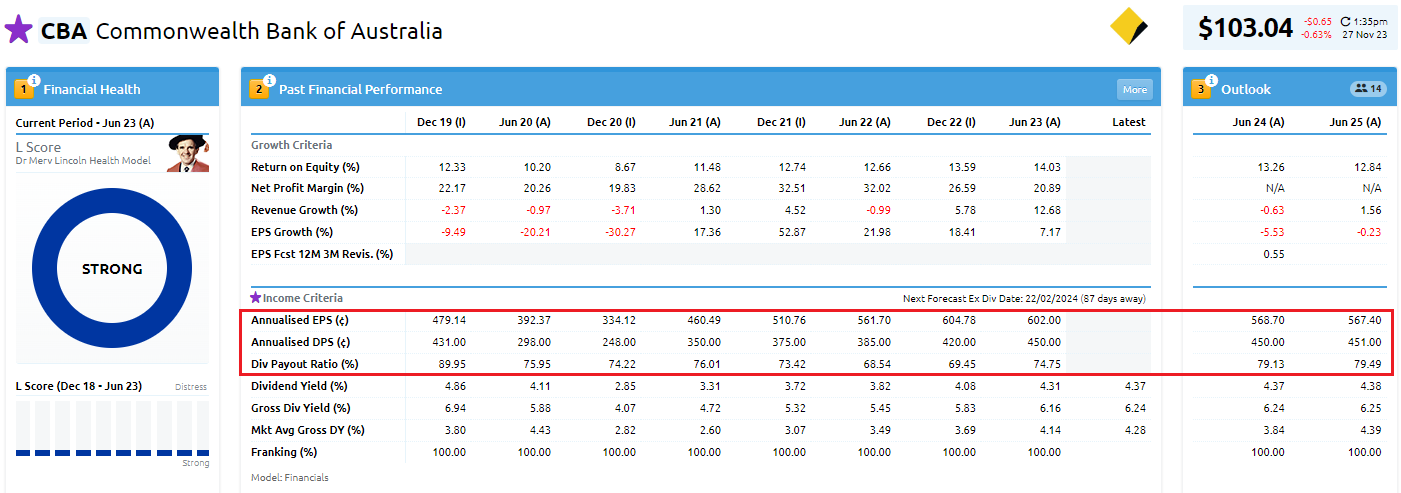

The Financial sector requires a different approach as well.

Cash flow figures alone do not effectively gauge dividend sustainability in this sector, as they may include cash from external business operations, such as customer deposits or loans.

Investors should instead examine earnings per share trends and compare them to dividends. Verifying that the payout ratio aligns with historical patterns is also crucial.

Stock Doctor‘s platform visualises historical trends, making it easier for investors to assess payout ratios.

In the case of Commonwealth Bank (CBA), the current payout ratio of about 73% is unstretched compared to its historical level.

The path to informed investment decisions

A cautious analysis of dividend-paying stocks is crucial in the current economic environment characterised by slowing growth and higher interest rates.

Many dividend-paying companies may represent yield traps, making it vital for investors to exercise due diligence.

Investors can make better-informed decisions and avoid yield traps by considering factors such as:

- Financial health

- Earnings revisions

- Share price sentiment

- Cash flow trends

- Dividend payment history, and

- Payout ratios

However, quantitative metrics alone may not be enough.

A comprehensive qualitative assessment plays a vital role in understanding dividend sustainability and avoiding potential pitfalls.

At Stock Doctor, you can speak to an equities analyst to help you understand whether a dividend is sustainable even when the numbers don’t add up.

Stock Doctor‘s methodology and 9 Golden Rules framework, along with its 40+ features and access to analysts, easily enables and empowers investors to identify high-yield stocks that provide a sustainable and long-term income stream for their ongoing financial needs and retirement.