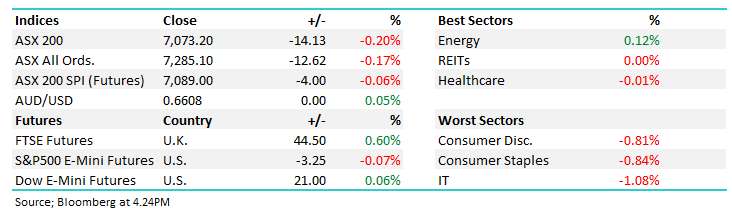

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.20% to 7,073.20.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

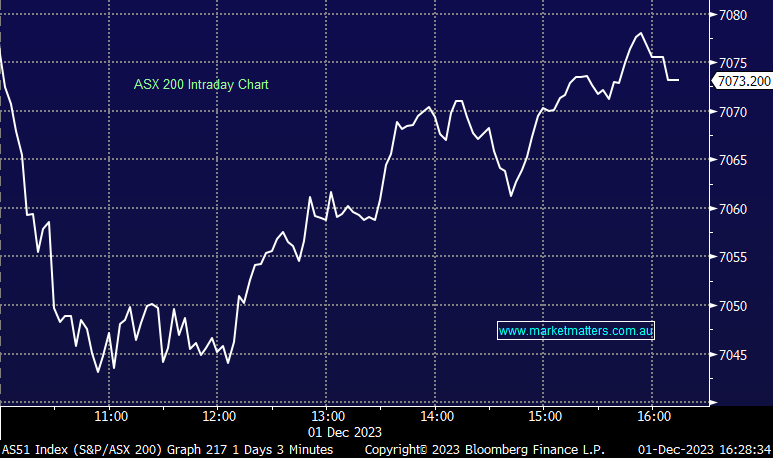

A choppy day to kick off the first day of the month with the market soft early, the ASX200 down ~40pts at the lows only to recover most of the declines before the close – not a bad effort for a Friday and another sign that markets have a bullish tone to them after a great November.

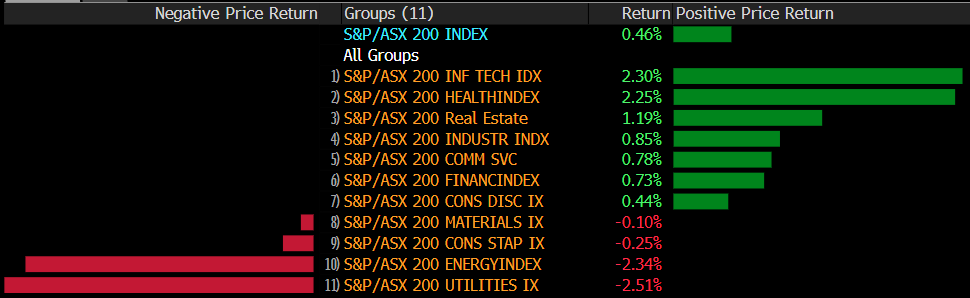

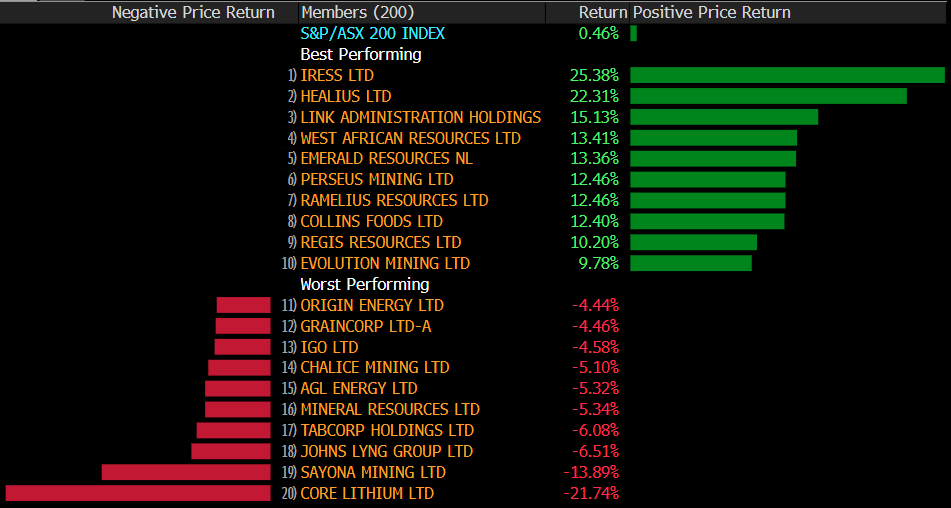

The ASX200 managed a gain of 32pts/+0.46% this week, Tech and Healthcare the standouts.

- The ASX 200 finished down -14pts/-0.20% at 7073.

- The Energy sector (+0.12%) was the only one in the black

- IT (-1.086%), Staples (-0.84%) & Consumer Discretionary (-0.81%) the biggest drag

- November was a great month for equities after a poor September/October period – the +4.5% advance by the ASX showing how important it is to stay the course.

- Pilbara Minerals Ltd (ASX: PLS) -0.82% as AusSuper takes a 5% stake – with 19% of the stock short sold, this is a stock firmly back on our radar.

- Core Lithium Ltd (ASX: CXO) -3.57% on the other hand was lower on a downgrade to sell rating from Citigroup Inc (NYSE: C).

- Premier Investments Limited (ASX: PMV) +2.83% rallied as they held their AGM saying Black Friday sales were the best ever.

- Mesoblast Ltd (ASX: MSB) halted is raising $98m through Bells – not long ago they upgraded the stock, now we know why!

- Iron Ore was higher in Asia, up 1.25%

- Gold edged up US$3 during our time zone today, trading at US$2040 at our close.

- Asian stocks were soft, Hong Kong -0.50%, Japan -0.06% while China lost 1%.

- US Futures are largely flat

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Sectors this week – Source Bloomberg

Stocks this week – Source Bloomberg

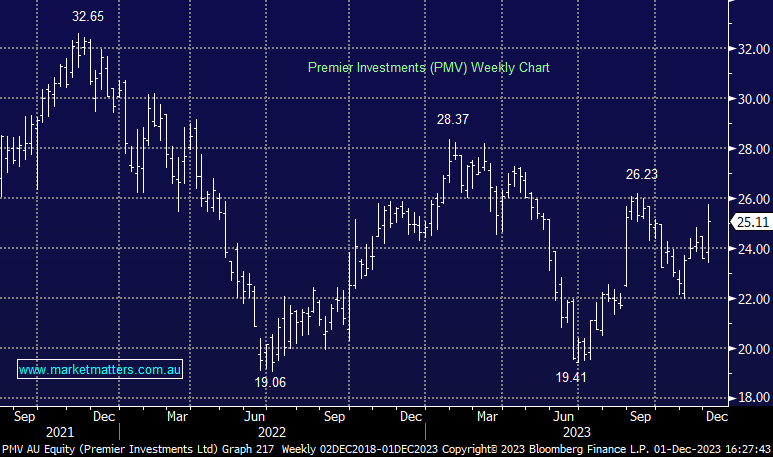

Premier Investments (PMV) $25.11

PMV +2.83%: despite a soft backdrop for retailers, Premier continues to show resilience in its earnings based on a positive update at the company’s AGM.

Solomon Lew’s retail group noted cost of living pressures were having an impact on the consumer however the company had a record sales week over the ‘Black Friday’ period across their brands which include Just Jeans, Peter Alexander & Smiggle.

Given the strong start to the year, Premier now expects EBIT for the 1H to be ~$200m in their retail division, 10% above consensus expectations, the caveat is that key Christmas and Back to School sales periods remain with the half-year wrapping up in January.

The EBIT guideline doesn’t include contributions from their investments in Myer Holdings Ltd (ASX: MYR) and Breville Group Ltd (ASX: BRG) where Premier owns ~25% of each.

Looking ahead, the market is after more commentary regarding plans to restructure the business, hoping to unlock value given the broad range of brands and investments within Premier.

Premier Investments (PMV) share price

Broker Moves

- Fortescue Ltd (ASX: FMG) Cut to Hold at Jefferies; PT A$23.90

- Allkem Ltd (ASX: AKE) Cut to Hold at Jefferies; PT A$8.50

- Gold Road Resources Ltd (ASX: GOR) Cut to Hold at Jefferies; PT A$2.10

- Iress Ltd (ASX: IRE) Raised to Overweight at Wilsons; PT A$8.16

- Fisher & Paykel Healthcare Corporatn Ltd (ASX: FPH) Cut to Underweight at Jarden Securities; PT NZ$22

- Iress Raised to Outperform at Macquarie Group Ltd (ASX: MQG); PT A$8.35

- Kinatico Ltd (ASX: KYP) Rated New Outperform at Taylor Collison

- Maxiparts Ltd (ASX: MXI) Rated New Outperform at Taylor Collison; PT A$3.40

- Antisense Therapeutics Limited (ASX: ANP) Reinstated Outperform at Taylor Collison

- Desane Group Holdings Limited (ASX: DGH) Reinstated Outperform at Taylor Collison

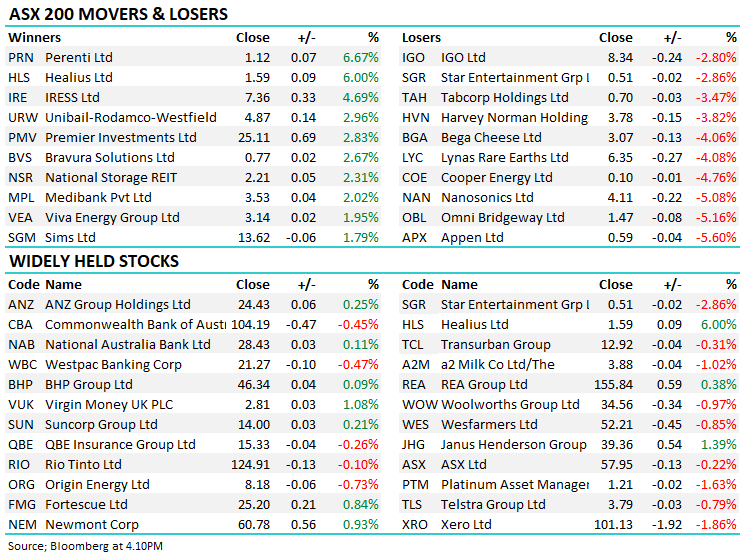

Major Movers Today