Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.73% to 7,124.70.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

A very solid start to the new week, particularly for resources, IT and property stocks as they key off more market-friendly rhetoric from the US Federal Reserve before the RBA’s Michelle Bullock steps up to the plate tomorrow, with the consensus call of no change one that Market Matters agrees with.

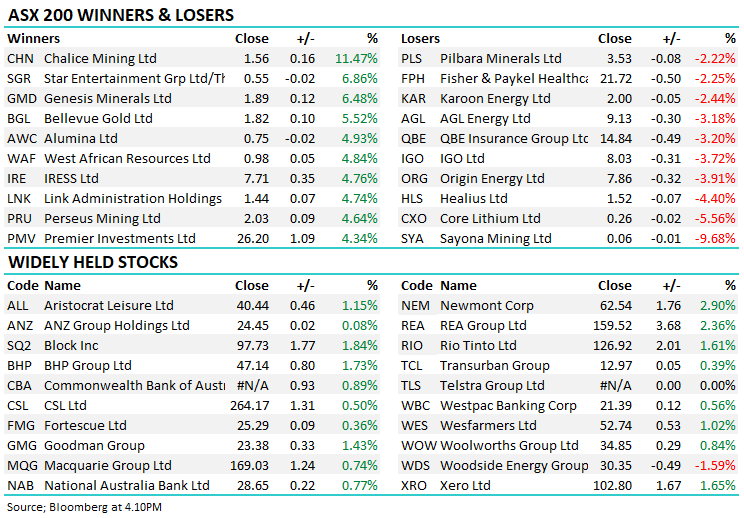

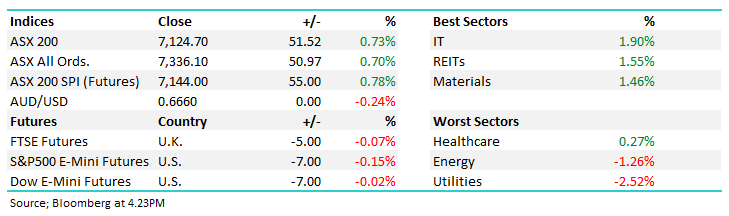

- The ASX 200 finished up +51pts/ +0.73% to 7124.

- The IT sector (+1.90%) was the standout, while Real Estate (+1.55%), Materials (+1.46%) and Consumer Discretionary (+1.25%) finished higher.

- Utilities (-2.52%) and Energy (-1.26%) were the only sectors to finish lower today

- Metcash Limited (ASX: MTS) +1.13% out with 1H24 results that were a touch above expectations thanks to a better result in Food, however, Hardware (ex-acquisitions) is slowing which is their growth engine.

- National Storage REIT (ASX: NSR) +3.17% caught our eye today rallying strongly on turning sentiment towards the sector. This is a high-quality self-storage business that has been hit for a number of reasons, all of which should prove transitory. We own NSR in the Active Growth Portfolio

- Aussie Broadband Ltd (ASX: ABB) -0.27% confirmed that their SPP was well oversubscribed with applications received more than doubling the top end of the target size. New shares to be issued on Wednesday, there was plenty of support for the raise and we like the deal they have put together for Symbio Holdings Ltd (ASX: SYM).

- Origin Energy Ltd (ASX: ORG) -3.91% hit an 8-month low before spending the afternoon in a trading halt before shareholders voted against the Brookfield takeover at $9.39/sh. A win for AusSuper, but they now have to come up with a plan to please the ~70% of shareholders that voted in favour of the deal.

- Gold hit an all-time high today at $US2135/oz after the Fed’s comments on Friday night. The precious metal did roll over throughout the session, currently up 0.67% at $US2,086/oz.

- We hold a number of gold stocks across the Market Matters Portfolios – Northern Star Resources Ltd (ASX: NST) +3.7%, Silver Lake Resources Ltd (ASX: SLR) +3.6%) and Evolution Mining Ltd (ASX: EVN) +2.48%

- Iron ore a touch lower, not that the miners took notice. BHP Group Ltd (ASX: BHP) +1.73% today.

- Asian stocks were down between -0.5% and 0.7% each at our close.

- US Futures are softer, S&P 500 (INDEXSP: .INX) futures -0.15% and Nasdaq Composite (INDEXNASDAQ: .IXIC) futures -0.35%.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Metcash (MTS) $3.59

MTS +1.13%: Out with 1H24 results this morning that were marginally above consensus at the group level driven by a better outcome in Food & Liquor, however, their hardware division was a negative surprise and is struggling to show growth outside of acquisitions.

1H sales of $9bn was up +1.6% and inline with market expectations with reported net profit after tax (NPAT) of $141m ~1% ahead of expectations.

An 11cps dividend was declared which was a smidgen better than the consensus of 10.6cps. The main drag came from hardware with EBIT -11.8% if we exclude acquisitions, rising costs the main issue there without enough growth to offset them.

They said sales for the first 4 weeks of the 2H were up +0.8%, again, inline with expectations.

The share is cheap trading on 12x while yielding 5.8% fully franked, however, their growth engine (Hardware) is spluttering.

Aside from yield, our premise for owning MTS is that over time, hardware will become a larger proportion of the pie and drive a re-rate of the group multiple, for now, it looks like patience is needed!

Metcash (MTS)

Broker Moves

- Endeavour Group Ltd (ASX: EDV) Raised to Buy at UBS; PT A$6

- Pilbara Minerals Ltd (ASX: PLS) Cut to Sell at UBS; PT A$3.05

- Beach Energy Ltd (ASX: BPT) Raised to Equal-Weight at Morgan Stanley (NYSE: MS); PT A$1.65

- Santos Ltd (ASX: STO) Cut to Equal-Weight at Morgan Stanley; PT A$7.71

- Chalice Mining Ltd (ASX: CHN) Raised to Overweight at JPMorgan Chase & Co (NYSE: JPM); PT A$2.20

- Universal Store Holdings Ltd (ASX: UNI) Raised to Buy at Citigroup Inc (NYSE: C); PT A$3.93

- Azure Minerals Ltd (ASX: AZS) Raised to Speculative Buy at Bell Potter

- Cochlear Limited (ASX: COH) Reinstated Buy at William O’Neil

- BHP Raised to Buy at Liberum; PT A$52.35

- Fleetpartners Group Ltd (ASX: FPR) Rated New Buy at Citi; PT A$3.60

Major Movers Today