Global markets

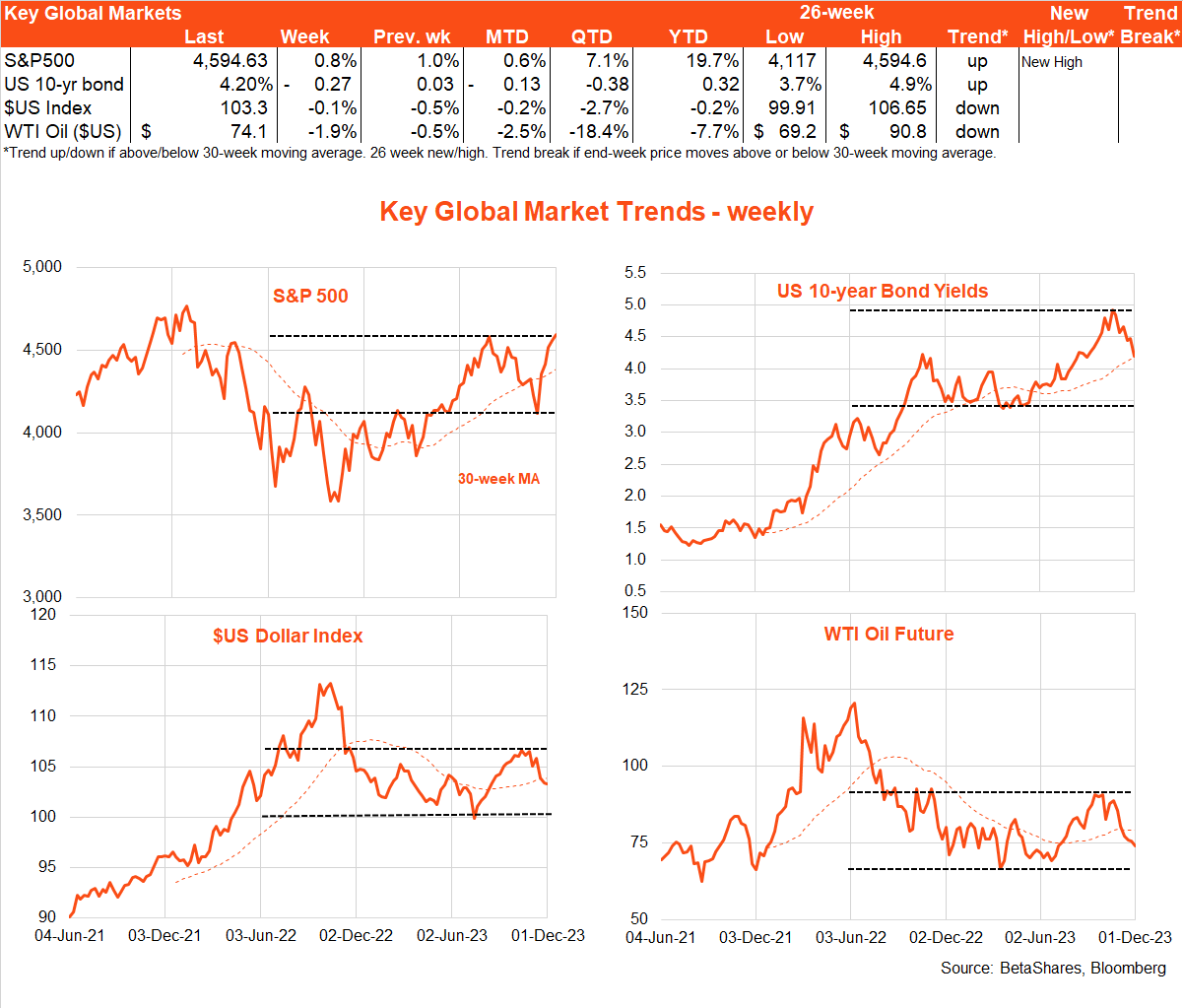

Global equities were up for the fifth week in a row as the remarkable bond rally continued.

US 10-year bond yields dropped a lazy 0.27% to 4.2%, with markets getting very excited about potential Fed rate cuts next year.

Importantly, this growing expectation does not reflect fears over economic growth – but continued encouraging US disinflation. Happy days!

It’s perhaps not surprising therefore that the S&P 500 (INDEXSP: .INX) lifted another 0.8% last week to reach a new high for the year and recover all of the losses since the late-July, bond yield driven, correction began.

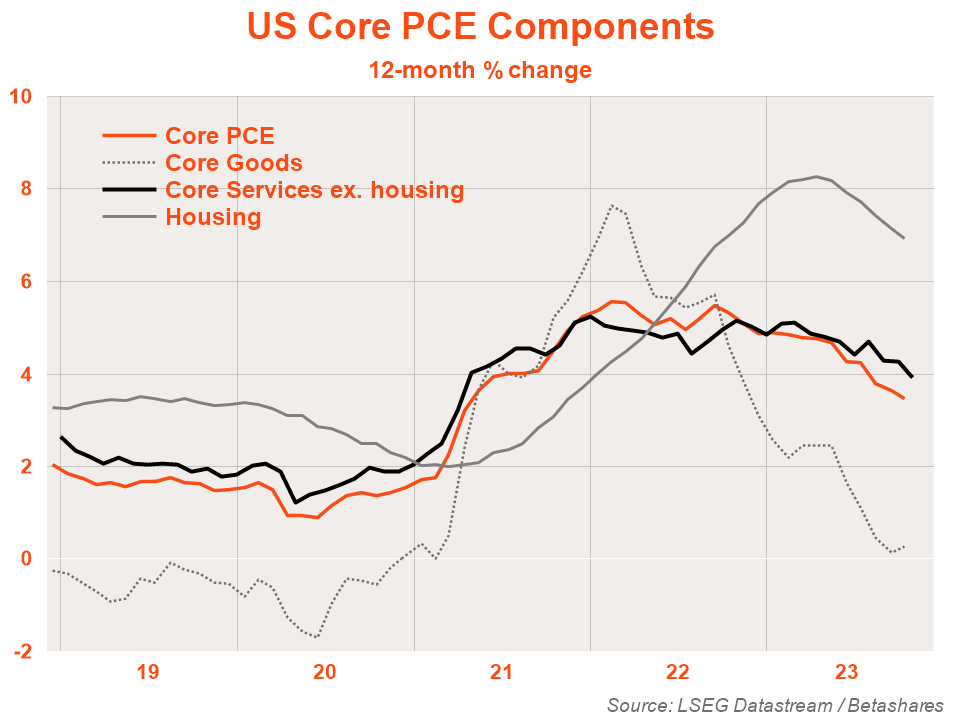

The main source for global cheer last week was a reassuring US October private consumption deflator.

Headline prices were flat in October, which was a touch lower than the +0.1% market expectation, while core prices (i.e. excluding food and energy) came out in line with the market expectation of 0.2%.

Annual rates of inflation continued to ease. As noted by no less than US Fed chair Powell on Friday, core prices have risen at an annualised pace of 2.5% over the past six months!

Looking at the details, US core goods inflation continued to ease nicely while housing sector inflation is also now into its long awaited downturn in earnest.

Even annual growth in core service inflation is easing, albeit somewhat more gradually.

Not be to outdone, European consumer prices also rose less than expected in November, with annual CPI inflation easing to 2.4% from 2.7%. With European growth soft, the ECB may well start to contemplate rate cuts in the new year.

Fed commentary, meanwhile, remains fairly mixed – though debate is shifting to how long to wait before cutting rates, rather than whether they need to be hiked further. The usually hawkish Fed Reserve Governor Waller suggested last week the Fed has likely done enough to bring down inflation.

Fed Chair Powell was a bit more restrained, but at least confirmed a rate hike this month is unlikely by indicating the Fed would “move cautiously” from here and economic risks had become more “balanced”.

Powell seems unwilling to tell markets what he likely truly believes – and what the markets want to hear – lest he unleash premature market euphoria which could ease financial conditions too quickly and reignite growth and inflation. He’s trying to hold back the horses, albeit without much luck to date!

Further supportive of easing inflation risks, OPEC agreed to a deeper 1 million barrel per day production cut though it was voluntary and so left unclear who could actually do the cutting. Markets reacted by pushing oil prices down.

A modest slowing in global economic growth, rising non-OPEC supply and a structural demand shift toward electric cars suggest oil prices could remain under downward pressure as we head into 2024.

In other news, key Chinese manufacturing and non-manufacturing indices were a touch softer than expected last week highlighting its still sluggish post-COVID economic recovery.

In New Zealand, the RBNZ held rates steady as widely expected, but pushed out the timing of its first anticipated rate cut from Q1 ’25 to Q2’25 due to concern over sticky core inflation. NZ business confidence, nonetheless, continued to recover – reflecting optimism that the RBNZ had at least finished raising rates.

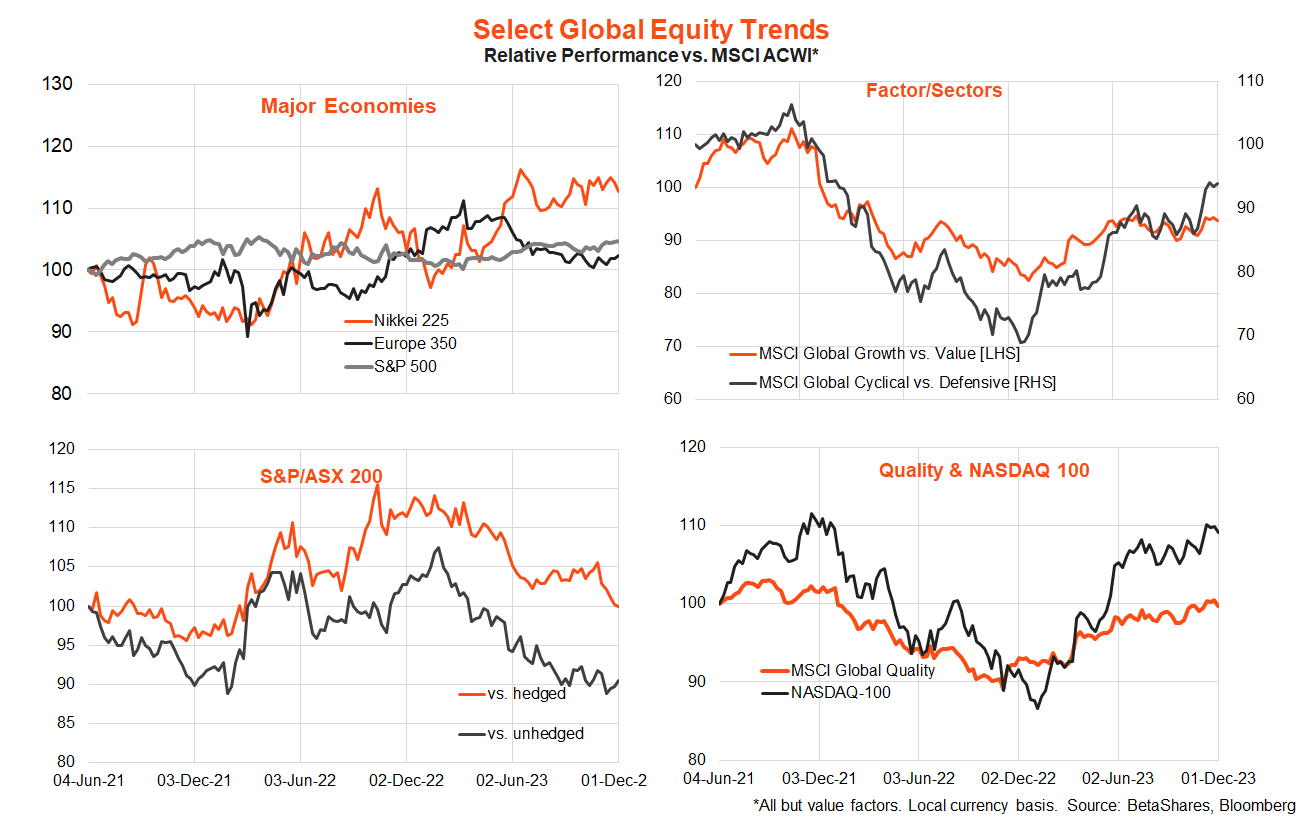

In terms of global equity trends, the overall relative performance of global growth relative to value continues to trend sideways, though quality, the tech-heavy Nasdaq-100 (INDEXNASDAQ: NDX) and cyclicals retain an outperforming bias.

US economic data will again take centre stage this week, with November payrolls on Friday and job openings on Tuesday expected to support the view that a “goldilocks” modest slowing in the labour market is underway.

Markets anticipate a jobs gain of 180k, steady unemployment of 3.9% and modest easing in annual growth in average hourly earnings from 4.1% to 4.0%. Job openings are expected to drop back in from 9.6 million to 9.4 million.

Obviously, a big risk for markets is stubborn strength in both employment and job openings, which could see bond yields move higher and equity prices likely move lower. At present, bad news is good news.

Australian markets

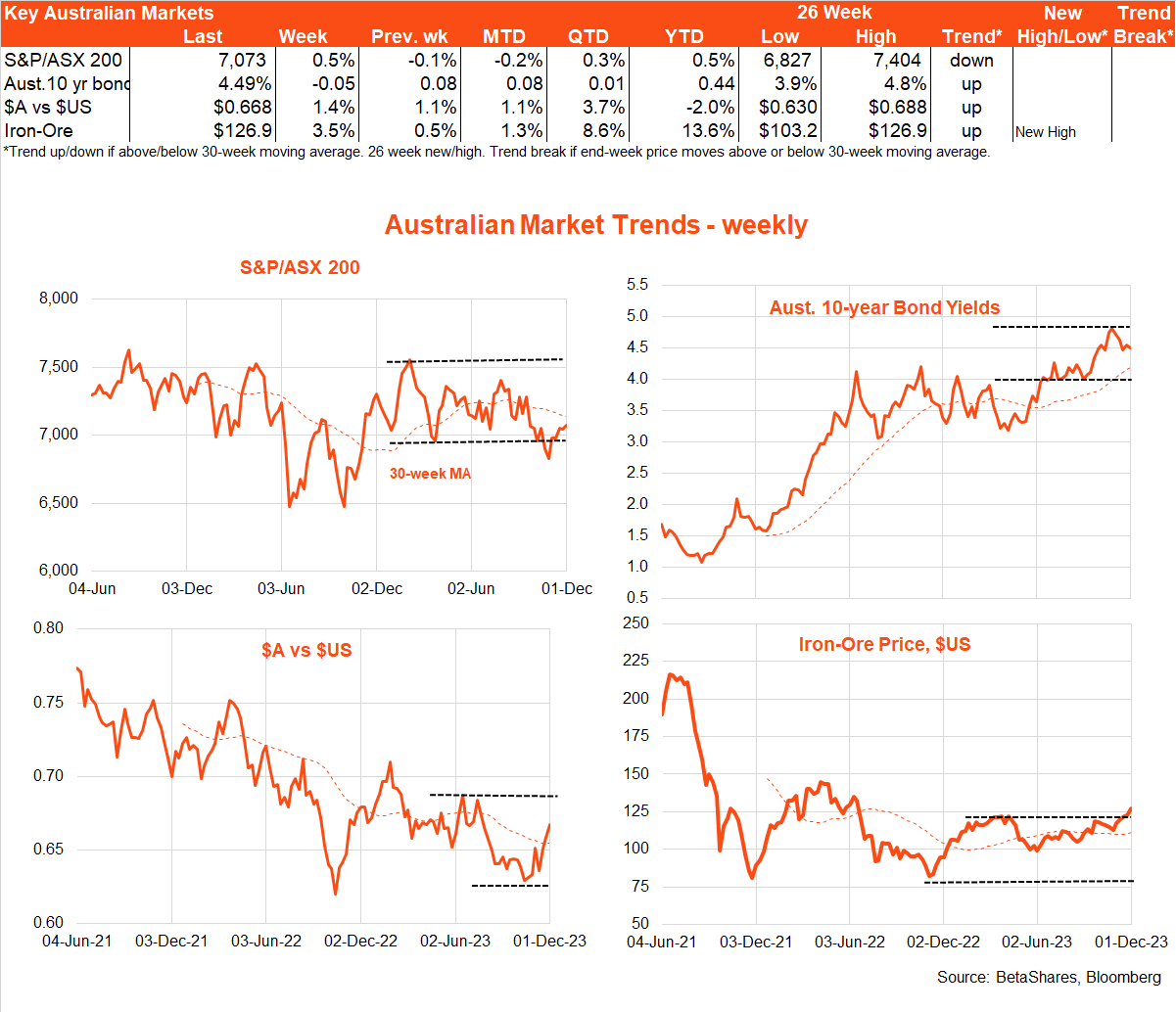

Key local highlights last week were softer-than-expected retail sales and consumer prices in October, which should effectively rule out any chance of an RBA rate hike at tomorrow’s last policy meeting for the year.

With the RBA still talking tough, local bond yields did not fall as much as in the US last week, while the equity market rebound continued. Iron-ore prices remained firm which along with a softer $US saw the $A gain further ground.

Retail sales dipped 0.2% in October, though the result could partly reflect seasonal factors given more spending now seems to take place during November “Black Friday” sales.

Annual growth in the monthly CPI slowed to 4.9% compared to the market expectation of 5.2%, though the decline in annual trimmed mean inflation was a bit more modest – from 5.4% to 5.3%.

Business investment, meanwhile, remains firm with capital expenditure survey revealing good growth in Q3 and a positive outlook for the year ahead. House prices also rose 0.6% in November – to a new record high – though if there is any consolation for the RBA the monthly pace of growth at least appears to be easing.

Key local highlights this week include tomorrow’s RBA policy meeting and the Q3 GDP report on Wednesday. As noted above, it seems unlikely the RBA will hike this week – preferring to await more detailed price information in the Q4 CPI due in late January.

Wednesday’s GDP report is likely to reveal continued sluggish growth, with another 0.4% gain (1.6% annualised) expected – dragged down by still subdued consumer spending.

Have a great week!