Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.89% to 7,061.60.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

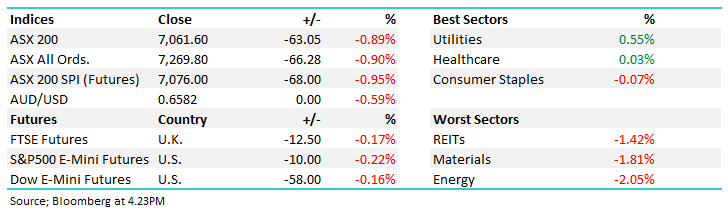

Futures were pricing a decline of ~40pts this morning however the market fell double that ahead of the RBA decision on interest rates – which were kept on hold as expected – before stocks had a slight whimper into the close.

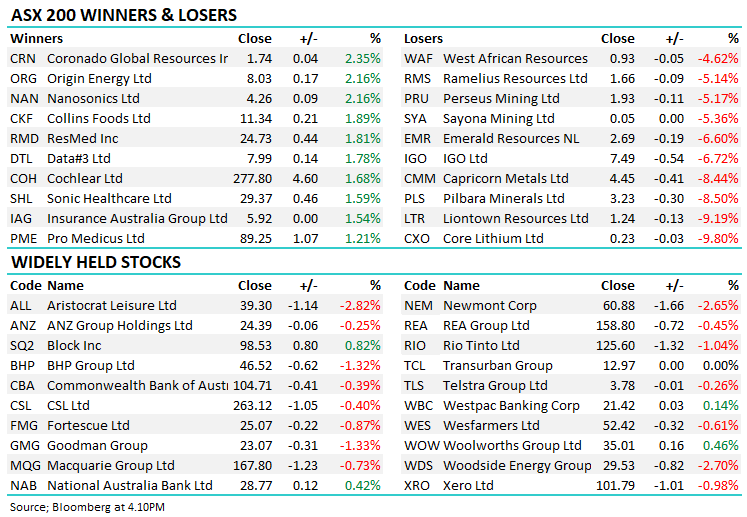

- The ASX 200 finished down -63pts/ -0.89% to 7061.

- The Utilities sector (+0.55%) was solid, while Healthcare (+0.03%) kept its head above water (just).

- Energy (-2.05%), Materials (-1.81%) and REITs (-1.42%) struggled most

- The RBA Held Rates at 4.35% as expected, the AUD fell 0.6% to US65.80c and bond yields pulled back, the Aussie 3-year yield dipped back below 4%.

- There was not a lot of new info for the RBA to rely on so they pretty much repeated the rationale for its November rate hike, sticking with their willingness to tighten further if inflation turns out to be higher than expected.

- We doubt that will be the case, the monthly inflation data supports that view while we’re starting to see some slack in the labour market.

- There was nothing in today’s update to change our view that the RBA is done – they’ve gone hard enough, demand and inflation pressures are easing, and the next decision will be when to cut, but that’s a while away.

- We presented a few ‘non-consensus’ scenarios for 2024 this morning that are worth keeping on the radar – read the report here

- Evolution Mining Ltd (ASX: EVN) Halted launched a $525m insto placement at $3.80 to fund an 80% stake in New South Wales gold and copper mine Northparkes. The stock closed yesterday at $4.14 – there will be a share purchase plan (SPP) for retail.

- Mesoblast Ltd (ASX: MSB) -17.96% fell following their capital raise at 30cps, interesting to see Bells upgrade the stock to speculative buy (55c PT) in September and then lead the capital raise – shares finished at 31.5c.

- Life360 Inc (ASX: 360) -2.57% was down after co-founder and CEO Chris Hulls sold $4m worth of shares for tax reasons.

- Capricorn Metals Ltd (ASX: CMM) – 8.44% also hit on insider selling, Chair Mark Clark and Director Mark Okeby sold 5m and 2m shares, respectively.

- Metcash Limited (ASX: MTS) -1.95% was hit, but more so early on as brokers were ho-hum on yesterday’s results, as we flagged at the time, the hardware business was disappointing to us (and others it seems)

- Lithium stocks continued to get whacked, the shorts here are having a field day – Pilbara Minerals Ltd (ASX: PLS) -8.5% hitting new 52-week lows, IGO Ltd (ASX: IGO) -6.72% closed at $7.49, down from a $17.32 high a year ago.

- We hold Mineral Resources Ltd (ASX: MIN) -4.34%, not straight Lithium but it’s looking average in the portfolio, down 21% as at this afternoon.

- Paladin Energy Ltd (ASX: PDN) -4.27% went against the overnight strength in Uranium stocks as ~$135m worth of shares crossed this morning at 99.5c, ~4.2% of the company. Tembo, previously No 2 shareholder was the seller apparently.

- Gold stocks gave back some recent outperformance, Northern Star Resources Ltd (ASX: NST) -4.03% no doubt used a funding vehicle for the EVN raise. We own both!

- Origin Energy Ltd (ASX: ORG) +2.16% higher as a plethora of fundies call for capital management as a way of unlocking the value that Brookfield saw. We intend to cover our view on ORG in tomorrow’s AM report.

- Iron ore a touch lower, down -0.70%, major miners were down a similar amount.

- Asian stocks were soft, Hong Kong -1.6%, Japan -0.96% while China lost -0.70%.

- US Futures are down around 0.20%.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

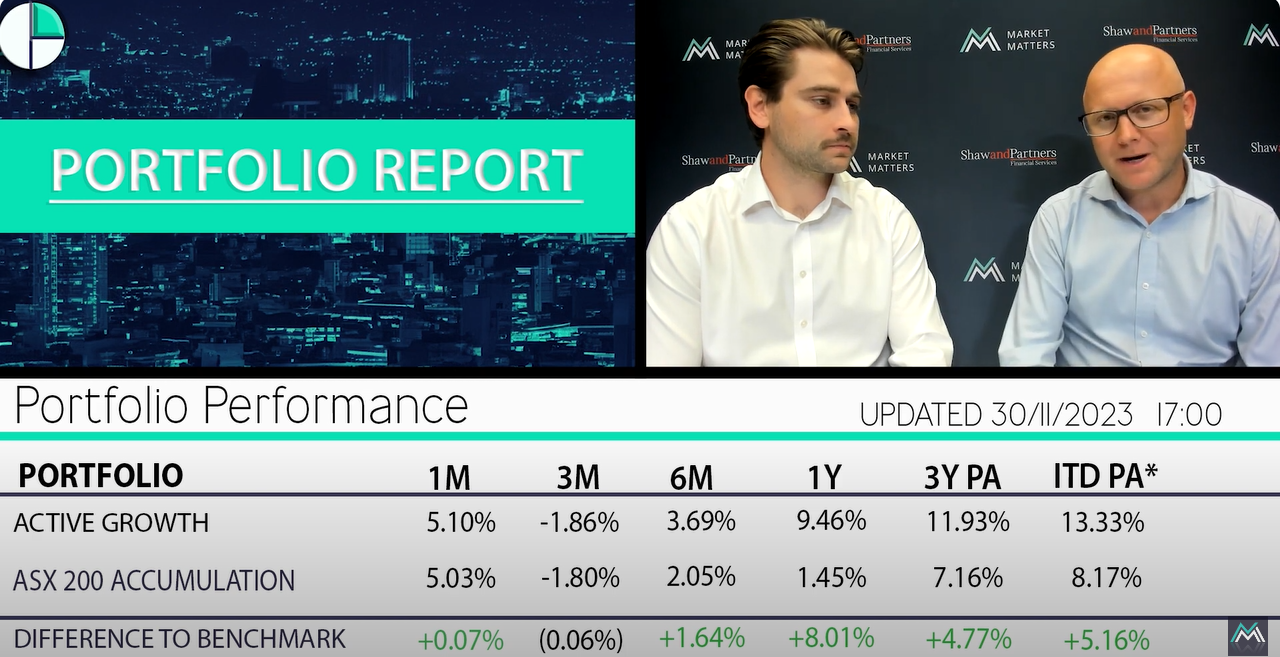

Market Matters Video Update

Portfolio Managers James Gerrish & Harrison Watt cover Market Matters (published) portfolio performance available on the Market Matters Website. They also cover their thoughts on positioning towards year-end and into 2024.

This calendar year, the ASX 200 Accumulation Index is up 4.81% to November 30.

The Performance of the Market Matters (website) portfolios is outlined below:

- The Active Growth Portfolio: +14.37%

- The Active Income Portfolio: +5.66%

- The Emerging Companies Portfolio: +3.80%

- The International Equities Portfolio: +21.43%

Broker Moves

- Insurance Australia Group Ltd (ASX: IAG) Raised to Neutral at UBS; PT A$6

- Coles Group Ltd (ASX: COL) Raised to Equal-Weight at Morgan Stanley (NYSE: MS); PT A$16.50

- Hillgrove Resources Limited (ASX: HGO) Rated New Speculative Buy at Canaccord Genuity Group Inc (TSE: CF)

- Metcash Cut to Accumulate at CLSA; PT A$4

- Data#3 Limited (ASX: DTL) Rated New Buy at Jarden Securities; PT A$8.93

- Dicker Data Ltd (ASX: DDR) Rated New Overweight at Jarden Securities

- Vicinity Centres (ASX: VCX) Rated New Outperform at Daiwa Securities Group Inc (TYO: 8601); PT A$1.97

- Telix Pharmaceuticals Ltd (ASX: TLX) Rated New Outperform at Cowen; PT A$16

- Aristocrat Leisure Limited (ASX: ALL) Cut to Underperform at Jefferies; PT A$35.85

- Alumina Limited (ASX: AWC) Raised to Overweight at JPMorgan Chase & Co (NYSE: JPM); PT A$1

Major Movers Today