Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +1.65% to 7,178.40.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

Stocks enjoyed the best one-day jump in over a year today as peak rates met solid but not spectacular growth numbers supporting the ‘goldilocks’ economic scenario, which is very bullish equities if it comes off.

The ASX recouped all of yesterday’s losses and some as we experienced a bottom left, top right sort of day, sessions like this are what equity investing is all about!

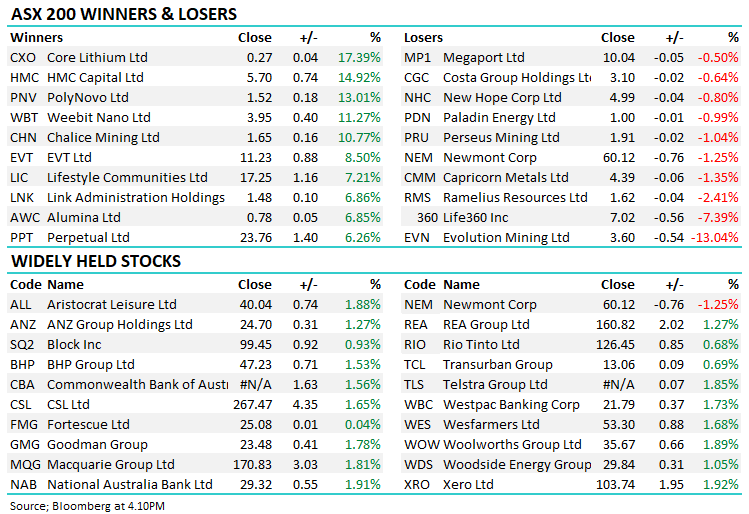

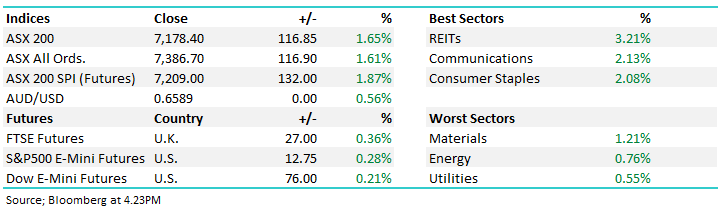

- The ASX 200 finished up +116pts/ +1.65% to 7178.

- The REITS sector (+3.21%) stormed higher, while Communications (+2.13%) & Staples (2.08%) put aside their defensive tags and ripped!

- Utilities (+0.55%), Energy (+0.76%) and Materials (+1.21%) were all up but underperformed the broader strength.

- Data at 11.30 am showed GDP expanded 0.2% in the 3Q, down from 0.4%. YoY the economy expanded 2.1%, slightly ahead of forecasts.

- Aussie bond yields were down ~10bps across the curve today, the 2-year now sub 4%.

- Banks & REITs were very strong, rates have peaked but growth is holding up, a bullish combo for these sectors if data continues to support this view.

- Evolution Mining Ltd (ASX: EVN) -13.04% was hit after coming back on the boards post $525m placement at $3.80 to buy a new mine, we like the deal & we own EVN, the pullback in the SP is understandable but probably overdone.

- Perpetual Ltd (ASX: PPT) +6.26% announced a strategic review, not sure they need it. They could just borrow Phil King’s playbook!

- They’re looking at a divestment and/or demerger of the corporate trust and wealth management businesses, which would leave Perpetual as a pure-play multi-boutique asset manager. We’ve written a lot about the imbedded value here, we previously owned PPT post takeover of Pendal but sold at higher levels. This sort of restructure has merit.

- Our preference turned to beaten-up Magellan Financial Group Ltd (ASX: MFG) +3.57%, which rallied today on a FUM update that implies performance was very strong in November.

- While Net Outflows were still ~$1bn, only $300m was retail and overall FUM went up ~$900m even with the currency up 5%. On our back-of-the-envelope numbers, it looks like the portfolio was up over ~10% on an underlying basis. We continue to see compelling value in MFG with the sum of the parts worth more than its current $1.4bn valuation.

- Lithium stocks had a very interesting session, knocked early before a very strong recovery played out, Pilbara Minerals Ltd (ASX: PLS) finished ~10% from the morning lows, down 4% to up 6% – you’ve got to take notice of that price action, particularly in a stock that is ~20% short.

- Centuria Capital Group (ASX: CNI) +5.08% remains one the highest beta ways to play peak interest rates, the stock is up ~37% since 1st November, Aussie 3-year yields are down 53bps in the same period.

- Other property stocks are looking good, we own National Storage REIT (ASX: NSR) +3.11%, Lendlease Group (ASX: LLC) +4.10% and Dexus (ASX: DXS) +2.99% in addition to CNI.

- Even Telstra Group Ltd (ASX: TLS) +1.85% rallied today!

- Iron ore up ~2% in Asia but the major miners underperformed the strength – both Fortescue Ltd (ASX: FMG) & Rio Tinto Ltd (ASX: RIO) near all-time highs.

- Asian stocks traded higher, Hong Kong +1.23%, Japan +1.95% while China added +0.16% edged higher.

- US Futures are pricing a positive start overseas, Eminis +0.3%.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Broker Moves

- Cyclopharm Limited (ASX: CYC) Raised to Buy at Bell Potter; PT A$4.25

- Rio Tinto Raised to Outperform at BNPP Exane; PT 6,500 pence

- South32 Ltd (ASX: S32) Cut to Underperform at BNPP Exane; PT A$3.15

- Star Entertainment Group Ltd (ASX: SGR) Raised to Overweight at Barrenjoey

- Santos Ltd (ASX: STO) Raised to Overweight at Jarden Securities; PT A$7.25

- Woodside Energy Group Ltd (ASX: WDS) Raised to Neutral at Jarden Securities

- Origin Energy Ltd (ASX: ORG) Affirmed at Baa2 by Moody’s Corp (NYSE: MCO)

Major Movers Today