The ETF industry have been steadily rising today. Annabelle Dickson of Betashares shows us the current market trend which includes 2 million Australians starting to invest in the world of ETFs.

There are now 2 million investors in Australia holding ETFs in their portfolio, up from 1.9 million last year – growth of 7% year on year.

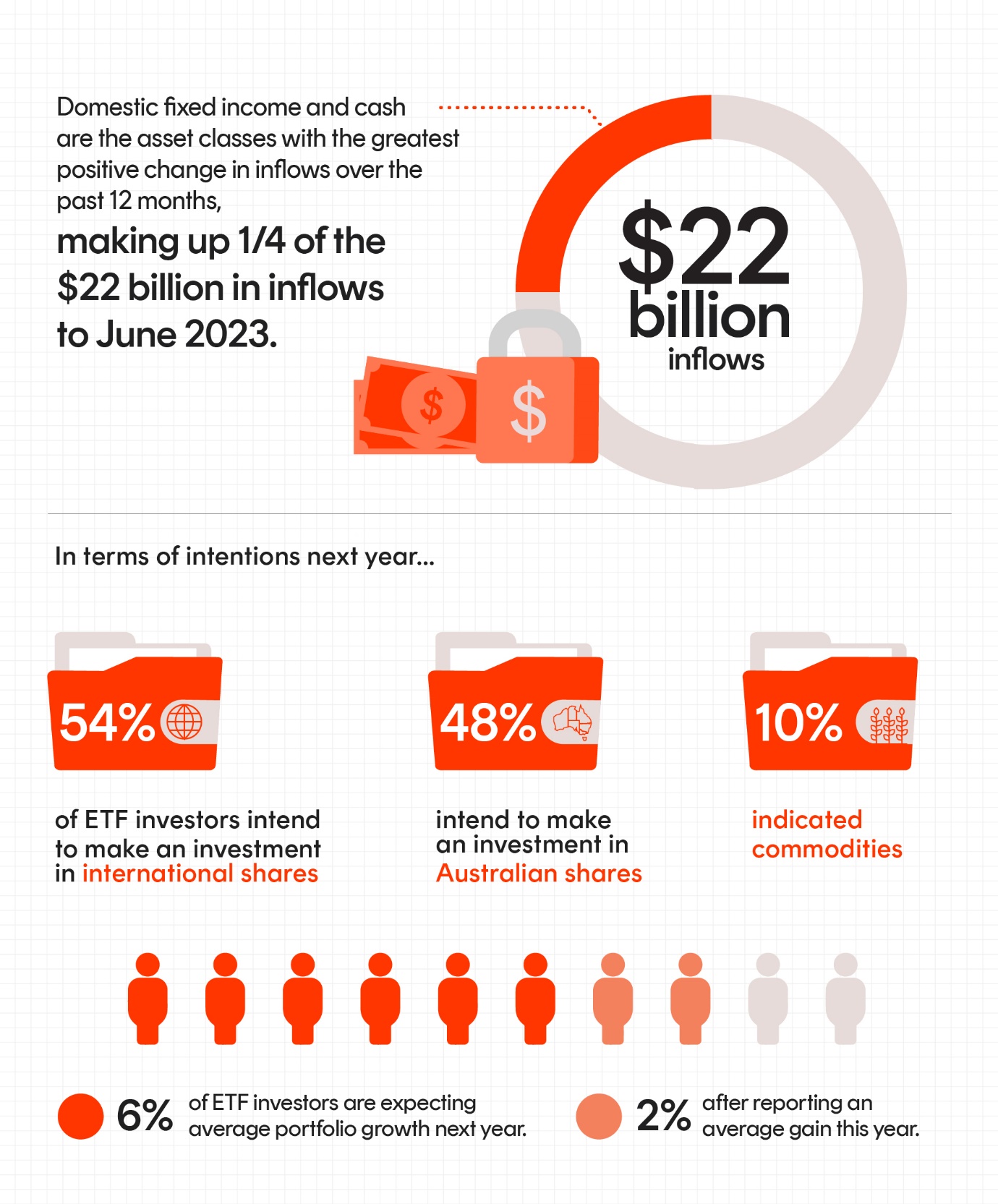

The 2023 Betashares/Investment Trends ETF Report also found that an additional 310,000 Australians intend to invest in ETFs for the first-time next year, while an existing 1.39 million existing ETF investors intend to reinvest more during 2024.

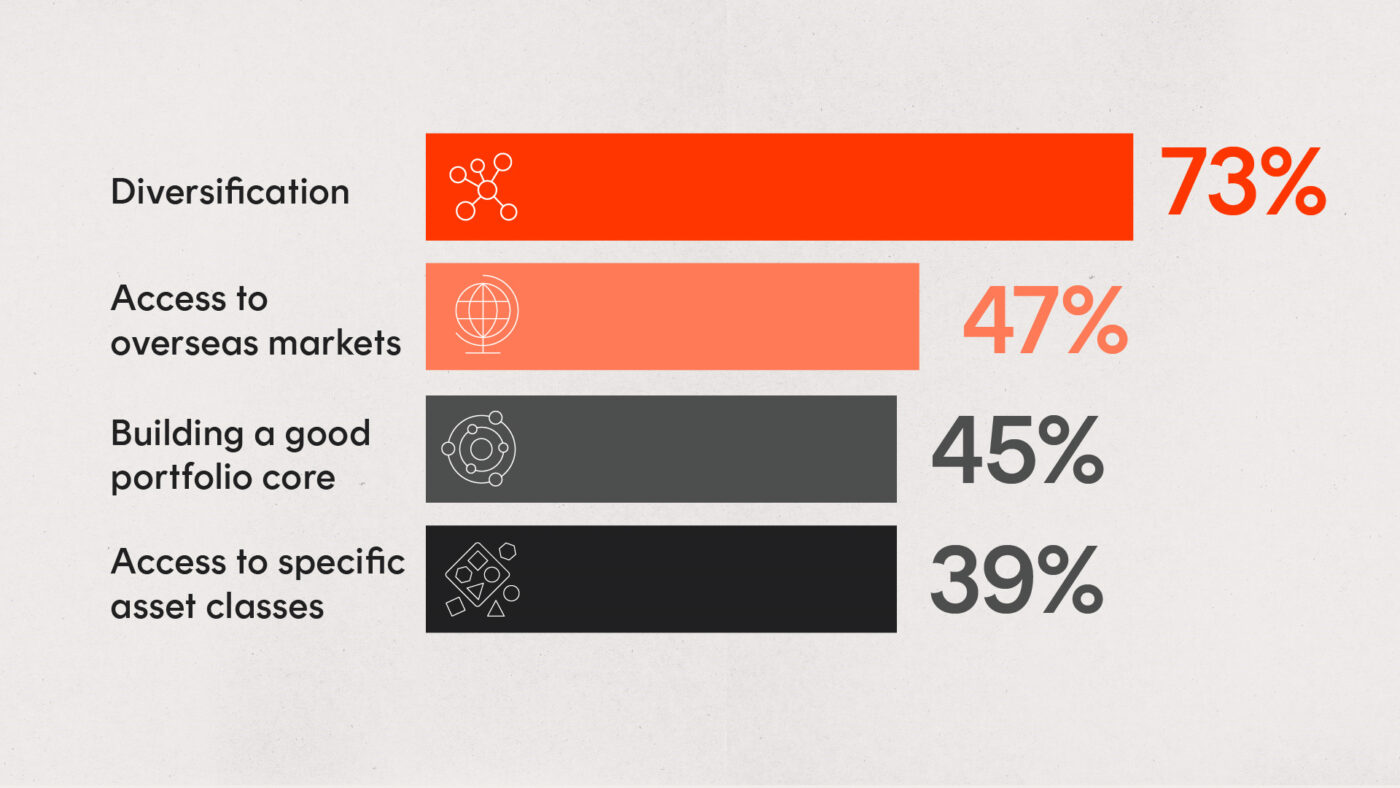

According to the report, investors are motivated by the following four factors to use ETFs:

Investor preferences

Portfolio diversification remains the single biggest reason investors choose ETFs, as has been the case in previous studies.

Convenience (saves me time from choosing individual stocks) also continued to rank second as a driver for ETF adoption, while the ability to gain exposure to specific overseas markets saw an uptick in responses from investors compared to previous years.

The volatile market conditions, coupled with a tense geopolitical environment over the last year, once again highlighted the importance of diversification, which is one of the key benefits of ETFs.

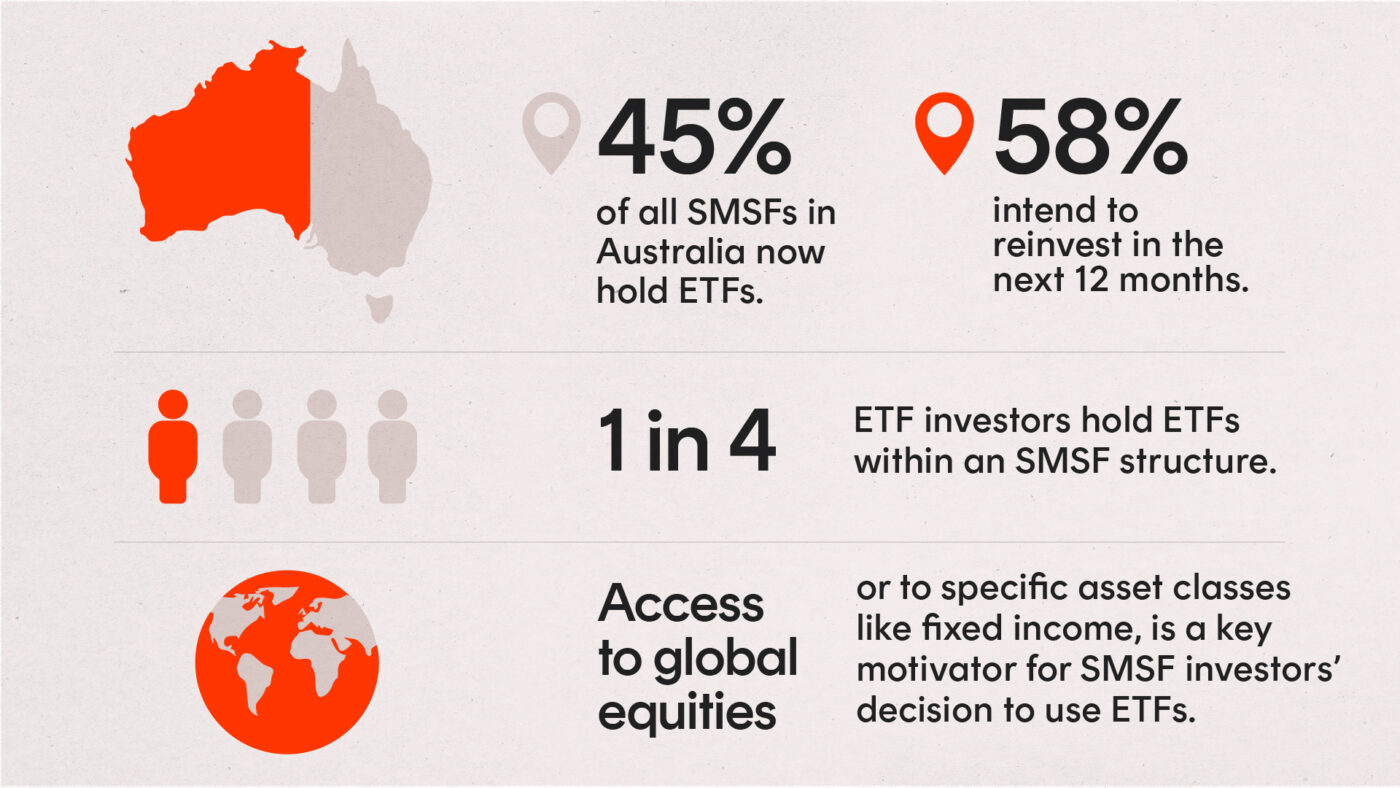

SMSF Investors

Highest forecast growth in new investors since 2020

Looking ahead to next year, the research indicates strong growth prospects, with an additional 310,000 Australians indicating they expect to start investing in ETFs for the first time – the highest pool in the next wave of ETF investors since 2020.

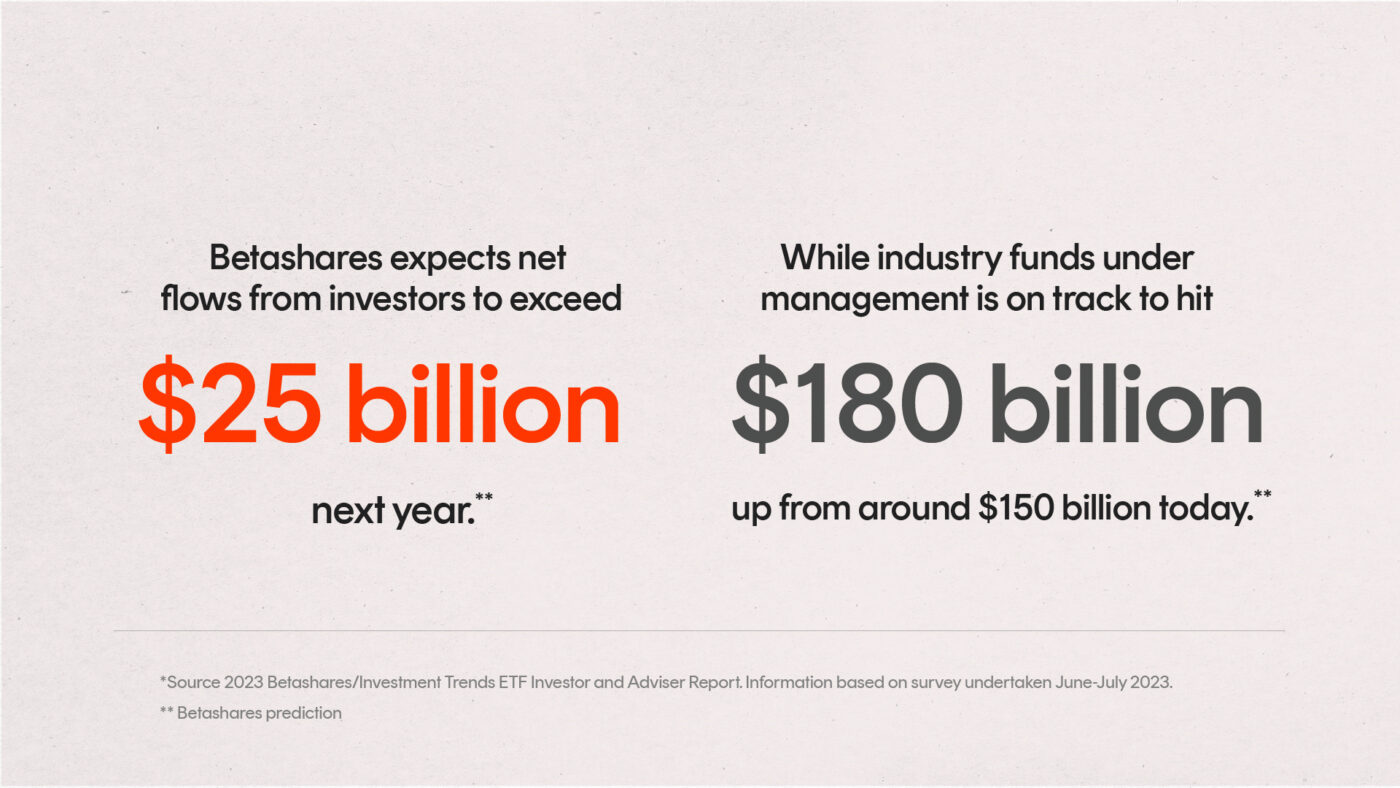

On the back of continued growth in the number of ETF investors, high levels of accessibility, and an ever-increasing universe of ETF solutions, Betashares expects net flows from investors to exceed $20 billion next year, with industry funds under management on track to exceed $180 billion by the end of 2024, up from around $150 billion today.

The 2023 Betashares/Investment Trends ETF Report surveyed 1,275 financial advisers and 1,757 current ETF investors between June and August 2023.