Both defensive and growth assets strengthened in November, with the latter outperforming the former, as a sharp reversal in bond yields boosted the value of both bonds and equities.

The decline in bond yields reflected easing US inflation, and growing hopes that the US Federal Reserve had not only finished raising interest rates but could cut them as early as H1 ’24.

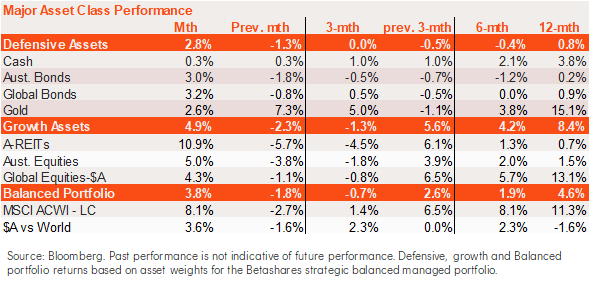

Growth assets returned 4.9%, with Australian equities up 5.0% and the interest rate-sensitive listed property sector rallied 10.9%.

Reflecting AUD strength, unhedged global equities returned 4.3%, somewhat weaker than the hedged return of 8.1%.

Among defensive assets, both global and Australian fixed-rate bonds outperformed cash, reflecting the drop in bond yields.

Gold prices also strengthened, reflecting lower bond yields and a weaker US dollar.