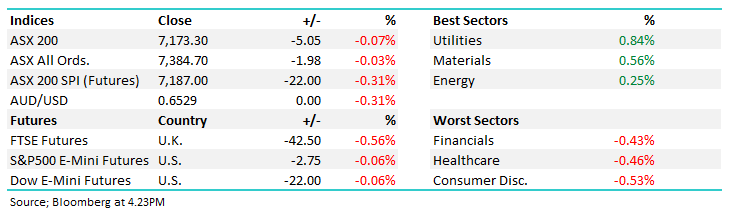

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.071% to 7,173.30.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

There wasn’t much on offer for the ASX today, a much calmer session after the fireworks of yesterday. Shares traded in a tight ~30pts range with a strong rally through the afternoon seeing it close marginally lower.

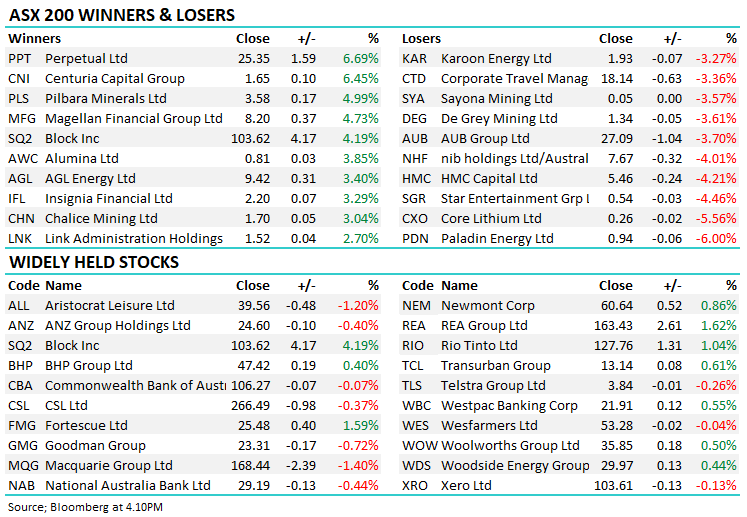

- The ASX 200 finished up +51pts/ +0.73% to 7124.

- The Utilities sector (+0.84%) was the standout followed by Materials (+0.56%0 and Energy (+0.25%

- Consumer Discretionary (-0.53%), Healthcare (-0.46% and Financials (0.46%) struggled the most.

- Crude traded below $US70/bbl for the first time since July overnight. There was some reprieve in Asian trade, however, it was unable to trade back above that key level today. Woodside Energy Group Ltd (ASX: WDS) was down -3.6% early on, before closing +0.44%

- As we discussed in the Morning Report, Perpetual Ltd (ASX: PPT) confirmed a bid from Washington H Sl Pttnsn nd Cmpny Ltd (ASX: SOL) in early November. The deal, worth $27/sh, was rejected by the Perpetual board with the view that they are best placed to unlock value. The announcement followed a strategic review of the make-up of the company looking at spinning out the Wealth and Corporate Trust business

- The space rallied on the news – Perpetual (PPT) +6.69%, Magellan Financial Group Ltd (ASX: MFG) +4.73%, Pinnacle Investment Management Group Ltd (ASX: PNI) +2.49% and Regal Partners Ltd (ASX: RPL) +2.17%. property Fund Manager Centuria Capital Group (ASX: CNI) +6.45% continued its recent strength as well.

- Boss Energy Ltd (ASX: BOE) -7.95% back after a $205m placement to fund a 30% stake in US Uranium project Alta Mesa and JV with enCore. Shares quickly traded through the $3.95/sh cap raise price, while the sector was weaker more broadly.

- The forgotten Buy Now Pay Later (BNPL) stocks have found their feet over recent weeks, tech catching a bid and Afterpay Ltd (ASX: APT) owner Block Inc CDI (ASX: SQ2) reported well at their most recent quarterly. SQ2 +4.19% today, and Zip Co Ltd (ASX: ZIP) +25% thanks to Citi talking up their US prospects.

- Gold continued to consolidate around the $US2,026/oz level, flat on the day..

- Iron ore was strong in Asia, BHP Group Ltd (ASX: BHP) struggled to follow suit but Rio Tinto Ltd (ASX: RIO) & Fortescue Ltd (ASX: FMG) performed well, up 1.04%% & 1.595 respectively

- Asian stocks were notably weak, most indices down more than 1%.

- US Futures are all marginally softer

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Broker Moves

- Macquarie Group Ltd (ASX: MQG) Cut to Neutral at UBS; PT A$180

- Evolution Mining Ltd (ASX: EVN) Cut to Equal-Weight at Morgan Stanley (NYSE: MS); PT A$4.50

- Whitehaven Coal Ltd (ASX: WHC) Raised to Buy at Citigroup Inc (NYSE: C); PT A$9.40

- Evolution Cut to Underweight at Jarden Securities; PT A$3.20

- Clean Seas Seafood Ltd (ASX: CSS) Cut to Neutral at Sparebank 1 SR Bank ASA (FRA: B4M1)

- Neuren Pharmaceuticals Ltd (ASX: NEU) Cut to Hold at Bell Potter; PT A$17.50

- Tuas Ltd (ASX: TUA) Rated New Buy at Peloton Capital; PT A$4.76

Major Movers Today