Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.30% to 7,194.90.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

The market opened on the backfoot, down early, before rallying ~50pts into the close to finish at session highs, clearly a bullish tone to end the week with the solid intra-day move.

The lack of selling as December wears on is the theme we’ve been highlighting in recent reports with a few examples taking shape in recent sessions.

We maintain our bullish bias targeting the 7400 level on the ASX 200.

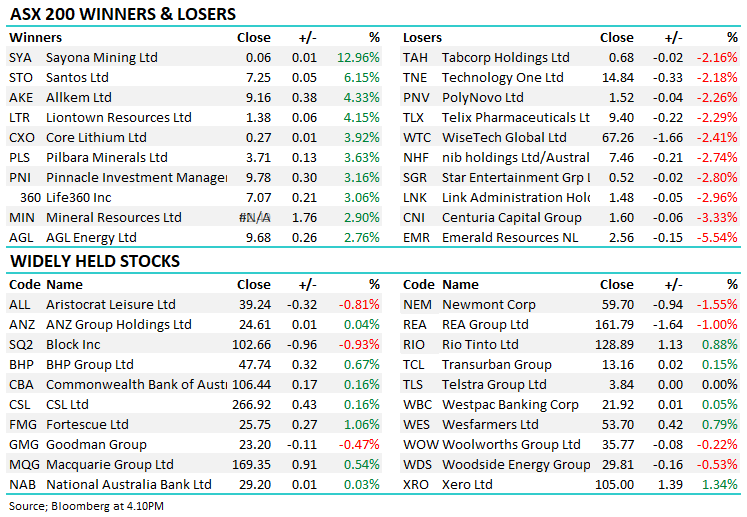

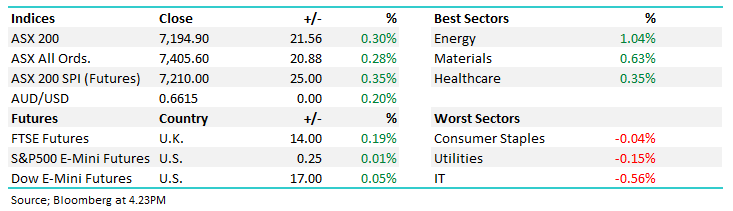

- The ASX 200 finished up +21pts/ +0.30% to 7194

- The Energy sector (+1.04%) was higher, while Materials (+0.63%) & Healthcare (0.35%) outperformed.

- IT (-0.56%), Utilities (-0.15%) and Staples (-0.04%) the weakest links.

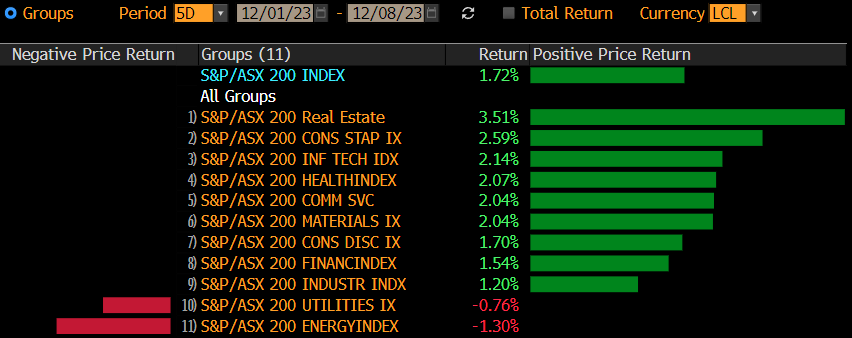

- For the week, the ASX 200 put on +1.72% with the Real-Estate sector the standout up +3.5%. t

- Woodside Energy Group Ltd (ASX: WDS) -0.53% fell while Santos Ltd (ASX: STO) +6.15% rose on merger talk, although WDS is bigger so it would be more of a takeover sort of scenario if it played out.

- Ramsay Health Care Ltd Fully Paid Ord. Shrs (ASX: RHC) +0.52% received FIRB approval to sell its 50-50 Asian joint venture to Columbia Asia Healthcare.

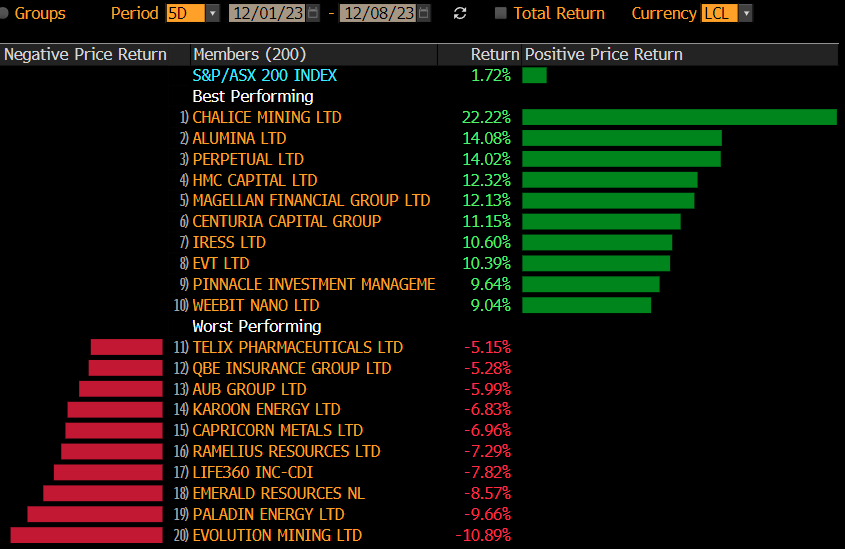

- Lithium stocks look to have bottomed, Pilbara Minerals Ltd (ASX: PLS) +3.63%, Mineral Resources Ltd (ASX: MIN) +2.9% & IGO Ltd (ASX: IGO) +1.87% all rallied.

- The Fund Managers have had a good week on the back of Perpetual Ltd (ASX: PPT) +1.38% being bid for by Washington H Sl Pttnsn nd Cmpny Ltd (ASX: SOL), however Magellan Financial Group Ltd (ASX: MFG) +2.56% also had a FUM update that implied good portfolio performance in November.

- Soul Patts (SOL) – 0.48% also hosted their AGM today, investment performance was a little soft to start FY23, -0.4% in the 3 months to October. The Perpetual (PPT) suitor has $469m in dry powder ready to invest and expects to see activity increase in 2024 – get active!

- Iron ore up ~2.4% in Asia to $US133.90,/mt supported by strong export data from China.

- Asian stocks were mixed, Hong Kong edged up 0.2%, Japan fell -1.8% while China added +0.43%.

- US Futures are pricing a flat open.

- Employment data due out in the US tonight, +183k jobs to be added with the unemployment rate stable at 3.9%.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Sectors This Week – Source Bloomberg

Stocks This Week – Sources Bloomberg

Broker Moves

- Gold Road Resources Ltd (ASX: GOR) Cut to Neutral at Macquarie Group Ltd (ASX: MQG); PT A$2

- Genesis Minerals Ltd (ASX: GMD) Cut to Neutral at Macquarie; PT A$2

- Alumina Limited (ASX: AWC) Raised to Neutral at Macquarie; PT 80 Australian cents

- Regis Healthcare Ltd (ASX: REG) Raised to Buy at Ord Minnett; PT A$3.50

- Data#3 Limited (ASX: DTL) Rated New Overweight at Wilsons; PT A$9.09

- Aussie Broadband Ltd (ASX: ABB) Rated New Positive at Evans & Partners Pty Ltd

- Deep Yellow Limited (ASX: DYL) Rated New Speculative Buy at Morgans Financial Limited

- Resolute Mining Ltd (ASX: RSG) Rated New Buy at Panmure Gordon

Major Movers Today