Drinks and hotels business Endeavour Group Ltd (ASX: EDV) recently held its Investor Day. The Analyst Team at Stock Doctor has provided an updated review of Endeavour Group, including our thoughts as to why the stock may be an undervalued opportunity for long-term investors.

Endeavor Group share price

Gaming Regulation

Earlier this year, the Victorian Government proposed mandatory closure periods, mandatory pre-commitments, identified play and changes to load limits and spin rates to reduce gaming harm and protect players from gambling irresponsibly.

To date, empirical studies about mandatory enforcement for pre-spend commitments and reducing time of play has provided a wide dispersion in outcomes. While studies overseas have found a 32% reduction in user turnover when harm minimisation initiatives were implemented, Australian states have typically experienced only 5-10% decrease in turnover.

If we take the midpoint of these studies as a baseline for expectations on gambling reduction, the market seems to have overreacted to this proposal as it is pricing in a ~30% reduction in Victorian gaming revenue by FY25.

Slowing Growth in Retail

The bulk of Endeavour’s total sales is driven by their retail drinks business – most notably Dan Murphys and BWS. In EDV’s first quarter update for FY24, quarter-on-quarter sales growth of 1.9% was below expectations of 2.7%.

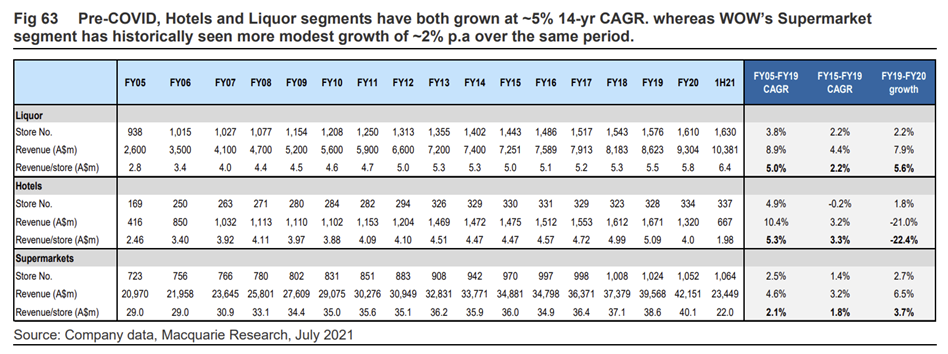

While on face value it appears low and disappointing, let’s also widen the lens and consider that Endeavour Group has grown revenue per store at 2.2% every year from FY15 to FY19 but accelerated markedly to 5.8% over the pandemic period.

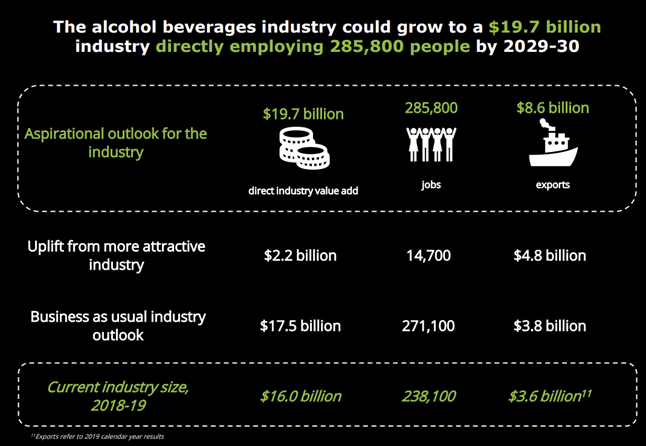

Our view is that the clear deceleration in sales growth is a function of normalizing post pandemic spending habits as opposed to more concerning trends like loss of market share. While people may be spending less at the bottle-o, the industry is still projected to grow considerably over the next decade and history suggests that they will likely be an outperformer given their market leadership and cost differentiation.

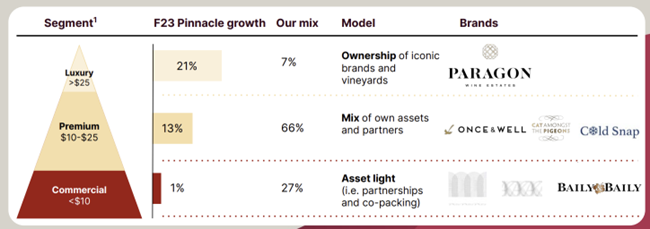

Deloitte’s 2023 Alcohol Beverage Report suggest that domestic spending on alcohol beverage products is expected to grow at an average rate of 2.1% in the next decade, supported by a shift in consumer preferences towards premium quality alcohol over quantity. We note that Endeavour’s focus on Pinnacle Drinks will likely give them more exposure to this, with recent acquisitions such as Paragon Wine Estates focussed on building out a luxury wine portfolio.

Going forth

Endeavour’s investor day presented strong cases for how the company will create shareholder value. They have multiple levers to pull to expand margins (either by increasing penetration of their own brand Pinnacle Drinks or through internal efficiency programs).

Nearer term, Endeavour is seeking to repair investor relations by lowering capital expenditure and reducing balance sheet leverage to ensure that FY24 will be highly cash generative and reflect the innerworkings of a healthy, sustainable business – as reflected by its strong financial health rating. This could be a strong catalyst for the market to rerate the stock higher.

Longer term, Endeavour has lifted medium term growth targets, with a headlining aspirational goal of delivering long-term double digit shareholder value growth per year. This sort of management optimism is the norm and as investors we are cautious that this may not reflect the base case.

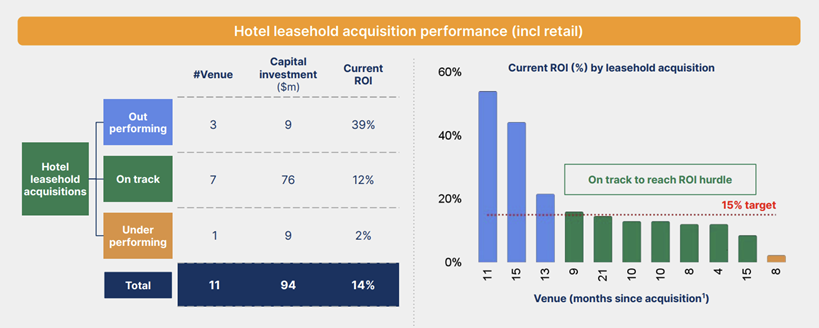

However, we do think that Endeavour has a long pipeline of viable growth opportunities. This includes but is not limited to lifting underperforming venues, improving legacy processes and systems, leveraging group capabilities, and renewing the aging network.

This, in conjunction with management’s defined plan of pursuing projects with return on invested capital of 14+% reflects a sensible approach that concentrates on metrics we think are most important, capital efficiency.

Final thoughts

We remain confident in the long-term competitive advantages of EDV’s retail business, and believe the market may be undervaluing its profitable Pinnacle Drinks segment. Furthermore, there is optionality to monetise the hotel and gaming assets, particularly with positive longer-term tailwinds for Australian tourism (notably the Brisbane 2032 Summer Olympics).

We continue to hold the stock within our Borderline Star Growth and Income universe.