Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.057% to 7,199.00.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

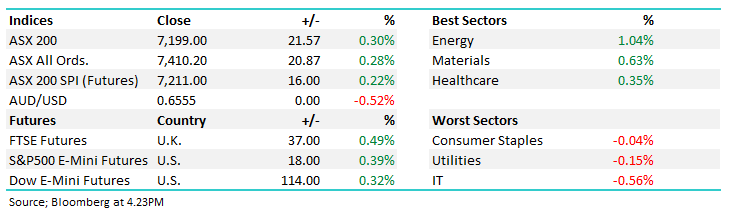

The ASX 200 broke out this morning, up through 7200 to hit a morning peak of 7226, but the gains were forfeited as the session wore on – the market closed flat on the day, coming off the back of a strong week.

Not a lot on the docket to drive stocks, some bits and pieces on the corporate front but a fairly muted session on low volumes.

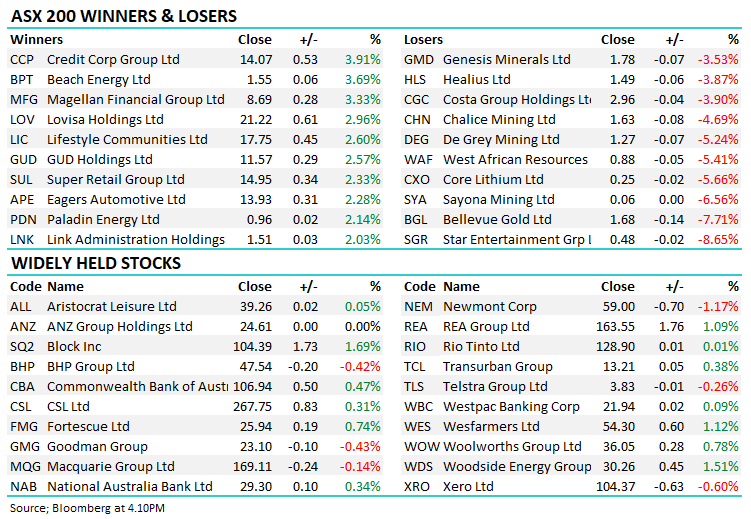

- The ASX 200 finished up +4pts/ +0.06% to 7199.

- The Energy sector (+1.04%) enjoyed a bounce in the oil price, Materials (+0.63%) & Healthcare (0.35%) outperformed.

- IT (-0.56%), Utilities (-0.15%) and Staples (-0.04%) finished lower.

- Pact Group Holdings Ltd (ASX: PGH) +22.63% rallied as Raffy Germinder’s Kin Group upped its buyout bid to 84c from a prior 68c a share offer. The stock closed today smack on the bid price and we suspect this is now a deal that will complete.

- Sigma Healthcare Ltd (ASX: SIG) Halted after agreeing to a “transformational merger” with Chemist Warehouse and capital raise, the deal will create a $8.8bn retail player, likely in the ASX 200.

- Smartgroup Corporation Ltd (ASX: SIQ) +7.44% after announcing a good contract win for salary packaging services.

- Bubs Australia Ltd (ASX: BUB) flat after saying US revenue will double in FY24 to $48m – early strength was sold into.

- Costa Group Holdings Ltd (ASX: CGC) -3.9% poured cold water on prior guidance, saying they expect unfavourable impacts from adverse weather conditions meaning they’ll miss prior forecasts- all too common.

- Rio Tinto Ltd (ASX: RIO) +0.01% & Fortescue Ltd (ASX: FMG) + 0.74% are a whisker away from all-time highs.

- Magellan Financial Group Ltd (ASX: MFG) +3.33% continues to recover, closed today at $8.69 having hit a $6.02 low on the 25th October. Regal Partners Ltd (ASX: RPL)+5.13% also strong.

- Dexus (ASX: DXS) +0.82% said that chief investment officer Ross Du Vernet will take on the role of CEO, stepping up in March.

- IGO Ltd (ASX: IGO) -1.96% has confirmed the appointment of Ivan Vella as MD, there was some conjecture over this given his clouded exit from RIO.

- Iron ore was down a touch in Asia.

- Asian stocks were mixed, Hong Kong fell 2%, Japan was up +1.5% and China dipped -0.5%.

- US Futures are mixed, Nasdaq the weakest down -0.3% – the rest flat.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Smartgroup (SIQ) $8.95

SIQ +7.44%: the salary packaging & novated leasing company has got one over a rival today, picking up the South Australian Government contract off the incumbent McMillan Shakespeare Ltd (ASX: MMS).

The contract will be handed over on 1 July next year, servicing the state government’s 110k employees where McMillian has 43k active services as disclosed in an announcement by the company today.

The initial 5-year contract is expected to add ~$6.5m to EBITDA ~6% of current 2024 consensus expectations for Smartgroup.

The announcement also came with a trading update for 2023 where the company expects revenue of ~$249m and Net Profit of ~$63m, a small beat to the $61.5m previously expected on the back of strong novated leasing volumes.

Smartgroup (SIQ)

Broker Moves

- Nido Education Ltd (ASX: NDO) Rated New Buy at Canaccord Genuity Group Inc (TSE: CF); PT A$1.30

- Pilbara Minerals Ltd (ASX: PLS) Cut to Neutral at Citigroup Inc (NYSE: C); PT A$3.90

- Orora Ltd (ASX: ORA) Reinstated Buy at CLSA; PT A$3.40

- Evolution Mining Ltd (ASX: EVN) Raised to Buy at CLSA; PT A$4.35

Major Movers Today