Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.31% to 7,257.80.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

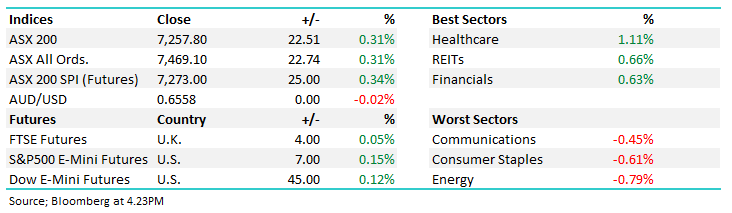

The ASX200 added to December’s gains today, taking it up more than 2.4% for the month, and we still have more than half of the month left. As we’ve said a few times of late, as we head into the seasonally strong fortnight for stocks, the index is looking good for at least a retest of the 7400-7450 area, now only two good sessions away.

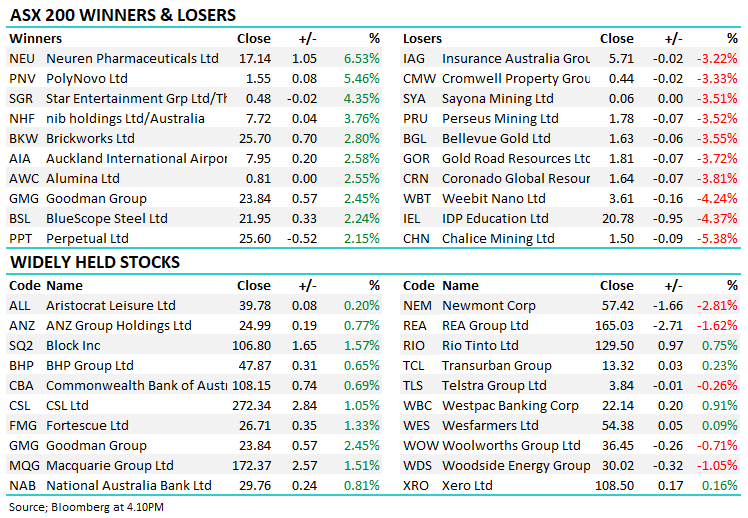

- The ASX 200 finished up +22pts/ +0.31% to 7257.

- The Healthcare sector (+1.11%) rallied, while Property (+0.66%) & Financials (0.63%) outperformed.

- Energy (-0.79%), Staples (-0.61%) and Communications (-0.45%) finished lower.

- Iron Ore was getting the most airtime today as Fortescue Ltd (ASX: FMG) +1.33% hit an all-time high of $27.08 while Rio Tinto Ltd (ASX: RIO) +0.75% hit its highest level in a few years, Iron Ore prices holding ~US$135/mt has caught many by surprise, including the Government, with higher prices underpinning a better budget outcome.

- Sigma Healthcare Ltd (ASX: SIG) +36.39% had a wild session trading in a 35% range after it came out of a halt following its Chemist Warehouse deal and capital raise. Opening $1.31, hitting a $1.35 high before closing $1.04.

- If the deal is approved, this will become a ~$9bn company, bigger than Seek Ltd (ASX: SEK), Treasury Wine Estates Ltd (ASX: TWE) & Ampol Ltd (ASX: ALD), and nearly as big as Qantas Airways Limited (ASX: QAN) making this a meaningful deal on many levels, not least from an index perspective.

- Perpetual Ltd (ASX: PPT) +2.15% rallied after Washington H Sl Pttnsn nd Cmpny Ltd (ASX: SOL) -2.05% increased their stake to 11.6%, although more like 15% with derivatives exposure –more to play out with this tussle.

- Goodman Group (ASX: GMG) +2.45% hit a new 52-week high, one we are backing into 2024 enjoying a combination of better property markets and a big push into Data Centres.

- Energy stocks continued to struggle, Woodside Energy Group Ltd (ASX: WDS) -1.05% is back testing $30 as crude oil corrected almost 15% from its September high put in when the Israel-Hamas War sparked fears of contagion in the Middle East. We think the path of least resistance remains down for Oil.

- Air New Zealand Limited (ASX: AIZ) -2.46% was hit after downgrading FY24 guidance to the low end of the prior range on weaker-than-expected demand. Travel starting to show signs of softening.

- Wednesday morning is our weekly portfolio positioning report for Market Matters, today we covered NAB for the Active Growth Portfolio, we looked at adding to our current holding in AGL Energy for the Income Portfolio, Silex Systems Ltd (ASX: SLX) got a run for the Emerging Companies Portfolio while we discussed our rationale for owning undervalued LIC, Pershing Square Holdings Ltd (OTCMKTS: PSHZF).

- CY23 to date, the Active Growth Portfolio has increased by 16.29%, strongly outperforming its benchmark return (ASX 200 Accumulation Index 7.01%)

- The Active Income Portfolio is up 7.45%, outperforming it’s benchmark.

- The Emerging Companies Portfolio has underwhelmed, although it’s still up 4.63% which is ahead of the S&P/ASX Small Ordinaries [XSO] (INDEXASX: XSO) Accum Index.

- International Equities have outperformed our own, underpinning a 22.78% return for the International Equities Portfolio so far this year, with hopefully a bit more upside before the year is out.

- Iron ore was down 1% in Asia.

- Asian stocks were mixed, Hong Kong fell -0.74%, Japan was up +0.43% while China dipped -0.5%.

- US Futures are higher, all up ~0.15%

- The US Fed is likely to keep interest rates unchanged tonight, although the economic projections and the press conference post the decision will be key for markets.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

ASX:GNP

ASX:GNP

Broker Moves

- Pilbara Minerals Ltd (ASX: PLS) Rated New Hold at Bell Potter; PT A$3.90

- Regal Partners Ltd (ASX: RPL) Rated New Buy at Unified Capital; PT A$4.56

- GUD Holdings Limited (ASX: GUD) Rated New Add at Morgans Financial Limited

- GenusPlus Group Ltd Fully Paid Ord. Shrs (ASX: GNP) Rated New Buy at Moelis & Company; PT A$1.56

- Sims Ltd (ASX: SGM) Raised to Outperform at Macquarie Group Ltd (ASX: MQG); PT A$17.30

- BlueScope Steel Limited (ASX: BSL) Raised to Outperform at Macquarie; PT A$24

- Southern Cross Gold Ltd (ASX: SXG) Rated New Buy at Eight Capital Partners PLC (FRA: ECS); PT A$1.60

Major Movers Today