Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.84% to 7,489.10.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

The bullish sentiment returned to the market today, storming higher to levels not seen for 10 months.

All sectors took part in the rally with the laggard, Staples, still up by more than 0.5%, though Utilities, Tech and Consumer Discretionary were the key winners.

Energy was also a standout following attacks in the Red Sea overnight, disturbing supply routes.

- The ASX 200 finished up +62pts/+0.84% at 7489.

- The Utilities sector (+1.82%) was best on ground, followed by Tech (+1.13%) and Consumer Discretionary (+1.13%).

- The worst sector was Staples (+0.53%)

- The RBA released the Minutes from their December meeting, the comments were mostly hawkish with some discussion around a hike at the meeting a fortnight ago. Bond yields and the AUD rose on the back of the news, but equities largely brushed the update.

- G8 Education Ltd (ASX: GEM) +13.57% surged on strong guidance thanks to improved costs in the 2H. More on that below

- Origin Energy Ltd (ASX: ORG) +3.24% edged higher after increasing their stake in UK energy retailer Octopus. They will pay $530m, taking their share to 23% following the company’s latest round of fundraising.

- Azure Minerals Ltd (ASX: AZS) +1.65% directs have unanimously recommended a $3.52/sh cash bid from Chile’s SQM and Australia’s Gina Rinehart. Gina has taken a significant interest in the junior lithium space, potentially the start of several deals to play out here.

- AGL Energy Limited (ASX: AGL) +0.55% signed off on a 500MW battery in the Hunter as part of their

- Iron Ore was flat in Asia but the big miners were strong, Fortescue Ltd (ASX: FMG) closing above $28 for the first time.

- Gold was marginally weaker, though gold equities largely took part in the rally.

- Asian stocks were soft as well, Nikkei -0.7% and Hang Seng -0.88%

- US Futures are all largely unchanged

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

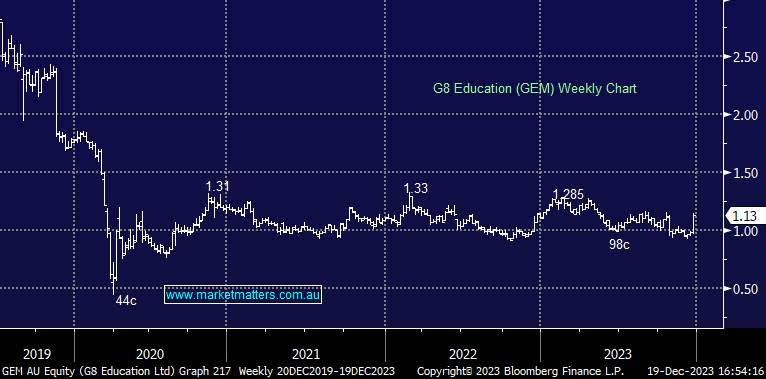

G8 Education (GEM) $1.13

GEM +13.57%: two month highs for the childcare centre operator today, G8 Education provided 2023 guidance that was better than expected.

They now see Operating EBIT at $99-102m and NPAT at 62-64m, coming in ~5% ahead of consensus on both fronts.

Occupancy had improved marginally since the company’s October Investor Day, however, it appears cost control was the main driver for the improved performance which includes divesting or cutting a number of underperforming sites.

The guidance shows a marked improvement from the first half where G8 posted operating NPAT of just $19.6m.

G8 Education (GEM)

Broker Moves

- Rural Funds Group (ASX: RFF) Reinstated Buy at Moelis & Company; PT A$2.40

- Pilbara Minerals Ltd (ASX: PLS) Cut to Sell at Citigroup Inc (NYSE: C); PT A$3.90

- IPH Ltd (ASX: IPH) Raised to Buy at CLSA; PT A$9.05

- Carnarvon Energy Ltd (ASX: CVN) Raised to Outperform at Macquarie Group Ltd (ASX: MQG)

- Neuren Pharmaceuticals Ltd (ASX: NEU) Raised to Buy at Bell Potter; PT A$27

- Link Administration Holdings Ltd (ASX: LNK) Cut to Reduce at CLSA; PT A$2.26

- Iress Ltd (ASX: IRE) Rated New Hold at Jefferies; PT A$8.64