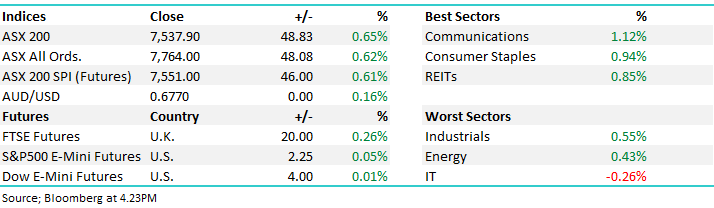

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.65% to 7,537.90.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

The march continues with positive momentum remaining in the latest broad-based rally today.

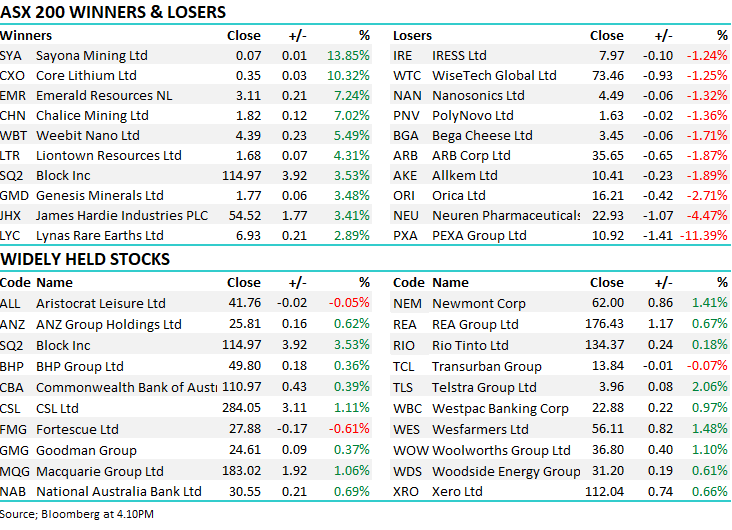

10 of the 11 sectors closed higher, Tech being the one in the red today thanks to weakness in some of the larger constituents.

As was the case yesterday, the ASX200 hit levels not seen since February this year, trading through 7550 late in the day before cooling off on the close.

- The ASX 200 finished up +48pts/+0.65% at 7537.

- The Telcos sector (+1.12%) was best on ground, followed by Staples (+0.94%) and Real Estate (+0.85%).

- The worst sector was Tech (-0.26%)

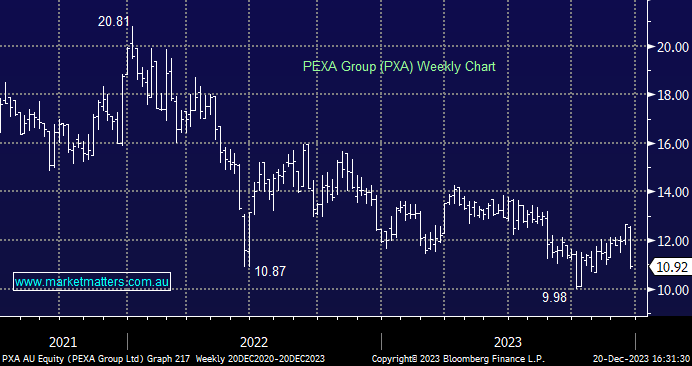

- PEXA Group Ltd (ASX: PXA) -11.79% struggled on their latest trading update ahead of completing the acquisition of Smoove. More on that below.

- KMD Brands Ltd (ASX: KMD) -7.95% fell to 3-year lows on a soft trading update. Group sales were down -12.5% in the year to the end of November. Group EBITDA was running $10m below the same period last year as they cycle record sales for a number of their brands.

- Pointsbet Holdings Ltd (ASX: PBH) -1.1% will lose their CFO in a brief announcement today. An internal promotion to fill the role.

- Orica Ltd (ASX: ORI) -2.53% a negative reversal from early strength, Orica announced of Terra Insights, a Canadian sensors business. The $CA505m, funded from cash and existing debt, is expected to be accretive from FY25, priced at 15.3x EBITDA.

- Iron Ore was flat in Asia, BHP Group Ltd (ASX: BHP) moved within a whisker of $50/sh but Fortescue Ltd (ASX: FMG) gave back some strength, down -0.75%.

- Gold was flat but Evolution Mining Ltd (ASX: EVN), Northern Star Resources Ltd (ASX: NST) and Silver Lake Resources Ltd (ASX: SLR), the three positions across our portfolios were all up more than 1.5%.

- Asian stocks were mixed with the Nikkei leading the way, up +1.52%, the Hang Seng adding +0.88% but China lagging, the Shanghai index down -0.73%.

- US Futures are marginally higher

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

PEXA Group (PXA) $10.92

PXA -11.79%: provided updated guidance ahead of their acquisition of Smoove acquisition in the UK which will complete tonight. Cost control has been solid, helping the company stick to EBITDA margin guidance of 35%, however, revenues have lagged expectations across the three business streams.

Refinance activity dropped from 28% in Q1 to 22% in the first 2 months of Q2, overall transaction growth has been modest and market share lost in international has not been recovered which is expected to cause a 10-14% drop in revenue in the first half vs 2H23.

Overall, the company expects Group EBITDA to be $54-58m in the first half, and $109-115m in the FY before taking into account the expected $4-6m drag from the acquisition.

PEXA Group (PXA)

Broker Moves

- Sigma Healthcare Ltd (ASX: SIG) Cut to Underperform at Macquarie Group Ltd (ASX: MQG)

- Iluka Resources Limited (ASX: ILU) Cut to Neutral at Citigroup Inc (NYSE: C); PT A$7.50

Major Movers Today