Unless that is, you have been invested in the US Magnificent Seven.

It has been a year of extraordinary moves in things we never saw coming. Bitcoin is the best performing ‘asset’ – and I use that term loosely.

US Bond markets have staged an extraordinary rally in the last month or so, as yields spiked and then collapsed.

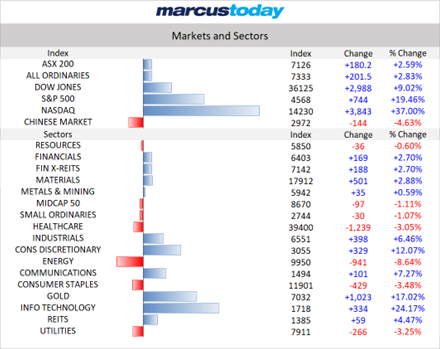

Iron ore has defied gravity and hit $200 in AUD terms, almost back to the halcyon days during CV-19, or the big gains we saw before the GFC – and all this without the bazooka stimulus we have come to expect from the Chinese. In fact, Chinese property seems to have gotten worse over the year.

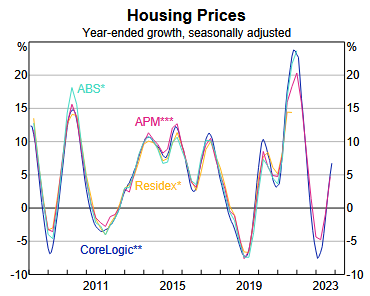

Here, the retailers have had a great year despite all the rate rises. Where was that mortgage cliff that traumatised markets? It’s coming apparently. Many have suffered, but we now have a pause in the inflation offensive.

Rates are normalising. The last decade was abnormal!

What happened to house prices? They just kept going higher

Trophy homes changed hands at record prices. Young people have given up on the Great Australian Dream. The Bank of Mum and Dad took a pounding this year – if you could find them on their holiday in Europe that is.

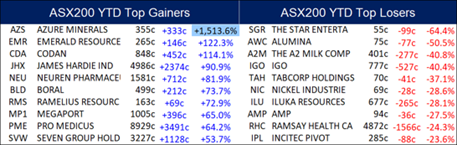

This time last year, lithium was riding high at extraordinary levels, and now we have gone from rooster to feather duster. Much like another white powder craze in milk powder! White line fever. Remember that? A2 Milk Company Ltd (ASX: A2M) hit 20 bucks – madness. Plenty of that around. Gone now though.

Some brokers were sounding the warning bell on lithium prices and were ‘pooh-poohed’ for their view. As General Melchett once said in Blackadder, you should never pooh-pooh a pooh-pooh. Wise words darling, eh?

At one stage this year, we had billionaires fighting to keep lithium assets Australian-owned. Hats off to you Gina. You succeeded. Unfortunately, it was at a cost. Quite a big cost. For everyone. In hindsight, it looks like two bald men fighting over a comb.

Origin Energy Ltd (ASX: ORG) saw off the ‘Brookfield Mounties’ after a rear-guard defence from Australian Super, though several other icons fell – Newcrest is no longer and OZ Minerals Ltd (ASX: OZL) fell to BHP Group Ltd (ASX: BHP). Is the ASX shrinking to greatness?

Then there are the gold miners. Who would have ‘thunk’ that gold would hit an all-time high whilst rates were going higher? Gold pays no dividends and actually costs money to store. It has always puzzled me why we spend so much time and money digging it up, making it into a nice bar shape, and then burying it again in an underground vault. The sector is up 17%. Still, many things in life puzzle me. I struggled with The Book of Mormon! Was that just me?

This year we had the rise of AI and the machine. I thought NVIDIA Corp (NASDAQ: NVDA) was a skin care product until this year! Even AI didn’t see that one coming. We also had a year where GLP-1 drugs offered a ‘miracle cure’ for obesity, and killed CSL Limited (ASX: CSL) and Resmed CDI (ASX: RMD) in the process. More iconic falls.

The consensus last year was that the US economy would experience a recession. The question was whether we were going to get a soft landing or a hard landing. Well, no recession. The experts got that wrong too. In fact, there is not much the experts got right. Oil was supposed to hit $100 due to Ukraine, and then Gaza. Nope. Oil is struggling, even if the Saudis are cutting production.

What to expect in 2024

Firstly, experts have no monopoly on making daft predictions. Just because they are on TV or interviewed in the media, I think 2023 shows how wrong they can be. There is one certainty in 2024 that even the experts will get right. The US Presidential Election. Everything to play for, and everything to lose. Are we really headed back to the chaos of the Trump era? It seems a distinct possibility. We are not talking about it yet – but we will. The US Election cycle kicks off early in 2024.

The experts are still forecasting a recession and a landing of some sorts in 2024. Hard or soft. Similar arguments triggered a war in Lilliput. Which end of the egg to crack? The markets are now pricing in quite savage rate cuts in the US in 2024. The reason is the US economy is crashing. Is it? I am not sure the Fed will be that aggressive. The economy is slowing, but crashing in an election year seems unlikely. Powell will want to keep his job and the Fed independent. Trump is an agent of change.

There are two themes that I think will manifest in 2024

Both out of favour. Both troubled, and both seeing serious negativity. The first one is lithium. At some stage, and we are not there yet, the price will have fallen so much that all that supply coming on stream will struggle to get funding. Plenty of it will be uneconomic. All those gold miners who switched to lithium may have to switch back to gold! Remember the dot-com boom? The miners became web-masters and then had to switch back! When was the last time that we saw a high-profile off-take agreement? Yep, I can’t remember one.

My ‘go-to’ would be Pilbara Minerals Ltd (ASX: PLS). It still has 20% shorted. A market cap of around $10bn with a cash stash and no problems with the US, as far as Chinese ownership is concerned. Remember when Liontown Resources Ltd (ASX: LTR) was valued at nearly $7bn for a project still under construction? We are not at peak bearishness in the sector as yet, but at some stage in 2024, there will be a huge bounce.

The other one which has been taken out the back is the oil and gas sector. BHP is looking pretty smart with its jettison of the oil and gas assets to Woodside Energy Group Ltd (ASX: WDS). If you had said there would be a war in the Middle East and interest rates would be at 4.35%, there would not be many experts who would have predicted consumer discretionary stocks would be out partying, and oil and gas stocks suffering from a serious hangover.

Yet here we are. I think the sell-down in oil has been overdone. WDS is the premier way to go with this, and I still like Karoon Energy Ltd (ASX: KAR), which has de-risked from a one-trick pony with the recent Gulf of Mexico acquisition. Both a big and a smaller one are buys for a better 2024.

Finally, I was asked to pick a stock for an Advent Calendar segment recently. I had two that I liked: Treasury Wine Estates Ltd (ASX: TWE) for a reopening of China year, and Zip Co Ltd (ASX: ZIP). I know. Crazy, but the US consumer is still spending, just finding different ways to pay. I think we are all guilty of that. Regulation is coming here, and that will provide some certainty. The key is the US, the growth of BNPL, and the pesky ZIP balance sheet. Could 2024 be the year we are talking BNPL again? Maybe, but then again, I have been wrong many times before. Why should this year be any different?

The good news is that next year, ChatGPT will be writing a similar article, and I will be redundant. You can blame it then.