Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.033% to 7,501.60.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

A quiet session as expected today, most of the country preparing for Christmas rather than concentrating on markets, the ASX trading is a tight ~20pt trading range ahead of the 4-day break. This will be the final note for 2023, with normal programming recommencing on Monday the 15th January.

Welcome to all the new members of Market Matters who have joined leading up to Christmas, great to have you on board, and for those existing members that continue to support and trust Market Matters for our insight, a huge thankyou from the entire team, we wish you a safe and wonderful holiday period.

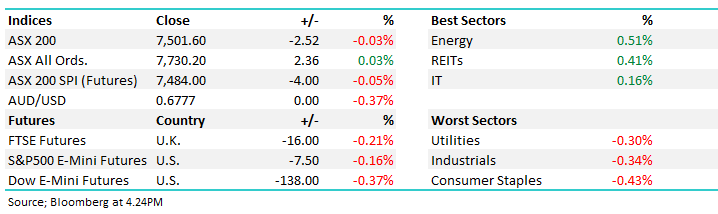

- The ASX 200 finished down -2pts/-0.03% at 7501.

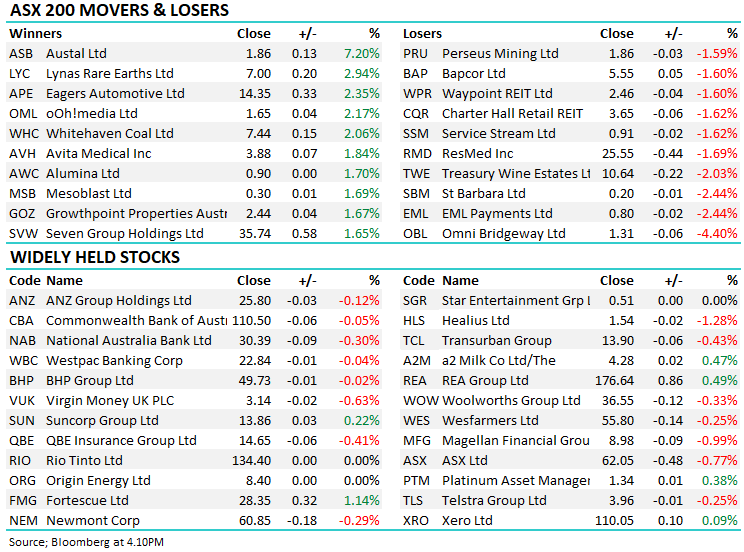

- The Energy sector was best on ground (+0.51%), joined in the black by Real Estate (+0.41%), Tech (+0.16%) & Materials (+0.15%).

- Staples (-0.43%) was the weakest sector, followed by Industrials (-0.34%) & Utilities (-0.30%).

- Boss Energy Ltd (ASX: BOE) +6.62% rallied after securing a US Uranium sales contract.

- Lynas Rare Earths Ltd (ASX: LYC) +2.94% and other rare earths stocks rallied on news China was banning some Rare-Earth Tech Exports.

- Core Lithium Ltd (ASX: CXO) -21.21% slumped on an operational review including pausing operations at their NT BP33 lithium site. This comes after lithium prices have slumped 80% this year.

- Austal Ltd (ASX: ASB) +7.20% announced two deals with the Australian Government and US Navy totalling over $1.3b

- Iron Ore was strong today, up ~3% in Asia.

- Gold was also strong in Asia, up ~$US17 to be trading $US2048 at our close.

- Asian stocks were mixed, Hong Kong down -1%, Japan flat while China was up 0.30%

- US Futures are down around -0.20%.

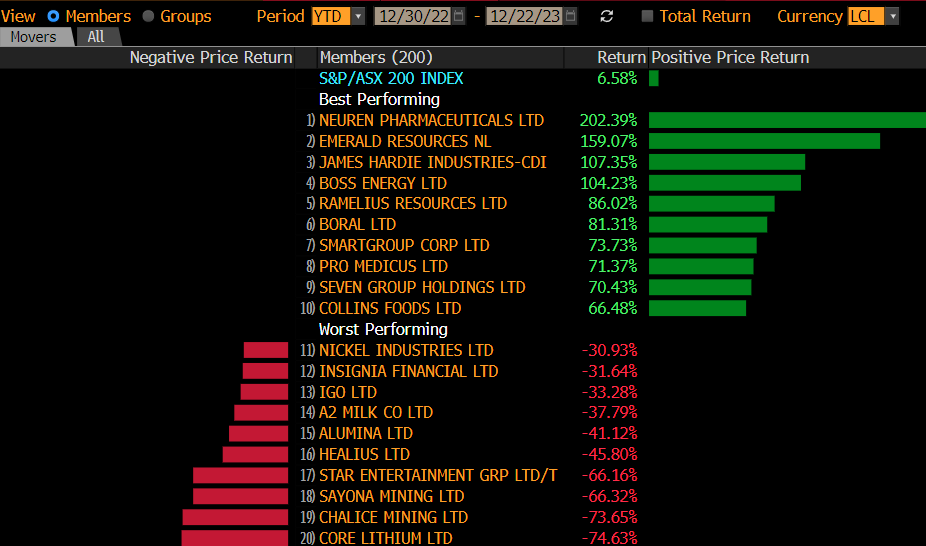

- We’re coming off the back of a strong period in markets, with our portfolios by in large doing well during the year:

- Active Growth Portfolio: +20.87%

- Active Income Portfolio: +8.79%

- Emerging Companies Portfolio: +7.71%

- International Equities Portfolio: +26.85%

*Performance from 1 Jan 23 to 22nd Dec 23

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Sectors CY to date – Source Bloomberg

Stocks CY to date – Source Bloomberg

Broker Moves

- Stanmore Resources Ltd (ASX: SMR) Rated New Overweight at Barrenjoey

Major Movers Today