What does the Australian ETF market look like in numbers?

Global X, Senior Product and Investment Strategist David Tuckwell shares the numbers behind ETF growth and development in Australia this year in a conversation with Owen Rask.

Some of the topics Owen & David cover:

Are you surprised by how big the ETF market has become? Hundreds of thousands of investors use ETFs to create wealth.

A lot of stories our parents or grandparents tell us are along the lines of ‘I remember buying CBA and CSL shares at $5’… Is it possible to compound. Do you think investors will talk about ETFs the same way in decades to come?

David, what’s done better over 10 years – Sydney property prices or shares?

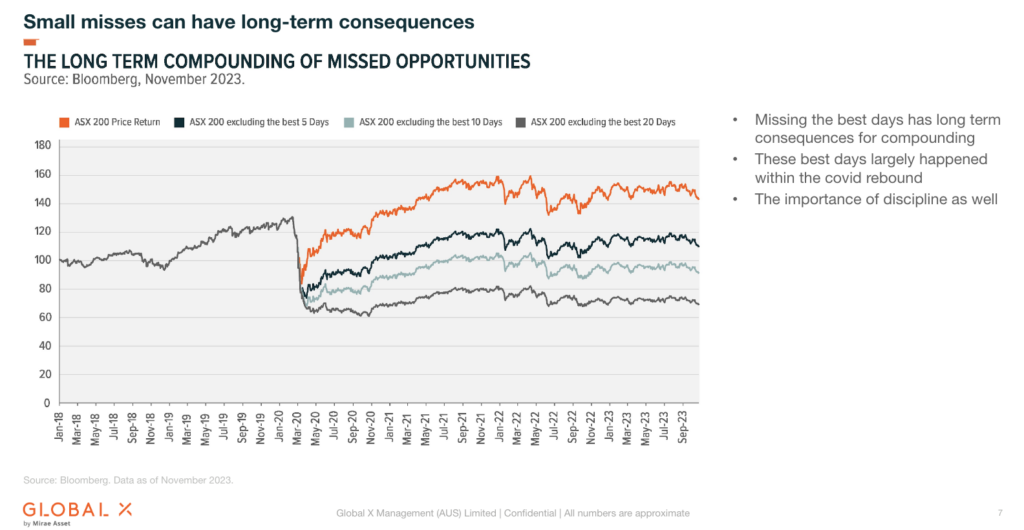

In a recent presentation you shared a few really interesting charts with a community that I want to reference. In one chart, you showed the impact of missing the best days in the market.

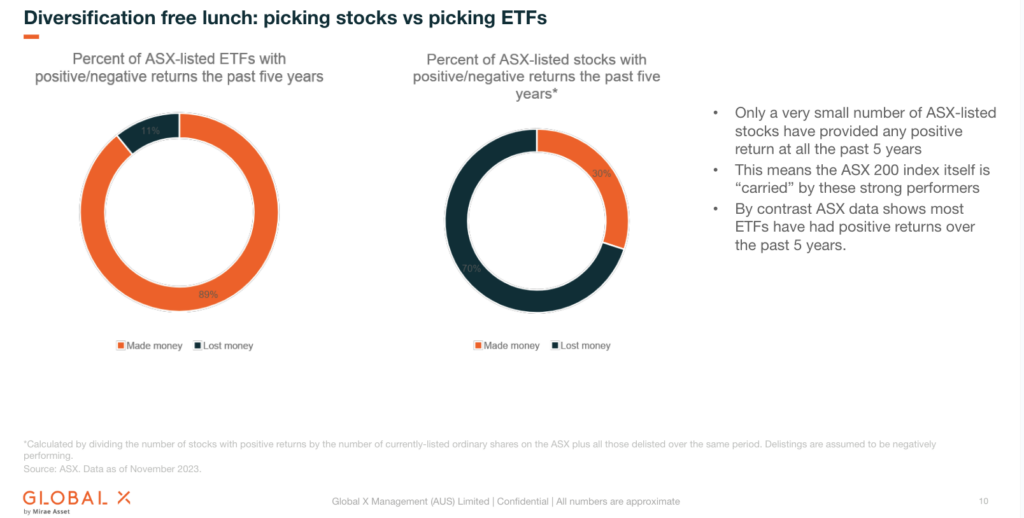

In another chart you did an Australian version of a very popular global study – the winners and losers in the stock market. We know the stock market tends to go up over time, not every year, and not even every few years. But over decades. However, from your study I saw you put ETFs side-by-side with stocks, showing how many made or lost money. What did you find and what does it tell us?

Across our podcasts we often talk about the virtues of using index funds and low-cost ETFs, compared to active fund managers who are paid to identify the ‘top stocks’. While it’s not always as clear cut across ever part of the market, what does the data reveal to us about where we should be going low-cost versus paying a professional?

Finally, I’d like to conclude with the essentials when building a portfolio of ETFs. A lot of data is showing us more investors are opting for low cost shares ETFs, quantitative strategies and bonds inside ETFs. Can you talk to us about the types of ETFs which could be considered Core and which might be considered satellite and why?