Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.027% to 7,496.30.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

Nice to get back to the desk after a break and re-engage with Market Matters members as we kick off what should be another exciting one, full of opportunities.

As we suggested this morning, we will endeavour to steer you all in the right direction throughout the year!

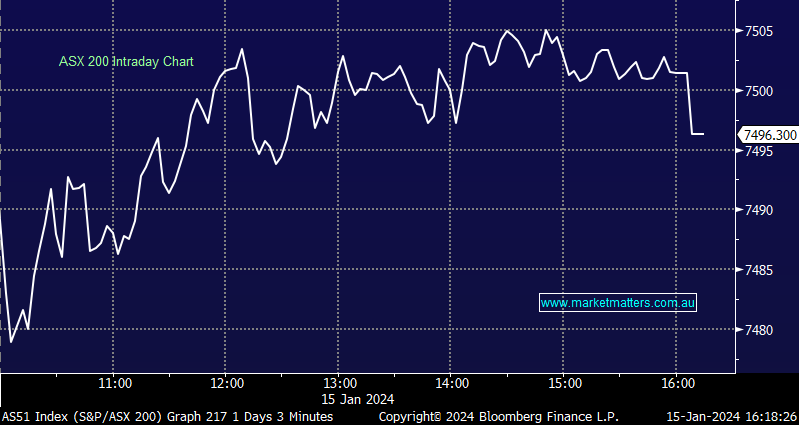

Today was a flat session at the index level, however, there were a few fire-works under the hood, the most obvious in the Uranium space after the world’s largest producer cut production forecasts highlighting just how tight the market currently is, while Consumer Discretionary stocks continue to surprise on the upside with recent (strong) trading from JB Hi-Fi Limited (ASX: JBH) and Super Retail Group Ltd (ASX: SUL).

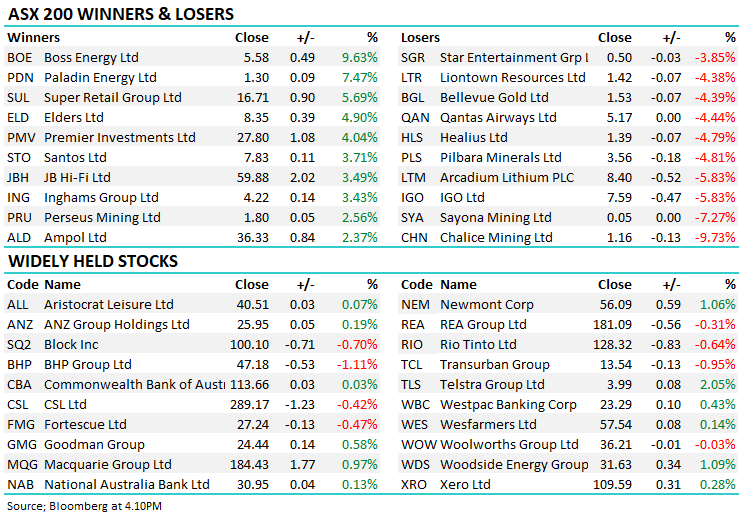

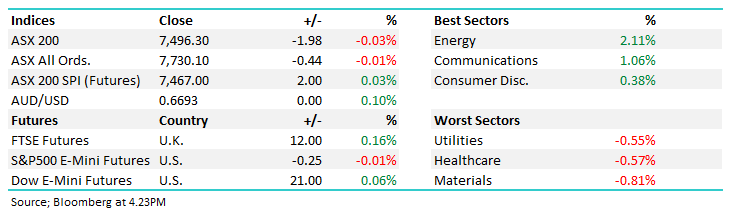

- The ASX 200 finished down -1pt/ -0.03% to 7496

- The Energy sector (+2.11%) was the place to be, while Communications (+1.06%) & Consumer Discretionary (0.38%) outperformed.

- Materials (-0.81%), Healthcare (-0.57%) and Utilities (-0.55%) finished lower.

- Uranium stocks lit up following production cuts by the world’s largest producer, Boss Energy Ltd (ASX: BOE) +9.63%, Paladin Energy Ltd (ASX: PDN) +7.47% while Peninsula Energy Ltd (ASX: PEN) +23.81% was the standout in the smaller space.

- We used strength to realise a very good profit in Paladin (PDN) today ~$1.30 across two portfolios, while we’re also intending to sell Cameco Corp (NYSE: CCJ) in the US following the public holiday tonight.

- Santos Ltd (ASX: STO) +3.71% rallied on a favourable Federal Court ruling.

- JB Hi Fi (JBH) +3.49% continued to rally after a very bullish note from Macquarie last week which was followed up by Citigroup Inc (NYSE: C) today – both brokers flagging strong sales momentum in Christmas.

- Super Retail (SUL) +5.69% was out with a positive trading update today while Citi also upgraded them to buy – the stock hitting an all-time high, clearly, investor concerns around consumer spending are yet to materialise!

- Taking a step back, 2023 was a good year for markets with the ASX 200 Accumulation Index up +12.42%, although when compared to US stocks, S&P 500 (INDEXSP: .INX) +26%, it was a more benign outcome.

- Ultimately, it was a year of surprises for the markets as the expectations for a recession never materialised, inflation fell faster than forecasts, corporate earnings proved resilient and central banks surprised markets by pivoting to a more dovish future policy.

- That environment was a good one for the Market Matters approach with solid portfolio performance across the suite of Market Matters (published) Portfolios in 2023, importantly, all portfolios outperformed their respective benchmarks.

- The Active Growth Portfolio advanced 22.43%, 10.01% ahead of its benchmark (ASX 200 Accumulation Index).

- The Active Income Portfolio advanced 9.43%, 1.56% ahead of its benchmark (RBA Cash +4%).

- The International Equities Portfolio advanced 26.60%, 3.57% ahead of its benchmark (MSCI World AUD).

- The Emerging Companies Portfolio advanced 9.37%, 1.55% ahead of its benchmark (Small Ordinaries Accumulation Index).

- The three domestic portfolios are open for investment via Market Matters Invest, noting that performance will be aligned with the above-mentioned returns, however, it is not identical.

- Performance updates for each portfolio were sent today. For those interested, you can sign up for monthly performance updates here.

- Iron ore was down 1% in Asia today, sitting at $US134/mt

- Asian stocks were mixed, Hong Kong fell -0.26%, Japan was up +0.84% while China put on +0.37%.

- US Futures are mostly flat

- No trade in the US tonight, closed for Martin Luther King Jnr Day.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Super Retail Group (SUL) $

SUL +%: retailers continue to defy pressure in the consumer space to post largely positive updates, today’s solid trading update came from Supercheap Auto owner Super Retail Group (SUL).

Super Retail expects 1H revenue of around $2b, in line with expectations. On a like-for-like basis, sales were up 1% in the first 26 weeks, led by Supercheap Auto (+3%) and BCF (+2%) while Macpac (flat) and rebel (-3%) lagged.

Earnings are expected to come in ~10% ahead of consensus though with the company looking for Profit Before Tax (PBT) of $200-203m at their half-year results to be presented on February 22nd.

The beat comes despite higher Cost of Doing Business (CODB) as a percentage of sales, under pressure from higher rents, wages and electricity costs.

Rebel has been the laggard for the group, a trend that continued in the half though a new loyalty program is showing early potential after its launch in October.

Super Retail Group (SUL)

Broker Moves

- Vicinity Centres (ASX: VCX) Cut to Underweight at Morgan Stanley (NYSE: MS); PT A$1.95

- Santos Cut to Neutral at Jarden Securities; PT A$7.70

- Woodside Energy Group Ltd (ASX: WDS) Cut to Underweight at Jarden Securities; PT A$29

- Pilbara Minerals Ltd (ASX: PLS) Cut to Sell at Goldman Sachs Group Inc (NYSE: GS); PT A$3.20

- Centuria Capital Group (ASX: CNI) Cut to Neutral at JPMorgan Chase & Co (NYSE: JPM); PT A$1.80

- Charter Hall Long WALE REIT (ASX: CLW) Cut to Underweight at JPMorgan; PT A$3.70

- Region Re Ltd (ASX: RGN) Cut to Underweight at JPMorgan; PT A$2.30

- Stockland Corporation Ltd (ASX: SGP) Cut to Underweight at JPMorgan; PT A$4.50

- Mirvac Group (ASX: MGR) Raised to Neutral at JPMorgan; PT A$2.30

- Vicinity Centres Cut to Neutral at JPMorgan; PT A$2.10

- GPT Group (ASX: GPT) Cut to Neutral at JPMorgan; PT A$4.80

- Goodman Group (ASX: GMG) Cut to Neutral at JPMorgan; PT A$25.50

- Smartgroup Corporation Ltd (ASX: SIQ) Raised to Buy at CLSA; PT A$10.50

- Premier Investments Limited (ASX: PMV) Raised to Buy at Citi; PT A$30.20

- JB Hi-Fi Raised to Buy at Citi; PT A$65

- Super Retail Raised to Buy at Citi; PT A$18

Major Movers Today