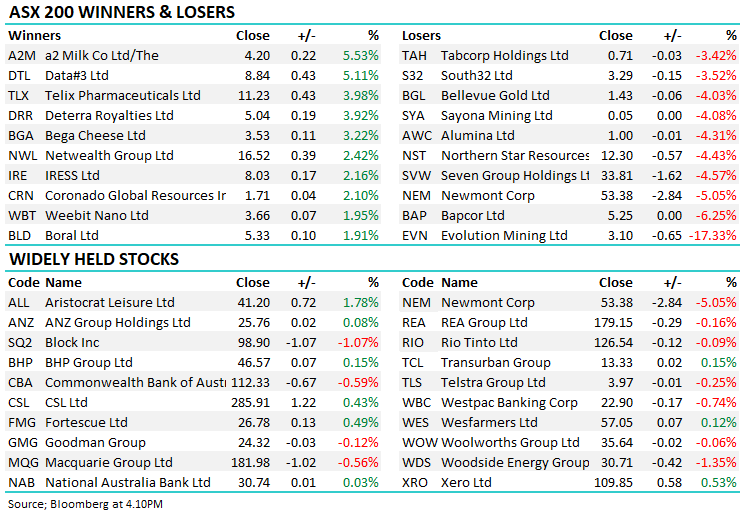

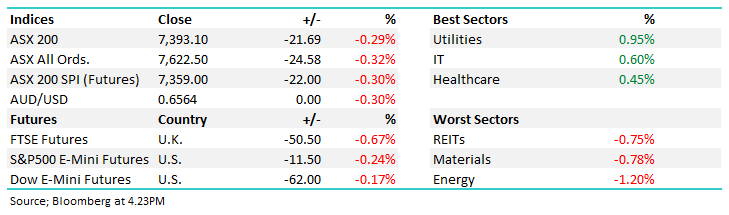

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.29% to 7,393.10.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

Gold stocks copped it on the chin following a pullback in Gold prices overnight and weaker-than-expected production numbers from sector pin-up Evolution Mining Ltd (ASX: EVN) today, continuing a soft period for the resources sector more generally.

The $US rallied overnight on higher bond yields, a Fed Governor suggesting that priced rate cuts in the United States are simply too excessive, a view we concur with.

Upward pressure on the greenback puts downward pressure on commodities, although this is a move we would fade rather than follow.

- The ASX 200 finished down -21pts/ -0.29% to 7393.

- The Utilities sector (+0.95%) enjoyed a bounce while IT (+0.60%) and Healthcare (+0.45%) were solid.

- Energy (-1.20%), Materials (-0.78%) and Property (-0.75%) finished lower.

- Chinese growth data released today was inline with expectations, GDP grew at 5.2% in 2023.

- National Australia Bank Ltd (ASX: NAB) have refreshed its economic assumptions, now expecting the RBA to remain on hold until November, before cutting rates.

- Evolution Mining (EVN) -17.33% was hit hard on a weak quarter of production which pushed costs higher – more on this below as we upped our position around $3 today.

- Barrick Gold Corp (NYSE: GOLD) in the US had a similar sort of quarter, and was knocked ~9% overnight, we also own that in our International Equities Portfolio, so it hasn’t been a good 24-hours for our gold exposure.

- Bapcor Ltd (ASX: BAP) -6.25% announced the departure of their CFO, leaving for a job at another listed company. A search is underway to replace Stefan Camphausen, the market concerned with his resignation ahead of HY results next month.

- Praemium Ltd (ASX: PPS) -5.13% fell after Funds Under Administration (FUA) was up 14% in the quarter to $48.3b, however, this was driven by $819m in positive market moves which offset outflows for the independent investment platform.

- Lottery Corporation Ltd (ASX: TLC) +0.44% said ex-Queensland Investment Corporation (QIC) CEO Doug McTaggart will take on the Chairman role at the lottery company.

- Iluka Resources Limited (ASX: ILU) flat a notable block trade through in the mineral sands company this afternoon, 2m shares changing hands. Shares are ~45% off 2023 highs, perhaps a clearing of the decks here. We this is one for the Hitlist.

- Iron ore was up 0.5% in Asia

- Asian stocks were mostly down, Hong Kong fell -3%, Japan was flat while China dipped -0.9%.

- US Futures are lower, off ~0.3% across the board.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

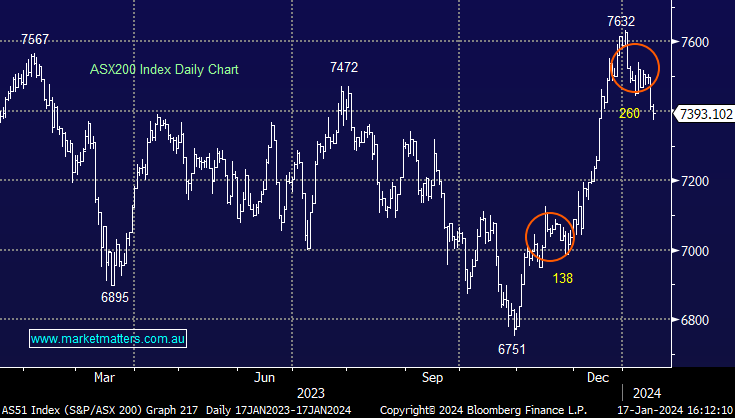

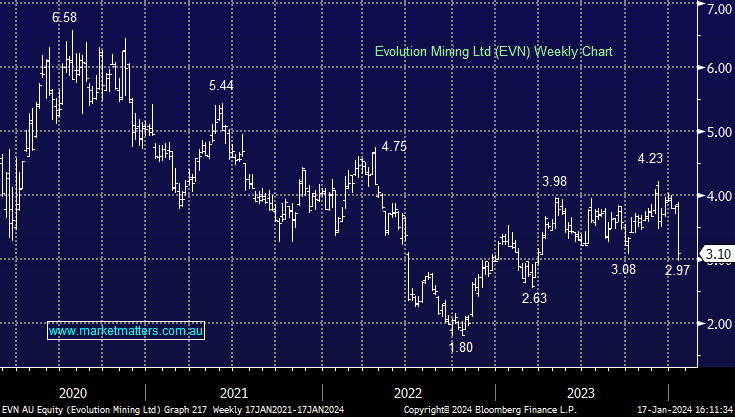

Evolution Mining (EVN) $3.10

EVN –17.33%: Shares of the Gold/Copper miner were knocked today, much like the West Indies batting lineup on a big 2Q production miss.

At a high level, production was 20% light on and costs were 20% too high, and the stock quickly dropped 20% implying some rudimentary analysis from traders, however, the 2H should be better and they maintained their FY24 production and cost guidance, although there is a high degree of scepticism that they’ll achieve it.

They blamed operational issues partly impacted by rainfall and continued issues at one of their mines, Red Lake as the main drivers.

To now meet the extremities of FY24 guidance they need to Increase production by 35% HoH and decrease 2H costs by 22% HoH, but, they do have additional production from Northparkes coming on which should aid in decreasing group costs.

- We think the sell-off today was overdone, remembering that EVN has quality assets, run by a very good team, and we used today’s weakness as an opportunity to increase our weighting in the Active Growth Portfolio from 3% to 5% around $3.00.

Evolution Mining (EVN)

Broker Moves

- Aurizon Holdings Ltd (ASX: AZJ) Cut to Neutral at Macquarie Group Ltd (ASX: MQG); PT A$3.88

- Data#3 Limited (ASX: DTL) Cut to Neutral at JPMorgan Chase & Co (NYSE: JPM); PT A$8.80

- Hub24 Ltd (ASX: HUB) Cut to Neutral at Barrenjoey; PT A$35.40

- NAB AU: NAB Raised to Equal-Weight at Morgan Stanley (NYSE: MS); PT A$30.30

- PSC Insurance Group Ltd (ASX: PSI) Rated New Neutral at Jarden Securities

- Seek Ltd (ASX: SEK) Cut to Neutral at Macquarie; PT A$26

- Westpac Banking Corp (ASX: WBC) Cut to Underweight at Morgan Stanley; PT A$21.70

Major Movers Today