Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -0.63% to 7,346.50.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

The sell-off on the ASX continued today, although the morning session saw the worst of it, with the market down ~70 points just after the open, before buying the dip played out initially, with that trend continuing as employment data came in softer than expected at 11.30 am, good for the prospect of rate cuts and therefore good for stocks, and that saw a choppy session end at the mid-point of the day’s trading range.

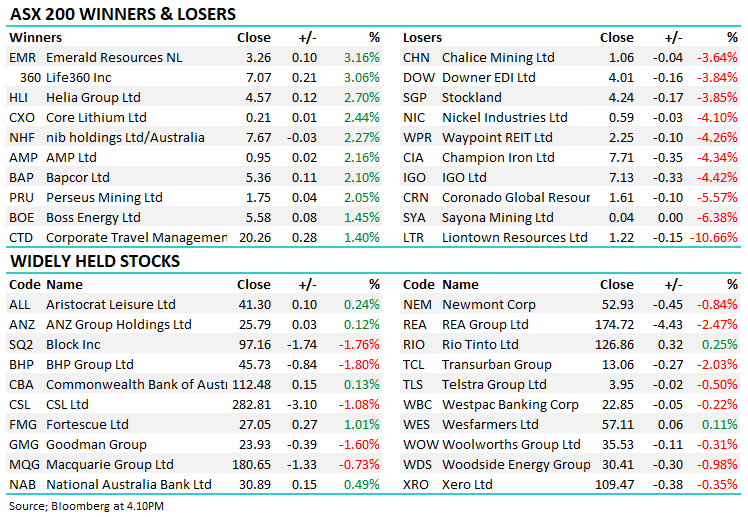

- The ASX 200 finished down -46pts/ -0.63% to 7346.

- The Consumer Discretionary sector (+0.30%) edged higher, while Financials (0.08%) finished in the black – the banks remained supported

- Property (-2.21%), Industrials (-1.09%) and Materials (-1.08%) finished lower.

- The unemployment rate stayed stable at 3.9%, although -65k jobs were lost in Dec (v exp for +15k), offset by a lower participation rate (66.8% v 67.1% exp)

- The AUD initially fell on the numbers but bounced back to settle around US65.5c at our close, although it is down 2% on the week.

- China’s Premier Li Qiang signalled to world leaders at Davos that Beijing would not resort to using big stimulus measures to boost the economy – we continue to think measures will remain targeted in nature

- We made some further tweaks to our Active Growth Portfolio today, stepping up and buying Pilbara Minerals Ltd (ASX: PLS), taking profit on Northern Star Resources Ltd (ASX: NST) after we increased Evolution Mining Ltd (ASX: EVN) into weakness yesterday.

- EML Payments Ltd (ASX: EML) +22.15% rallied after starting wind-up proceedings for a troublesome division – more on that below.

- BHP Group Ltd (ASX: BHP) -1.8% fell after releasing production numbers that were solid in some parts (Iron Ore) and softer than expected in others, net-net, earnings revisions should be on the downside, but only marginally.

- Bapcor Ltd (ASX: BAP) +2.1% bounced after the they shone more light on the CFO departure, moving to a CEO roll.

- Iron ore fell 0.60% in Asia, sitting around $US125/mt

- Asian stocks were mixed, Hong Kong up +0.25%, Japan was flat while China dipped 2%.

- US Futures are lower, off ~0.10% across the board.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

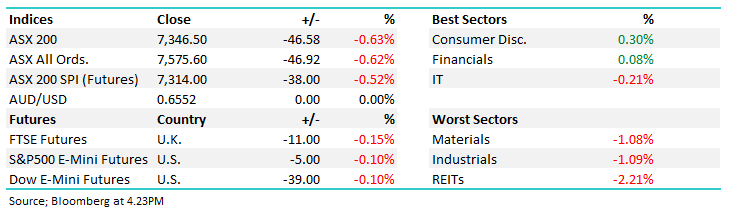

January Update, performance review for the month & CY23, looking ahead & 2 stock ideas

Portfolio Managers James Gerrish and Harry Watt cover the year that was, portfolio performance and how they’re thinking about markets for the year ahead.

Video Update

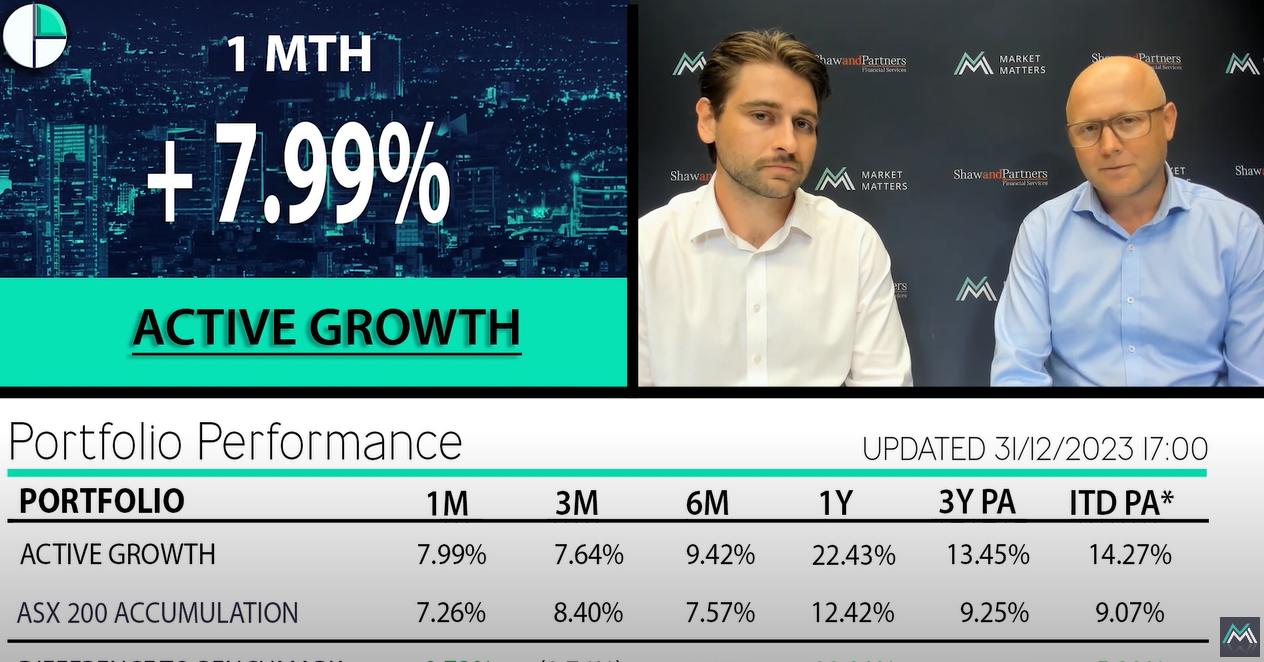

BHP Group (BHP) $45.73

BHP -1.8%: The Big Australian was out with 2Q production numbers today with the high notes coming broadly in line with expectations. Iron ore output was up marginally on 1Q24, but down -2% on pcp.

Copper was the reverse, down -4% on 1Q but up +3% on 2Q23.

Elsewhere, nickel and energy coal production was in line with expectations but met coal struggled which also weighed on costs. Guidance was left unchanged for all except for energy coal which was lowered by ~20%. For the most part there will be few changes to expectations on the back of today ‘s update.

BHP has been weak in recent sessions as steel mills in China seem oversupplied and demand faces some headwinds.

For now, BHP looks well placed though and remains our preferred large resource company pick.

BHP Group (BHP)

EML Payments (EML) $0.91

EML +22.15%: the payments tech company surged higher today after finally drawing a line in the sand with their PCSIL business which has been weighing on performance for some time.

EML has brought in liquidators for the struggling unit, battling with regulators, client remediation and an outflow of expertise over the last few years.

EML paid $423m for the PCSIL brand back in 2019 but lately has been grappling with numerous issues, bringing in liquidators to salvage the business which is costing ~$20m a year to run.

By turning the page on a disappointing part of the business, EML can get back to focusing on what it does well and return to growing the business.

EML Payments (EML)

Broker Moves

- Mineral Resources Ltd (ASX: MIN) Cut to Market Perform at China International Capital Corp Ltd (SHA: 601995); PT A$59.20

- Evolution Cut to Accumulate at CLSA; PT A$3.50

- APM Human Services International Ltd (ASX: APM) Cut to Hold at Jefferies; PT A$1.32

- Car Group Ltd (ASX: CAR) Cut to Underweight at Jarden Securities; PT A$27.50

- Rea Group Ltd (ASX: REA) Cut to Underweight at Jarden Securities; PT A$155

- Domain Holdings Australia Ltd (ASX: DHG) Raised to Overweight at Jarden Securities

- Elders Ltd (ASX: ELD) Rated New Hold at Jefferies; PT A$7.70

Major Movers Today