Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +1.02% to 7,421.20.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

Local equities snapped a 5-session losing streak today, rounding out a soft few days to bounce into the weekend.

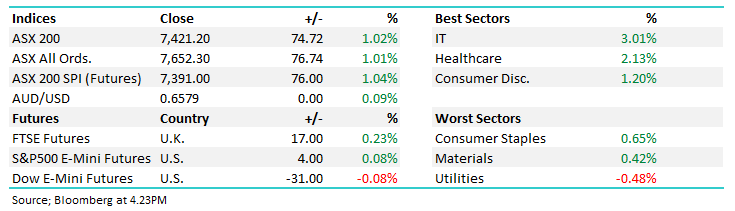

Supported by strength overnight, the ASX200 hit a high of 7446 early, up +100pts on the session but the move tempered into the afternoon.

Still, the 74pt gain today was the best session for the index in more than a month, led by Tech and Healthcare. Utilities were the only sector to finish the session lower.

The ASX200 fell -1% this week, a soft Materials sector being the main drag.

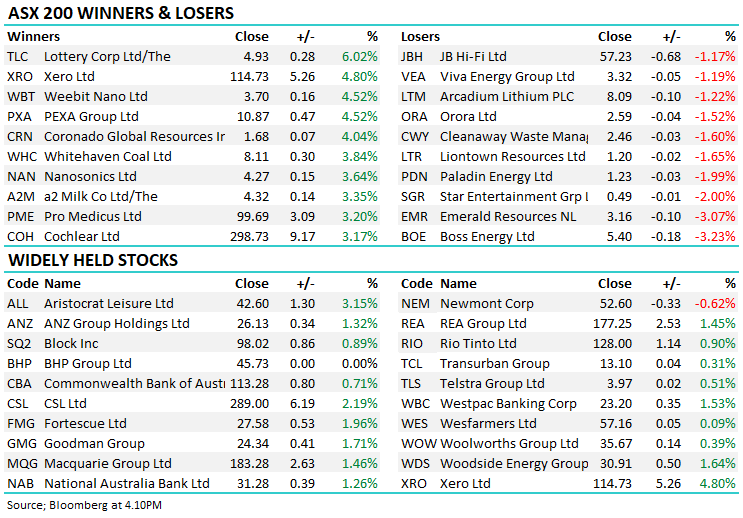

- The ASX 200 finished up +74pts/+1.02% at 7421.

- The Tech sector (+3.01%) surged today as bond yields eased. Healthcare (2.13%), Discretionary (+1.20%), Energy (+1.18%) and Financials (+1.09%) were the other notable gainers

- Utilities (-0.48%) was the weakest space today.

- Whitehaven Coal Ltd (ASX: WHC) +3.84% was strong following a decent quarterly update today. More on that below.

- Mesoblast Ltd (ASX: MSB) +13.21% received FDA approval for Rare Paediatric Disease (RPD) designation for their Revascor drug.

- Lottery Corporation Ltd (ASX: TLC) +6.02% copped a broker upgrade but will also see a boost after last night’s $100m Powerball jackpot failed to goof.

- Iron Ore was higher in Asia, up 1.98% – a bit of restocking ahead of the China holiday period looks to be the reason. Fortescue Ltd (ASX: FMG) added +1.96%.

- Gold was marginally lower today, trading at $US2,020 at the close.

- Asian markets were mixed – Japan’s Nikkei +1.05%, but Hog Kong’s Hang Seng -0.13% and China -0.66%.

- US Futures were flat, though Nasdaq Futures are up +0.2%.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Sectors this week – Source Bloomberg

Stocks this week – Source Bloomberg

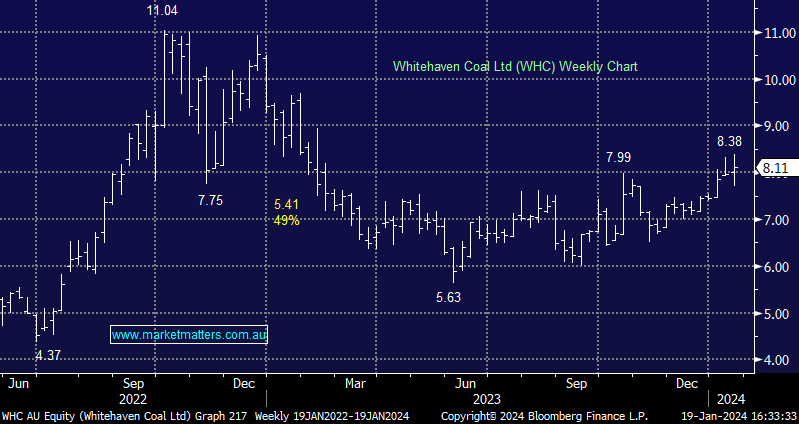

Whitehaven Coal (WHC) $8.11

WHC +3.84%: hit ~11 month highs today on the back of a reasonable 2Q production report.

WHC managed 3.89Mt in coal sales in the quarter, up 17% from 1Q and marginally higher than the same period in the prior year. Pries were ~5% lower vs 1Q on average with some weakness across coal markets despite commentary that demand has remained resilient.

While production was a touch better than expectations, Narrabri disappointed and guidance for the year was cut 10% as a result. Maules Creek picked up some of the slack though costs are expected to be higher in FY24 as a result of a shift from open cut to underground.

The market seemed pleased with WHC’s plans to pair back capex intentions as they digest the acquisition of Daunia and Blackwater from BHP Group Ltd (ASX: BHP), expected to complete the deal in April.

Overall, the update was slightly better than expected while WHC remains cheap in our view.

Whitehaven Coal (WHC)

Broker Moves

- Transurban Group (ASX: TCL) Cut to Neutral at JPMorgan Chase & Co (NYSE: JPM); PT A$14

- Aurizon Holdings Ltd (ASX: AZJ) Cut to Neutral at JPMorgan; PT A$3.90

- Lottery Corp. Raised to Overweight at Barrenjoey; PT A$5.50

- Ingenia Communities Group (ASX: INA) Rated New Neutral at Barrenjoey; PT A$4.50

Major Movers Today