Eliza Clarke of Firetrail Investments highlights 3 things that has impacted the global stock market and the Australian share market this week, featuring Nexgen Energy (Canada) CDI (ASX: NXG) and Boss Energy Ltd (ASX: BOE). How will this update affect the Australian share market?

1. The Uranium renaissance continues…

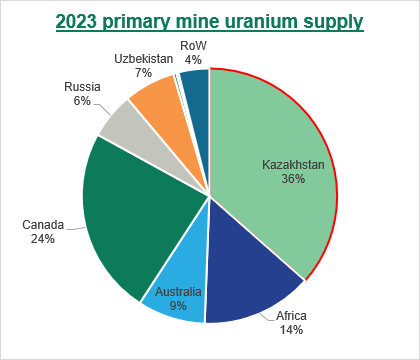

The uranium price spiked ~15% over the weekend to eclipse US$100/lb for the first time! The catalyst was a Kazatomprom, the world’s largest uranium producer, announcement that issues sourcing sulphuric acid (a key operating material in uranium mining) may result in lower production in 2024/2025.

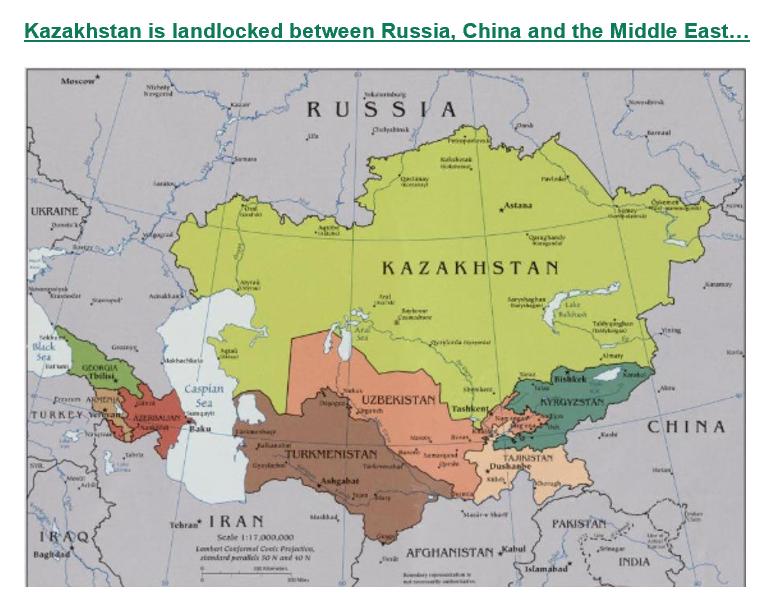

For context, Kazakhstan makes up 36% of uranium supply. Changes to its production levels can have a big impact on the uranium price. Given the country is landlocked between Russia, China, and the Middle East, you can imagine why its difficult to source supplies and export uranium at the moment.

We continue to see upside for uranium producers Nexgen Energy and Boss Energy, key holdings in the Firetrail Small Companies and Firetrail Absolute Return Funds. The demand outlook is strong with 22 countries committing to tripling nuclear energy capacity by 2050 at COP28.

At the same time, it is taking longer for new projects to come online. Our research suggests we’re heading into a supply deficit over the coming years.

2. Copper pure-play incoming…

Firetrail analyst Alex Collen was out in Cobar NSW this week, inspecting soon-to-be ASX-listed Metals Acquisition Ltd’s (NYSE: MTAL) copper mine, CSA. We’ve dropped some photos from his trip below.

Cobar is one of Australia’s oldest and greatest mining regions. The CSA mine is the region’s oldest and largest mine, first developed in the early 1900s! It is the highest-grade copper mine in Australia, as well as one of the deepest at 1,800m vertical.

With limited pure-play copper options available on the ASX, Metals Acquisition Corp’s listing will provide Aussie investors with much-needed choice in accessing exposure to the commodity.

We view this as highly positive given the important role copper will play in decarbonisation, and its strong global demand outlook as a result.

3. Population boom…

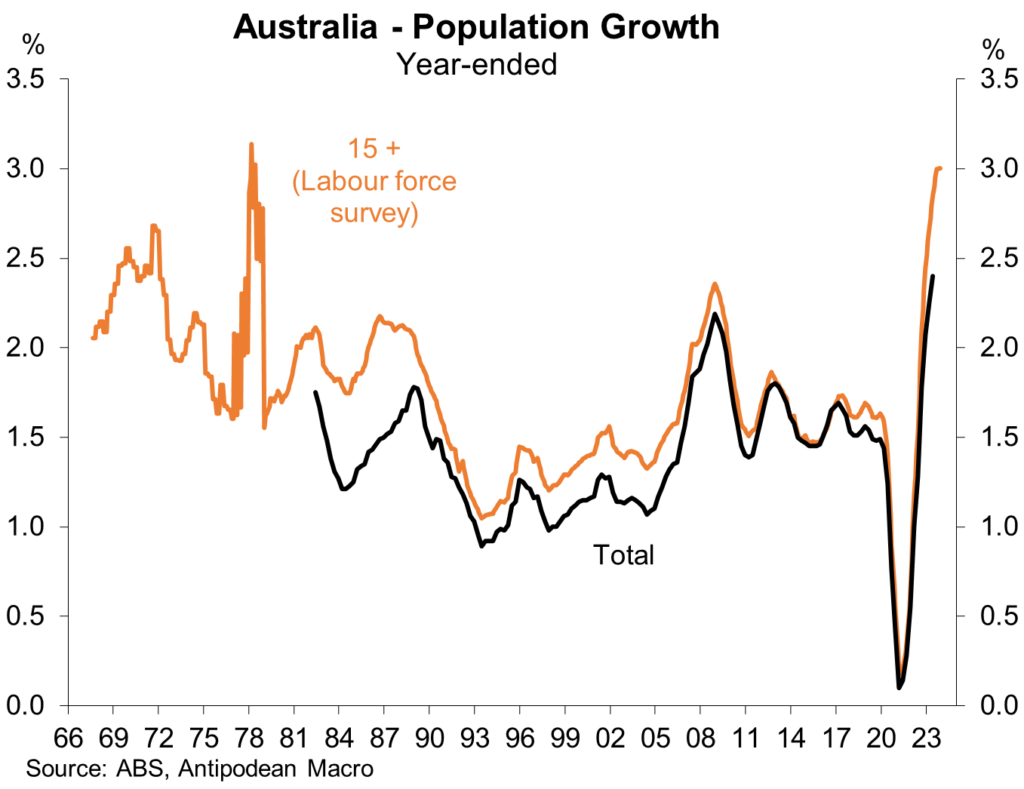

Immigration to Australia is booming post-COVID. The population over age 15 grew 3% in 2023 according to the ABS labour force survey.

Australia hasn’t seen this level of population growth since the 1970s. Population growth is the key economic tailwind likely to help Australia avoid a recession.

Population growth is also helping to cool a tight labour market, which should put downward pressure on wage inflation and help the RBA wrestle inflation back within its target band.