Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.75% to 7,476.60.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

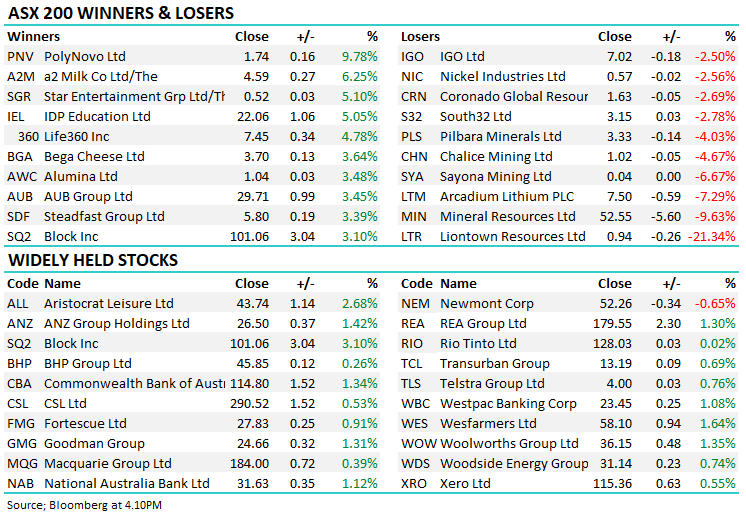

A good session today unless you hold Lithium stocks, with the ASX kicking off the shortened trading week on the front foot. Banks offered support at the index level with the Big 4 breaking out of their recent trading ranges and looking strong, while the supermarkets finally found some love and rallied from recent lows – the risk/reward now looking good in that sector.

- The ASX 200 finished up +55pts/ +0.75% to 7476.

- The Discretionary Retail sector (+1.68%) was strong as were Staples (+1.33%) & Financials (1.20%).

- Materials (-0.21%) and Utilities (-0.17%) finished lower.

- ANZ Group Holdings Ltd (ASX: ANZ) +1.42%, Commonwealth Bank of Australia (ASX: CBA) +1.34%, National Australia Bank Ltd (ASX: NAB) 1.12% & Westpac Banking Corp (ASX: WBC) +1.08%

- Lithium stocks were hit hard today on news that banks were pulling back on development funding for Liontown Resources Ltd (ASX: LTR) -21.34%

- The rest of the sector was smashed, which was prompted by a ~80% fall in the Lithium price.

- Mineral Resources Ltd (ASX: MIN) -9.63%: was weak, with the market focussing on their Lithium exposure. They have 3 key segments, Iron Ore, Mining Services and Lithium, with the latter being their growth engine. Chris Ellison has gone hard in the space, developing its own assets and buying stakes in other junior developers, this strategy is clearly now being tested/questioned.

- The market has turned against MIN and it looks to MM like a discounted equity raise is being priced in, despite the company’s previous comments that it would not be needed. We can’t help but think this is the capitulation-style move that often pre-empts a major low, but only time will tell.

- Pilbara Minerals Ltd (ASX: PLS) -4.03%: also knocked lower, but more resilient than many others, they’re fully funded and printing $$, and should in theory be in a good space to see through this market turmoil. We actually bought PLS on Thursday!

- Zip Co Ltd (ASX: ZIP) +16.54%: Climbs to its highest level in about a year after the payments company said its 2Q transaction volume and revenue increased.

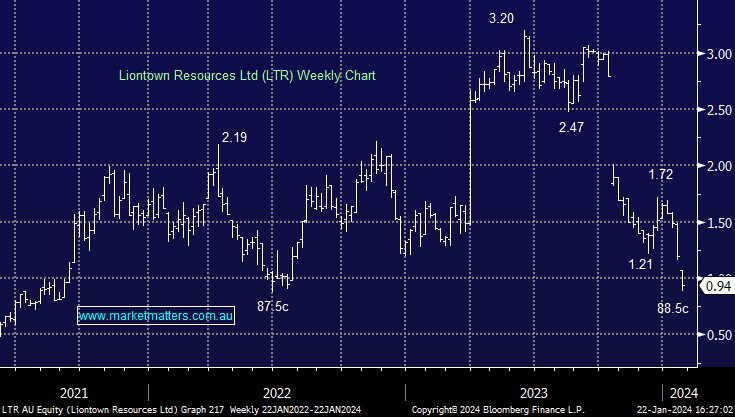

- Austin Engineering Ltd (ASX: ANG) +14.26%: the mining products manufacturer upgraded guidance today, shares are now up ~80% from October lows. More on this below.

- Lynas Rare Earths Ltd (ASX: LYC) -1.34%: quarterly production was disappointing, with total production down 65% on 2Q23 and prices down 40% on average vs 1Q24.

- Appen Ltd (ASX: APX) -40.22%: has lost an ~$80m contract with Google, around a third of the company’s expected revenue as the ChatGPT owner brings their data cleansing in-house. Shares were over $40 in 2020, down to 27.5c close today, a decline of 99.34%!

- South32 Ltd (ASX: S32) -2.78%: 2Q production looks light vs expectations, particularly on copper where the company lowered guidance by ~3%. Despite a softer start to the year, the company remains upbeat on demand, prices and costs where they see the 1H average below guidance.

- Iron ore was up 0.5% in Asia

- Asian stocks were mixed, Hong Kong fell 2%, Japan was up 1% and China dipped -1.4%.

- US Futures are up, led by Nasdaq Futures +0.6%

- Stocks we own reporting in the US this week: Freeport-McMoRan Inc (NYSE: FCX) 24th Jan & Blackstone Inc (NYSE: BX) 25th Jan

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

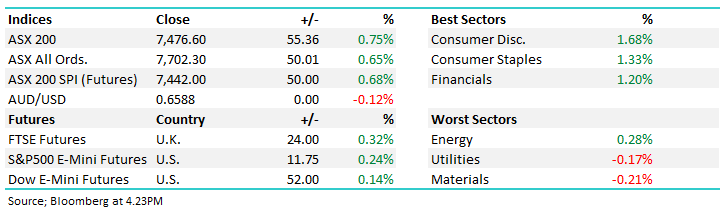

Liontown Resources (LTR) $0.94

LTR -21.34%: The wild story of LTR printed another chapter today with banks stepping back from their $760m debt package that was stitched up last year to build the company’s Kathleen Valley lithium mine, conditions in the funding agreement around Lithium prices mean banks get to recut the size of the cheque they will write.

As a result, LTR will scale back its ambitions of 3m-tonne-per-year from the Kathleen Valley mine set to start production this year, with the development work for the mine’s eventual 4m -tonne-per-year underground expansion now put on ice.

As we know, lithium prices have fallen off a cliff with the market now in surplus, and this is making financing new production a tough ask. As a refresher, Gina Rineheart owns 19.9% of LTR, having bought most of the holding at $3 a share, used as a blocking stake to scuttle Albemarle’s bid, the price now less than a 1/3rd of that in the space of 3 months. Ouch!

As is often the case though, the remedy for low prices is low prices themselves given it disincentives new production and ultimately prices stabilise – we’re starting to see this happen. While today’s announcement from LTR casts a shadow over the junior developers in the space, particularly those with big funding needs, these sorts of announcements are often indicative of a low point – here’s hoping!

We increased our Lithium exposure last week with the purchase of Pilbara Minerals (PLS) in the Active Growth Portfolio, with that call under pressure today, however, we still think the sector is ‘looking for a low’ and the turn, if/when it happens will be an aggressive one.

Liontown Resources (LTR)

Austin Engineering (ANG) 40c

ANG +14.29%: the mining products company rallied to 9-month highs today after a strong trading update and improved 1H guidance.

They now expect Revenue of $138-144m and Net Profit of $12-14m, an 8% and 18% upgrades at the midpoints respectively.

The upgrade came from an increase in deliveries on the back of a record (and growing) order book as well as improving operational efficiencies, something the company has been focussing on since 2021.

The strong demand has been underpinned by a higher iron ore price, supporting demand from key clients including Rio Tinto (RIO).

- Austin is on the hitlist for the Emerging Companies Portfolio, though we remain on the sidelines for now.

Austin Engineering (ANG)

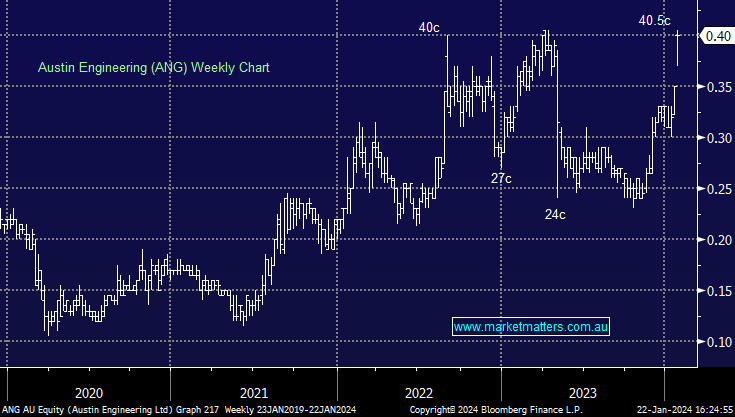

Broker Moves

- A2 Milk Company Ltd (ASX: A2M) Raised to Overweight at Jarden Securities; PT NZ$5.15

- Harvey Norman Holdings Limited (ASX: HVN) Raised to Buy at UBS; PT A$4.75

- Zip Co. Raised to Buy at Ord Minnett; PT 75 Australian cents

- Pilbara Minerals Raised to Neutral at Citigroup Inc (NYSE: C)

- Australian Finance Group Ltd (ASX: AFG) Cut to Sell at Citi; PT A$1.50

- Resimac Group Ltd (ASX: RMC) Cut to Sell at Citi; PT 95 Australian cents

- Fisher & Paykel Healthcare Corporatn Ltd (ASX: FPH) Cut to Underperform at RBC; PT NZ$20

- Regis Healthcare Ltd (ASX: REG) Raised to Outperform at RBC; PT A$3.90

- Capitol Health Ltd (ASX: CAJ) Cut to Sector Perform at RBC

- Australian Clinical Labs Ltd (ASX: ACL) Raised to Outperform at RBC; PT A$3.75

- Cochlear Limited (ASX: COH) Cut to Underperform at RBC; PT A$219

- Centuria Capital Group (ASX: CNI) Cut to Hold at Bell Potter; PT A$1.60

- Arcadium Lithium CDI (ASX: LTM) GDRs Rated New Buy at Citi; PT A$10.75

- Mineral Resources Cut to Hold at Jefferies; PT A$65

- Judo Capital Holdings Ltd (ASX: JDO) Cut to Sell at Citi; PT 87 Australian cents

- Arcadium Lithium GDRs Rated New Buy at Bell Potter; PT A$12.10

- Whitehaven Coal Ltd (ASX: WHC) Cut to Hold at Morgans Financial Limited; PT A$8.50

Major Movers Today