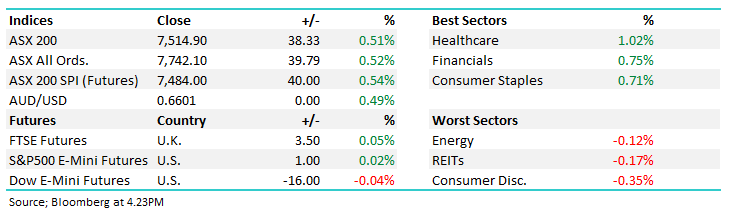

Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.51% to 7,514.90.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

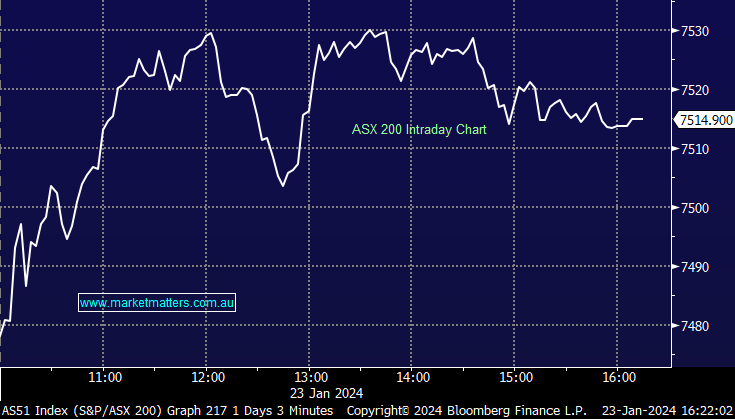

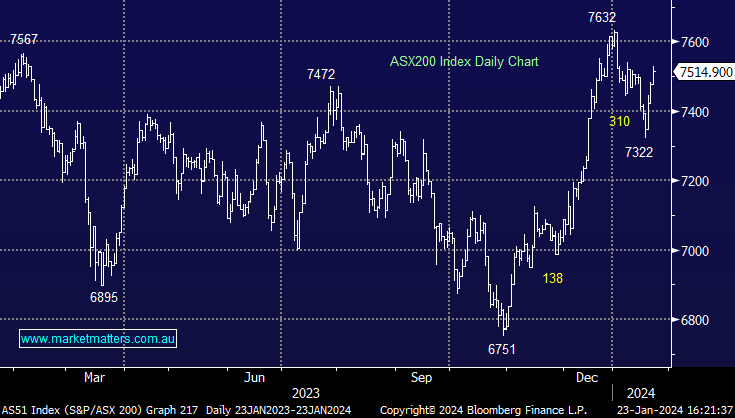

The market was more bullish today than futures were implying this morning with strength across the resources overlapping bank buying, which is an influential partnership at the index level. Clearly, the market is retaining its bullish bias as more fundies get back to their desks with the least resistance still on the upside – a trend we need to respect for now.

- The ASX 200 finished up +38pts / +0.51% to 7514.

- The Healthcare sector (+1.02%) was best on ground, followed by Financials (+0.75%) & Staples (+0.71%).

- Discretionary (-0.35%), Real Estate (-0.17%) and Energy (-0.12%) were the only areas to finish lower.

- Hong Kong shares were strong, up ~3% at the peak on reports that Chinese authorities are considering a package of measures to stabilize the stock market.

- Apparently, they’re looking to mobilize $278 billion, mainly from the offshore accounts of Chinese state-owned enterprises, to buy shares onshore through the Hong Kong exchange.

- Idp Education Ltd (ASX: IEL) -5.85% fell sharply as Canada announced changes to its intake of international students, a major market for the company.

- Boss Energy Ltd (ASX: BOE) +2.08% released a strong set of drilling results that are supportive of their growth strategy – we like BOE and the Uranium space more generally in the medium term, but we just think it’s a little frothy in the short term.

- Karoon Energy Ltd (ASX: KAR) -4.8% fell after it reduced production guidance by ~7% for CY24.

- Iluka Resources Limited (ASX: ILU) +2.16% rallied from a low base on 4Q production results that were a tad ahead of expectations, while total production for CY23 was up 8% vs. 2022. This is a stock that has been hit hard and should have plenty of upside when the worm turns.

- Coronado Global Resources Inc (ASX: CRN) +3.07% a big turnaround from early weakness, today’s 4Q production update was a miss but the outlook comments supported the stock.

- Silex Systems Ltd (ASX: SLX) -0.84% finished lower despite extending an existing offtake agreement for enriched silicon used in quantum computing.

- Lithium shares were mixed after a horrible session yesterday, Mineral Resources Ltd (ASX: MIN) +2.93%, Pilbara Minerals Ltd (ASX: PLS) -1.80% & Liontown Resources Ltd (ASX: LTR) -3.19%

- Banks continued to run, Commonwealth Bank of Australia (ASX: CBA) +0.75% hitting a new all-time high at $115.98, Macquarie Group Ltd (ASX: MQG) +1.55% also chimed in.

- Interesting to see some of the other more defensive stocks attracting some flows, Supermarkets, Infrastructure – a topic we’ll look at in the morning note tomorrow.

- Resmed CDI (ASX: RMD) +1.13% deliver a Q2 update tomorrow, this will be very interesting for their commentary around demand given the rise of weight loss wonder drugs. The stock has been firm in the past month or so.

- Worley Ltd (ASX: WOR) +1.27% is recovering from recent weakness, concerns about bribes and so on not enough to overshadow the tailwinds for the stock

- Iron ore was up 1.35% in Asia

- Asian stocks were mixed, Japan and China flat, Hong Kong added +2.43%.

- US Futures are largely flat, the best being Nasdaq +0.11%.

- Companies we own reporting in the US this week: Freeport-McMoRan Inc (NYSE: FCX) 24th Jan, Blackstone Inc (NYSE: BX) 25th Jan

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

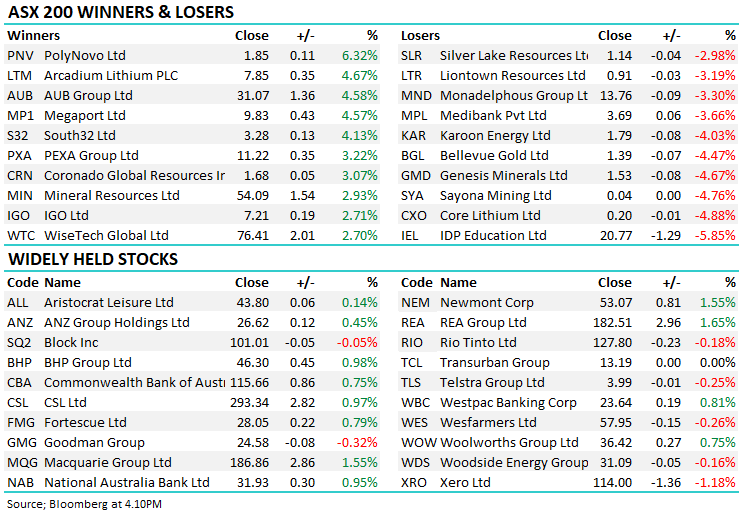

Broker Moves

- Beacon Lighting Group Ltd (ASX: BLX) Rated New Outperform at Taylor Collison

- Domain Holdings Australia Ltd (ASX: DHG) Raised to Neutral at Macquarie; PT A$3.49

- Polynovo Ltd (ASX: PNV) Raised to Market-Weight at Wilsons; PT A$1.79

- Liontown Resources Raised to Neutral at Jarden Securities

- Cooper Energy Ltd (ASX: COE) Cut to Neutral at Jarden Securities

- Westpac Banking Corp (ASX: WBC) Raised to Outperform at Macquarie; PT A$24

- Lottery Corporation Ltd (ASX: TLC) Cut to Neutral at Macquarie; PT A$5.05

- Cooper Energy Raised to Outperform at Macquarie

- Baby Bunting Group Ltd (ASX: BBN) Raised to Buy at Citigroup Inc (NYSE: C); PT A$2.15

- Boss Energy Raised to Hold at Shaw and Partners; PT A$4.75

Major Movers Today